KEYTAKEAWAYS

- The Fed’s September 2025 rate cut confirmed expectations, but dot plot divisions revealed uncertainty over the future path of monetary policy.

- Powell defended the Fed’s independence from political pressure, seeking to maintain credibility and market stability.

- Bitcoin briefly surged toward $117K before consolidating, reflecting cautious optimism dependent on further easing.

CONTENT

The Fed cut rates by 25bps in September 2025. Powell stressed independence amid political pressure, while Bitcoin and global markets reacted cautiously to dot plot divisions.

INTRODUCTION

On September 17, 2025, the U.S. Federal Reserve announced its widely anticipated interest rate decision, cutting the federal funds target range by 25 basis points to 4.00%–4.25%.

This was the first reduction since December 2024 and marked a significant policy shift against the backdrop of slowing job growth and persistent inflation pressures.

Shortly after the announcement, Federal Reserve Chair Jerome Powell held a press conference to explain the decision, address internal divisions within the committee, and emphasize the Fed’s independence amid growing political scrutiny.

The move sparked immediate reactions across global financial markets, including equities, bonds, and cryptocurrencies such as Bitcoin (BTC). Understanding both the decision and Powell’s message is essential for analyzing how markets may respond in the coming months.

Read More:Federal Reserve Interest Rate Decision On September 17: Implications For Markets And Crypto

THE RATE CUT DECISION

The Federal Open Market Committee (FOMC) reduced its benchmark rate by 25 basis points, a move that was widely expected.

For months, investors had priced in the likelihood of easing given the slowdown in economic activity. August job growth fell significantly short of forecasts, and the unemployment rate rose to approximately 4.3%. While inflation has been gradually easing, it remains above the Fed’s 2% target, creating a delicate balance between stabilizing prices and supporting employment.

By opting for a modest cut, the Fed signaled its intention to manage risks carefully: acknowledging weakness in the labor market while remaining cautious about persistent inflation. Powell described the move as a “risk management” measure, underscoring the Fed’s commitment to flexibility rather than committing to a fixed trajectory.

DOT PLOT DIVERGENCE

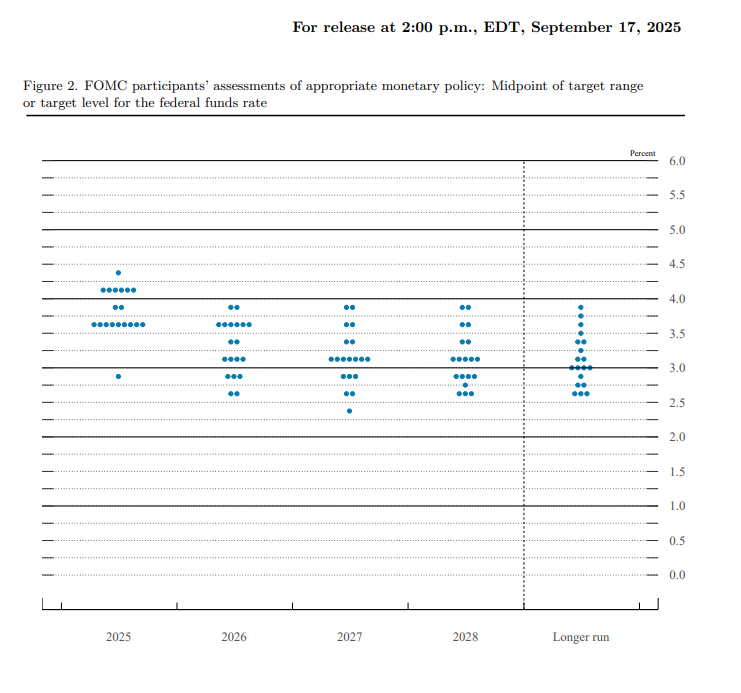

A key element of the meeting was the updated “dot plot,” which illustrates FOMC members’ expectations for future interest rate levels. The September dot plot revealed striking differences among policymakers.

Most members projected at least two more rate cuts by the end of 2025, consistent with a gradual easing path. Others expected only one more cut, while a few indicated no further reductions this year. Forecasts for the year-end policy rate spanned a wide range, from 3.5% to over 4.2%, reflecting divergent views on the outlook for inflation and employment.

This divergence underscores the uncertainty surrounding monetary policy. Some policymakers believe disinflation will continue and justify faster easing, while others remain cautious about sticky inflation. The split highlights that the pace and extent of policy adjustments in 2026 will remain highly dependent on incoming data, leaving markets with little clarity about the Fed’s direction.

POLITICAL PRESSURES AND FED INDEPENDENCE

Powell also addressed concerns about the Fed’s independence in the face of intensifying political pressure. President Trump and members of his administration have repeatedly criticized the central bank, calling for more aggressive rate cuts. Recent controversies—such as Trump’s attempt to dismiss Fed Governor Lisa Cook and his appointment of Stephen Miran, who simultaneously served as a presidential adviser—have raised concerns about undue political influence.

During the press conference, Powell emphasized that Fed decisions are based on economic analysis, not politics. He stated that only “very strong arguments” could sway FOMC members’ views, implicitly rejecting the notion that presidential criticism influences policy. His remarks sought to reassure markets that the central bank remains focused on its dual mandate—price stability and maximum employment—despite external political pressures.

The issue of independence is not merely symbolic. If markets perceive that monetary policy is guided by political expediency rather than economic fundamentals, confidence in the long-term stability of U.S. monetary policy could weaken. This would have implications not only for Treasuries and equities but also for global risk assets, including Bitcoin.

Read More:Trump Moves to Fire Fed Governor Lisa Cook: A Historic Clash Over Central Bank Independence

MARKET REACTION TO THE DECISION

Markets responded swiftly to the rate cut and Powell’s remarks.

EQUITY AND BOND MARKETS

U.S. equities initially rose following the announcement, reflecting relief that the Fed acknowledged economic weakness. However, gains moderated as investors absorbed the mixed signals from the dot plot and Powell’s measured tone. Bond yields edged lower, with the 10-year Treasury yield slipping from around 4.05% to 4.01%, suggesting cautious optimism about further easing.

THE U.S. DOLLAR

The U.S. dollar index weakened slightly after the announcement, as lower interest rates reduce its relative yield advantage. However, the currency remained supported by safe-haven demand, preventing any sharp depreciation.

BITCOIN PRICE MOVEMENTS

Bitcoin drew particular attention as investors gauged the impact of monetary easing on digital assets.

BTC briefly surged from roughly $116,000 toward $117,000, testing resistance levels between $117,500 and $118,500. The rally proved short-lived, with prices retreating to the $115,000–116,000 range soon after.

This price action suggests that the rate cut was largely priced in. Traders had already anticipated a 25-basis-point move, so the announcement did not deliver a significant surprise. Bitcoin’s near-term direction will likely depend on expectations about the pace of further cuts and how liquidity conditions evolve.

THE BROADER INTERPRETATION

The September decision highlights three important dynamics:

- Expectations were already priced in. The modest rate cut produced limited market moves because investors had anticipated it well in advance. For Bitcoin, the outlook now hinges on whether the Fed follows through with additional cuts.

- Policy uncertainty remains elevated. Divergences in the dot plot emphasize how little consensus exists within the Fed. As a result, markets will remain highly sensitive to upcoming inflation and labor market data.

- Political pressures complicate the outlook. With a U.S. presidential election cycle approaching, external attempts to influence monetary policy could intensify. Powell’s ability to maintain the Fed’s independence will be closely watched by global investors.

CONCLUSION

The Federal Reserve’s September 2025 rate cut was a cautious step aimed at managing competing risks: rising unemployment and persistent inflation. Powell’s press conference reinforced both the Fed’s recognition of labor market weakness and its concern about inflation. The updated dot plot revealed significant internal disagreement, while Powell’s defense of independence highlighted the unusual political pressures facing the central bank.

For financial markets, including Bitcoin, the decision confirmed expectations but did not deliver a breakout. BTC’s brief spike toward $117,000 reflected optimism about easing liquidity, but its failure to sustain gains signaled ongoing caution. The months ahead are likely to be volatile, with every new data release scrutinized for signals about the Fed’s next move.

Ultimately, the Fed must navigate a narrow path—balancing economic stability, inflation control, and political independence. How successfully it manages this challenge will shape the trajectory of both traditional and digital asset markets through the end of 2025 and beyond.