KEYTAKEAWAYS

- BOJ's December rate hike to 0.75% remains historically low compared to US Fed's 3.5-3.75%, maintaining significant interest rate differential favoring continued global liquidity.

- Yen carry trade funds fragment across countries and asset classes, with only modest portions reaching crypto after dilution through Treasuries, equities, and corporate bonds.

- Current market represents healthy bull correction, not 2022 bear market, as leverage already cleared and fundamentals remain strong despite short-term funding flow volatility.

CONTENT

Japan’s BOJ rate hike to 0.75% poses limited crypto risk. US Fed cuts offset tightening while carry trade impact disperses across global markets beyond digital assets.

The crypto market has been buzzing with concern lately. Following Glassnode co-founder’s recent analysis of Japan’s monetary policy shift, I found myself nodding along with many of his points. But here’s where I want to dig deeper into something that often gets lost in the noise: the actual magnitude of impact we should realistically expect from the Bank of Japan’s upcoming rate decision.

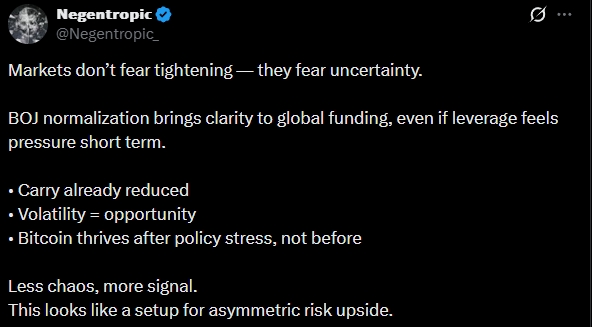

https://x.com/Negentropic_/status/1999988696192299339

Look, I get it. The headlines make it sound dramatic. “Japan raises rates to 30-year high!” Sure, that’s technically true. However, when you strip away the sensationalism and look at the numbers, the story becomes far less alarming for crypto investors. Frankly, the panic seems overdone given what’s actually happening beneath the surface.

THE CONTEXT EVERYONE’S MISSING

First off, this isn’t Japan’s debut performance in the rate-hiking arena. The Bank of Japan already ended its negative interest rate policy in March 2024 and raised rates to 0.5% in January 2025. The market didn’t collapse then. Bitcoin didn’t go to zero. The world kept spinning.

Now, as the BOJ prepares for its December 18-19 policy meeting, market consensus has coalesced around another 25 basis point increase, bringing the rate to 0.75%. All 50 economists surveyed by Bloomberg are betting on this move. This level of agreement is unprecedented under Governor Kazuo Ueda’s watch, which tells you something important: this is the most telegraphed rate hike in recent memory.

But here’s the kicker that really matters. Even if Japan pushes rates to 0.75%, we’re still talking about a rate environment that remains extraordinarily accommodative by global standards. Compare that to the United States, where the Federal Reserve just cut rates on December 10 to a range of 3.5%-3.75%. Japan’s borrowing costs will still be less than a quarter of America’s, even after the hike.

THE OFFSETTING FORCES AT PLAY

What makes this situation particularly interesting – and frankly, less worrying than the doom-and-gloom crowd suggests – is the divergence in monetary policy trajectories. While Japan inches rates higher, the United States has embarked on an easing cycle. The Fed delivered its third rate cut of the year in December, bringing rates down 75 basis points since September. Their projections signal another 25-50 basis points of cuts through 2026.

This creates a natural offset. Yes, Japan’s tightening reduces one source of global liquidity. But simultaneously, the world’s largest economy is loosening policy and injecting liquidity back into the system. The net effect on risk assets, including crypto, becomes far more nuanced than simple cause-and-effect narratives would have you believe.

Moreover, and this point can’t be stressed enough, markets have had months to digest this information. Governor Ueda hasn’t been coy about the BOJ’s intentions. He’s basically pre-announced the move, using language that central bankers deploy when they want to avoid shocking markets. In his early December speech, he discussed the “pros and cons” of raising rates – central banker code for “we’re probably doing this, so get ready.”

This matters enormously. The violent market reactions we saw in early August 2024, when Bitcoin dropped from around $65,000 to $50,000 following Japan’s July rate hike, came partly from the element of surprise. That’s not the case this time. Positioning has already adjusted. Speculative excess has already been wrung out. The market has had time to prepare.

UNPACKING THE CARRY TRADE HYSTERIA

Now let’s talk about the elephant in the room: the yen carry trade. This is where things get interesting, and where I believe much of the fear stems from fundamental misunderstandings about how money actually flows through the system.

For years, Japan’s ultra-low (and at times negative) interest rates created a unique arbitrage opportunity. Institutions would borrow yen at essentially zero cost, convert those funds into dollars or other currencies, and deploy the capital into higher-yielding assets. US Treasuries, tech stocks, emerging market debt, and cryptocurrency all benefited from this flood of cheap Japanese money.

Estimates of the carry trade’s size vary wildly. Conservative figures based on Japanese banks’ foreign lending put it around $1 trillion. More aggressive calculations using the notional value of foreign exchange swaps and forwards reach as high as $14-20 trillion, though these higher numbers include substantial double-counting and derivatives exposure that doesn’t translate directly to risk asset purchases.

But even if we take the high-end estimates at face value, here’s what people miss: this money doesn’t all flow into crypto. Not even close. The vast majority of yen carry trade capital gets distributed across multiple countries, multiple asset classes, and multiple strategies. The United States captures the lion’s share, certainly. However, within the US, those funds fragment further into Treasuries, equities (particularly large-cap tech), corporate bonds, and numerous other categories before even a sliver reaches digital assets.

Think about it logically. If the total carry trade is $1-5 trillion, maybe half flows to the US. Of that US portion, equities might get 30-40%. Of equity exposure, maybe 10% ventures into more speculative territory like crypto. We’re talking about multiple layers of dilution. By the time you trace the money through this complex web, the portion directly affecting crypto markets becomes relatively modest.

THE LEVERAGE EQUATION

There’s another crucial piece that often gets overlooked in the analysis: leverage. The crypto market went through a significant deleveraging event throughout late 2024. Open interest in futures has contracted meaningfully. Funding rates have normalized. The system is cleaner now than it was during previous periods of yen carry trade unwinding.

When leverage is high, small funding cost changes can trigger cascading liquidations. However, when the market has already been through the wringer and speculative excess has been cleared out, the same policy shifts produce far more muted effects. We’re not in a 2022-style environment where everything was overextended. This is a healthier market structure, and healthy markets absorb shocks better.

Furthermore, the relationship between leverage and carry trade exposure isn’t linear. Many of the headline figures quoted for carry trade size represent leveraged positions. A $1 trillion leveraged exposure might only represent $200-300 billion in actual capital deployed. And as that leverage unwinds in response to changing rate differentials, it doesn’t necessarily mean all that capital exits risk assets immediately. It might just mean positions get deleveraged, not liquidated.

WHAT THIS MEANS FOR THE CRYPTO CYCLE

So where does this leave us? I’ve been discussing these dynamics with numerous colleagues and investors lately, and there’s remarkable consensus on one point: we’re nowhere near a 2022-style bear market. That was a fundamentally different environment – tightening global liquidity, collapsing leverage, fraud and contagion, and a macro backdrop moving decisively against risk assets.

What we’re experiencing now resembles a bull market correction far more closely. These are normal, healthy, and frankly necessary. Bull markets don’t go straight up. They climb, consolidate, shake out weak hands, then resume their ascent. The strongest bull runs are built on these periods of consolidation that create new support levels and reset sentiment.

The volatility we’re seeing isn’t a signal that the cycle is over. It’s a signal that the cycle is maturing and finding a more sustainable path forward. After the explosive moves we saw through much of 2024, some cooling off isn’t just expected – it’s desirable. It creates opportunities for new buyers to enter at more reasonable levels and for the market to build a more solid foundation for the next leg higher.

Japan’s rate normalization is part of this broader recalibration. Markets are adjusting to a world where ultra-easy policy is gradually unwinding. But “gradual” is the operative word. Japan isn’t slamming on the brakes. They’re easing their foot off the accelerator, and they’re doing it in the most telegraphed, predictable way possible.

THE BIGGER PICTURE

Taking a step back, the fundamental drivers of crypto adoption and value appreciation remain unchanged. Institutional interest continues to grow. Regulatory clarity is improving in major jurisdictions. The technology continues to mature. These structural tailwinds don’t evaporate simply because Japan moves rates from 0.5% to 0.75%.

What we need to watch is the interest rate differential and its trajectory. As long as Japan remains significantly below global rates – which it will for the foreseeable future – the funding advantage doesn’t disappear entirely. It just narrows somewhat. And as long as the US continues on its easing path, that offsetting dynamic remains in play.

The real risk wouldn’t come from Japan’s measured rate normalization. It would emerge from a scenario where Japan had to hike aggressively and repeatedly while the US simultaneously pivoted back to tightening. That would create genuine funding stress and could trigger a more serious carry trade unwind. However, that’s not the scenario we’re facing, and it’s not what markets are pricing in.

Instead, we’re looking at a managed, gradual adjustment that markets have had ample time to prepare for. Yes, there will be volatility. Yes, there will be periods where funding dynamics create temporary headwinds. But none of this invalidates the broader bull case for crypto assets.

THE PATH FORWARD

As we move through this period of adjustment, the key for investors is maintaining perspective. Don’t let short-term volatility driven by funding flows distract from longer-term fundamentals. Don’t confuse a healthy correction with a trend reversal. Most importantly, don’t panic over headlines that strip away crucial context about what’s actually happening.

The crypto market will continue to experience turbulence as it navigates this transitional period. Some days will feel rough. Some moves will feel unsettling. That’s part of the process. However, when you examine the actual numbers – Japan’s rates still near zero, the US easing policy, carry trade impact diluted across global markets, and leverage already wrung out of crypto – the case for major systemic risk looks thin.

We’re going through a shake-out, not a breakdown. The bull market is consolidating, not ending. When this period of volatility passes, as it will, the market that emerges will be healthier and better positioned for sustainable growth. That’s not blind optimism. That’s what the data and the fundamentals actually tell us once we cut through the noise.

The above viewpoints are referenced from @Web3___Ace