KEYTAKEAWAYS

- Visa, a global payments technology company, earns revenue through services to banks, data processing, and international transaction fees without issuing credit cards or assuming credit risk.

- Visa's financial performance is robust, consistently outperforming the S&P 500, with a high net profit margin and a strong Return on Equity (ROE), indicating healthy profitability and growth.

- Visa is expanding into the cryptocurrency market, collaborating with major crypto platforms to offer integrated credit and debit card services, demonstrating adaptability and potential for growth in digital finance.

- KEY TAKEAWAYS

- VISA CORPORATE PROFILE

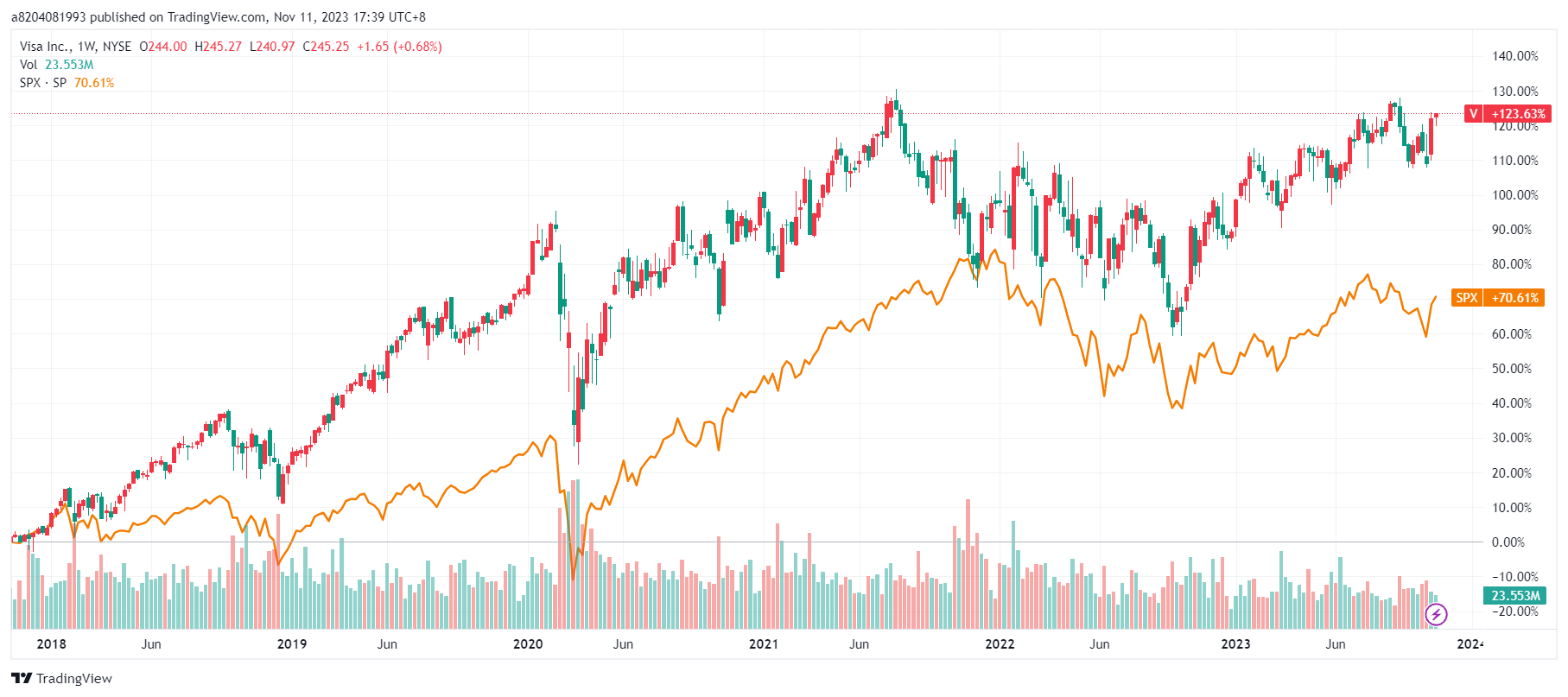

- COMPARISON OF VISA STOCK PRICE WITH THE S&P 500 INDEX

- VISA REVENUE AND FINANCIAL ANALYSIS

- GROWING NET PROFIT MARGIN

- EXCELLENT ROE (RETURN ON EQUITY)

- VISA’S EPS PERFORMANCE

- VISA’S CONTINUOUS DIVIDEND GROWTH AND STOCK BUYBACKS

- THE RISKS VISA FACES

- VISA WITH CRYPTO.COM & COINBASE

- VISA’S OUTLOOK

- DISCLAIMER

- WRITER’S INTRO

CONTENT

For most investors, Visa (V) is a familiar and unfamiliar name. While people frequently use Visa credit cards for their purchases, they often have little understanding of the company’s underlying cash flow and profit model. Many even mistakenly believe that Visa issues credit cards, misunderstanding it as a financial institution. However, Visa’s financial reports state, “Visa is a global payments technology company.” Besides traditional financial services, Visa is also involved in the payment and crypto realms.

Today, let’s start our investment journey with data and share our knowledge about Visa with readers.

VISA CORPORATE PROFILE

Source: CoinRank

First, Visa is not responsible for lending money to consumers, nor does it assume any credit risks. Visa’s role in the credit card industry is to facilitate the flow of funds between issuing banks and acquiring banks.

For example, when a consumer shops at a department store and checks out using a card from Bank B, the transaction information is transmitted through the card reader to the acquiring bank (Bank A, for example). The data will be sent to Visa, then to the issuing bank, Bank B, to obtain authorization before returning to the store for the signature on the receipt. The flow of funds settlement and clearing between the department store and Bank A, as well as between Bank A and Bank B, all rely on VisaNet.

So, Visa provides a network for participants in this fund flow to manage the process of authorization, clearing, settlement and fraud prevention. In addition to credit cards, Visa also offers two other card types: Debit Cards and Prepaid Cards. The differences between these three products lie in the order of payment and consumption.

- Credit Card: Payment comes after consumption.

- Debit Card: Payment is deducted from the account simultaneously with the consumption.

- Prepaid Card: Payment is made in advance, and each consumption is deducted from the prepaid amount.

COMPARISON OF VISA STOCK PRICE WITH THE S&P 500 INDEX

Source: TrendingView

In the long term, when we look at Visa’s stock price and performance compared to the S&P 500 Index, Visa’s stock price consistently performs better. Even when faced with challenges like the COVID-19 pandemic in 2020 or the U.S.-China trade war that began in 2018, Visa’s returns still outperformed those of the S&P 500 Index during the same period. The reason is naturally related to Visa’s intrinsic value. The following section will discuss Visa’s revenue and financial analysis.

VISA REVENUE AND FINANCIAL ANALYSIS

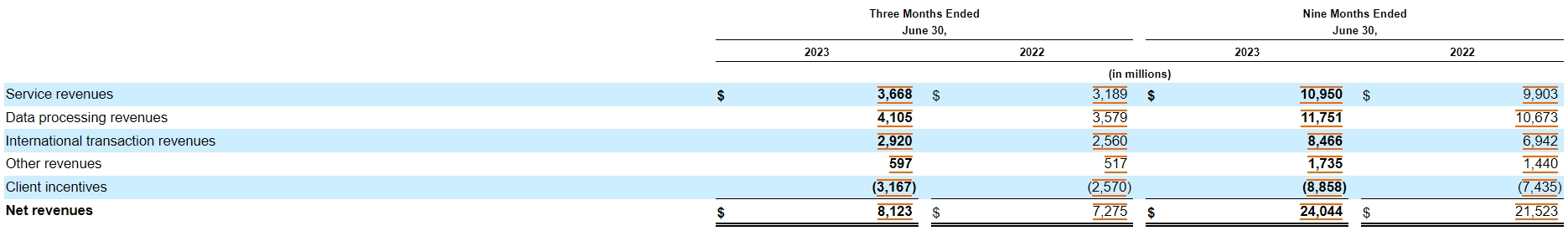

Source: UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Visa (V) is not an issuing bank, so it does not charge cardholders annual fees, nor is it responsible for installing card readers in stores. However, Visa’s revenue sources are diverse, as seen in its financial reports. Visa generates revenue from five distinct business segments.

- Service Revenue: Visa charges banks (issuing and acquiring banks) for customers’ transactions made by Visa credit cards based on transaction amounts.

- Data Processing Revenue: As funds flow through the system, Visa assists in processing authorizations, clearing, and settlement between issuing and acquiring banks. Visa charges banks information processing fees based on transaction volumes.

- International Transaction Revenues: When consumers use Visa cards for transactions outside the country of their issuing bank, Visa charges fees based on transaction amounts.

- Other Revenues: Including authorization fees generated when banks use the Visa brand and other income unrelated to the three segments above.

- Client Incentive: This section represents a reduction in revenue and includes incentive bonuses paid to banks (Visa’s clients) when they sell Visa products. The purpose is to encourage banks to issue and acquire Visa cards, thus generating cardholder spending volume and transaction counts.

Notice that the most crucial sources of Visa’s revenue are the “transaction counts,” “transaction amounts,” and “international spending volume” generated by Visa cardholders. The higher the transaction volume, the greater the revenue.

GROWING NET PROFIT MARGIN

Look at Visa’s net profit margin performance over the past five years. The chart above shows that Visa’s net profit has been consistently rising, and its net profit margin remains stable. The company’s average net profit margin has reached 50% in the last five years. The high net profit margin indicates that it maintains strong profitability even as Visa continues to expand its operations and revenue.

EXCELLENT ROE (RETURN ON EQUITY)

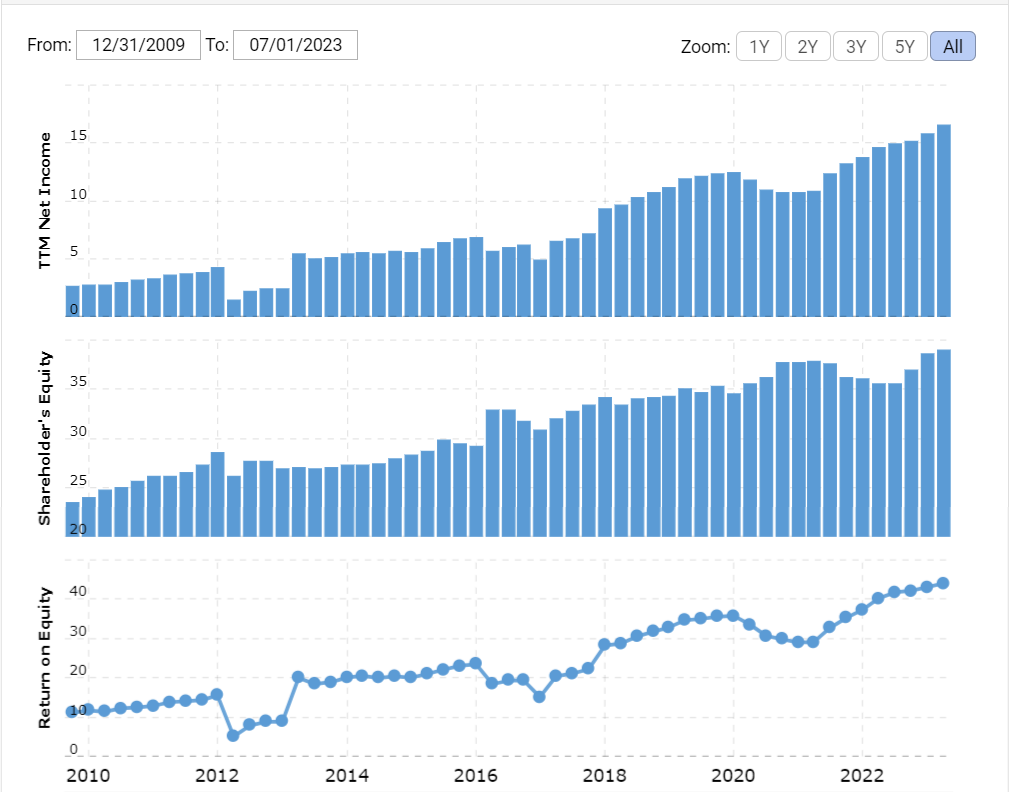

Source: Macrotrends

Investors often pay close attention to ROE (Return on Equity), which can be understood as a measure of a company’s profitability. Generally, a higher ROE indicates the higher profit shareholders can earn, and a good ROE is typically expected to be maintained at or above 15-20% over the past 5-10 years.

Visa’s ROE once bottomed up in 2012, hitting 7.91%. However, it gradually increased yearly, climbing to 37.51% in 2021. As more people use Visa’s payment services, the associated software can generate more revenue, contributing to Visa’s outstanding profitability efficiency. Simply put, Visa’s revenue model depends on how many people use its system, and the actual additional costs are relatively low, which has a beneficial effect on keeping Visa’s steady growth.

However, investors should still be mindful of the reasons behind the continuous increase in ROE and examine Visa’s income statement to see if the core business is profitable. If the core business remains profitable, it indicates that the ROE growth is not coming from non-core income sources, which means the company still focuses on improving its core business revenue, providing a relatively low-risk investment for shareholders.

VISA’S EPS PERFORMANCE

Network Effect and Economies of Scale

The network effect is one of Visa’s significant advantages. Just think, when you consider using a credit card, what’s the first related company that comes to mind? Most likely, it’s Visa, right? This reaction is an example of the benefit brought by the network effect. Relying on Visa’s usage, market share, and position in digital media, consumers often encounter its presence on platforms like Meta (Facebook) and Google. In terms of usage, the more people use Visa, the more revenue Visa generates, naturally driving market share to a significant scale and creating a positive feedback loop. Today, Visa is no longer the small business that started in California but has a global presence with services in over 200 countries and regions, boasting approximately 2.5 billion Visa cardholders.

Brand Effect

In the credit card business, Visa can be considered an overnight success, with nearly everyone recognizing the company and e achieving a global market share of around 40%. The successful establishment of Visa’s brand has instilled trust in people, especially since most people are cautious about entrusting their money to others. This strength is one of the intriguing aspects of Visa.

Throughout its developmental history, Visa has dealt with issues such as card fraud scams, and, most importantly, it has gained consumers’ trust. These efforts contribute to its position as the world’s largest financial services company in the payment network.

VISA’S CONTINUOUS DIVIDEND GROWTH AND STOCK BUYBACKS

Returning to the concern of some shareholders regarding dividend yield, it’s true that Visa currently has a “low dividend yield.”, which makes many income-seeking investors less interested. Observing the chart shows that Visa’s current dividend yield is 0.74%, which is less than half of the S&P 500’s average dividend yield. This return might be less attractive for investors who prefer higher dividend yields.

However, Visa remains attractive to “dividend growth” investors. By looking at the same chart, Visa’s dividend has continued to grow over the past five years. Its dividend will likely increase proportionally with the expectation of revenue and profit growth.

The boosting dividend growth rate of Visa is naturally due to Visa’s ability to generate significant cash flow, which is Visa’s third advantage. Visa can reward its shareholders through dividends and stock buybacks. In January 2021, Visa’s board of directors approved an $8 billion stock repurchase program. In the 2021 annual report, Visa repurchased 40 million shares in the open market for $8.7 billion.

In 2023, Visa’s board of directors raised the quarterly cash common stock dividend for Visa Class A shares by 15.5% to $0.52 per share and authorized a new $25 billion Class A stock repurchase program.

*The Significance of Stock Buybacks:

Increase EPS: EPS is calculated by dividing net profit after tax by the number of outstanding shares, so stock buybacks can help increase EPS.

Boost Confidence: Stock buybacks indicate that the company has great confidence in its future development, which is a factor that can boost shareholders’ confidence in the company.

THE RISKS VISA FACES

Regulation: Visa’s business is subject to government regulatory oversight. Changes in regulations may impact Visa’s business development.

Global Economic Downturn: During economic downturns, consumer spending may decrease, reducing the demand for Visa’s products and services. Visa’s business operations may be affected.

Cybersecurity: Visa’s business is vulnerable to cyberattacks. Cyberattacks can damage Visa’s reputation and financial performance.

VISA WITH CRYPTO.COM & COINBASE

The other notable aspect of Visa is that it is one of several major financial services companies leading the mainstream adoption of Bitcoin and other cryptocurrencies. Visa offers a variety of credit card and debit card services related to cryptocurrencies, allowing customers to make purchases using Bitcoin and earn rewards. For example, Visa has partnered with the largest cryptocurrency exchange in the United States, Coinbase, to introduce a card that automatically converts Bitcoin and other cryptocurrencies into US dollars at the point of sale. Customers can also earn Bitcoin reward points.

Visa also collaborates with another significant cryptocurrency exchange company, Crypto.com, to jointly launch a prepaid card to store Bitcoin. This feature is similar to other Bitcoin reward savings cards in collaboration with Fold. According to reports, since its launch in 2020, over $30 million worth of Bitcoin has been issued.

These product collaborations with cryptocurrency companies have contributed to the continued growth of Visa’s cryptocurrency business. In the first quarter of 2022, Visa reported that customers made transactions valued at $2.5 billion on their Visa cryptocurrency cards. The company stated that by early 2022, its cryptocurrency wallet partner network had expanded from 54 to 65, including well-known companies like Coinbase, Circle, and BlockFi. Nearly one billion merchants are active on the Visa network.

In March 2023, Cuy Sheffield, Head of Visa’s cryptocurrency division, tweeted that Visa will continue to collaborate with cryptocurrency companies to improve fiat on-ramp/off-ramp channels and make progress on Visa’s product roadmap to build new products that facilitate stablecoin payments in a secure, compliant, and convenient manner.

On March 7th, the South Korean card industry giant BC Card announced that it had signed a memorandum of understanding with Crypto.com and Visa at the local Crypto.com headquarters in Singapore on March 4th. According to the agreement, BC Card and Visa will combine their processing and digital platform capabilities to actively collaborate with Crypto.com, offering customers innovative digital financial experiences such as Web 3.0 blockchain solutions. The three companies will also conduct joint research and launch Crypto.com’s Business Identity Credit Card (PLCC) and new services to increase customer profits.

Visa has already become a provider of credit and debit cards accepted by millions of merchants worldwide and used by millions for everyday shopping. Now, the world’s largest payment processing company is also exploring new ways for customers and businesses to use cryptocurrencies.

Although the recent partnership between Visa and Binance failed, developing new areas and experimentation often comes with setbacks. Perhaps investors are witnessing the dawn of a brand new era in payments. Maybe investors are seeing the beginning of a brand-new age in payments.

VISA’S OUTLOOK

Visa reported its fiscal third-quarter results for 2023 on July 25th (ending on June 30th), with revenues of $8.1 billion, a 12% year-on-year increase, net profits of $4.5 billion, a 7% year-on-year increase, and earnings per share of $2.16, a 9% year-on-year increase. Both revenue and earnings exceeded expectations.

The company’s management indicated that international travel and healthy consumer spending are picking up. Summer travel is anticipated to continue to drive cross-border transaction volume and support ongoing recovery in operations. Visa also expected revenue to grow by 10% in the next quarter, and full-year revenue and profits are projected to achieve double-digit growth.

Visa’s future growth prospects can be categorized into three main drivers: increasing market share, rising consumer spending, and higher credit card usage. In mature markets like the United States, substantial changes in market share are less likely. Growth primarily relies on the latter two drivers, particularly in countries like Spain, Italy, and Poland, where the company disclosed that cash transactions still account for 60% of total transactions, representing an opportunity for Visa’s future growth.

On the other hand, Visa targets less mature regions in the credit card industry, such as India. Despite local competition, Visa’s market share has rapidly grown and now exceeds 50%. Policies like the demonetization in 2016 accelerated the adoption of non-cash transactions. Besides India, the company continues witnessing increasing business in Southeast Asia and South America.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!