KEYTAKEAWAYS

- Powell emphasized steady inflation progress but warned that external pressures like tariffs could complicate achieving the 2% target.

- The Fed will proceed “meeting by meeting,” suggesting policy flexibility and a potential end to quantitative tightening soon.

- Crypto markets reacted positively, viewing Powell’s balanced tone as a signal of easing liquidity pressures and a nearing end to the tightening cycle.

CONTENT

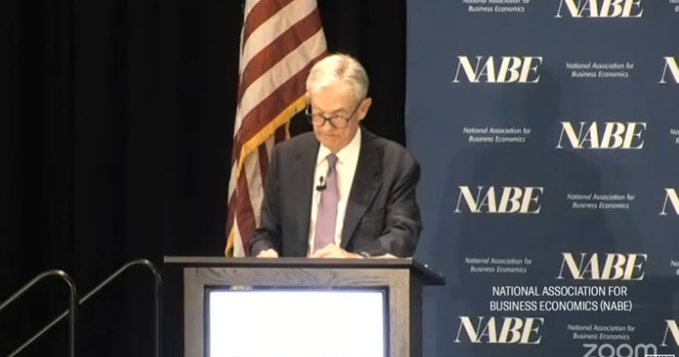

Jerome Powell’s latest speech struck a cautious balance, signaling progress on inflation while warning of risks ahead. Markets reacted mildly, with crypto seeing cautious optimism amid policy flexibility.

THE ECONOMIC OUTLOOK AND INFLATION PATH

Federal Reserve Chair Jerome Powell delivered a closely watched speech on the U.S. economic outlook and monetary policy early Wednesday (Beijing time), striking a delicate balance between optimism and caution.

Speaking just weeks ahead of the next FOMC meeting, he emphasized that while inflation has eased, progress remains uneven. The core PCE price index stands at 2.9%, and Powell noted that recent price pressures have been largely driven by higher import costs and tariffs rather than strong domestic demand.

He highlighted that while inflation is trending in the right direction, external shocks could still threaten the Federal Reserve’s long-term goal of returning inflation to 2%. His remarks reflected a broader awareness that the Fed must navigate between restoring price stability and maintaining economic momentum — a path that requires both flexibility and restraint.

EMPLOYMENT CONDITIONS AND POLICY FLEXIBILITY

Powell acknowledged that the labor market remains solid but is showing early signs of softening.

Hiring has slowed, job openings have declined, and wage growth is moderating — all indications of an economy moving toward balance. “There is no risk-free path,” he said, underscoring that monetary policy must weigh both the risks of cutting rates prematurely and those of keeping them elevated for too long.

He reiterated that the Federal Reserve will proceed “meeting by meeting,” making decisions based on incoming data rather than adhering to a predetermined policy path. Importantly, Powell hinted that the ongoing balance sheet reduction — known as quantitative tightening (QT) — could conclude within the coming months, a move that would slightly ease overall financial conditions.

MARKET REACTIONS AND CRYPTO IMPLICATIONS

Financial markets responded calmly yet optimistically.

The U.S. dollar weakened slightly, Treasury yields dipped, and equity futures rose modestly as traders interpreted Powell’s tone as leaning dovish, albeit cautiously. The Chair’s refusal to commit to a specific rate-cut timeline prevented excessive speculation but reinforced the expectation that the tightening cycle is nearing its end.

In the crypto market, Powell’s remarks were seen as mildly bullish.

The possibility of ending QT and maintaining a data-dependent, less restrictive policy stance could gradually improve liquidity conditions — a key factor for digital assets.

Bitcoin and Ethereum experienced mild upticks after the speech, signaling renewed risk appetite. However, Powell’s warning that inflation could resurface if policy eases too quickly reminded investors that volatility remains inherent.

Ultimately, his message was one of balance — between confidence in the economy’s resilience and humility in the face of uncertainty. The Fed’s new posture signals the transition from aggressive tightening to strategic patience, shaping expectations across both traditional and digital markets alike.

However, based on my observations of the crypto community, Powell’s speech was generally viewed with overoptimism. It’s important to note that while the crypto market recently experienced a major price correction, it quickly recovered, with some major assets even reaching new highs.

Furthermore, Trump’s tariff policy remains a significant variable that cannot be ignored, and the ongoing battle between major exchanges like BN and OKX will also impact market sentiment.