KEYTAKEAWAYS

- Market Sentiment & Rate Cuts: Explore why investor confidence remains low despite anticipated interest rate reductions, highlighting risk-aversion and macroeconomic concerns.

- Liquidity & Financial Conditions: Analyze how liquidity constraints, credit flows, and policy expectations are shaping slow market responses even with easing signals.

- Economic Indicators & Outlook: Break down key economic data—employment, inflation, corporate earnings—and their mixed signals, contributing to muted bullish momentum.

CONTENT

A concise 160-character summary that naturally includes your focus keyword and entices clicks from search results.

Why is the market still so sluggish even though the path of interest rate cuts is already clear?

Why did Bitcoin continue to fall despite three consecutive interest rate cuts by the US?

Are macroeconomic indicators really useless?

Today we’ll talk about this major event: interest rate cuts.

First, interest rate cuts reduce nominal interest rates, while professional institutions focus more on real interest rates, which also take into account inflation.

I won’t go into detail about this point, as I’ve mentioned it many times before.

The actual interest rate can be seen here.

In a real business environment, interest rate cuts do not necessarily mean immediate easing of liquidity.

Every FOMC meeting’s interest rate cut decision, dot plot, and various statements from Fed officials are now answering the same question—”Will interest rates fall?”

But the more important question – “Will the money actually flow out?” – remains unanswered, and they have no say in it.

There are three key logical links in the two questions.

1. POLICY LEVEL: IT HAS BEEN CLEARLY ENTERED A PERIOD OF INTEREST RATE CUTS.

This layer is for viewing:Is the interest rate path trending downwards, and is the policy stance shifting towards “more accommodative”?。

The last FOMC meeting lowered the target range for the federal funds rate to3.50%–3.75%This is the third consecutive time the 25bp rate has been lowered

Furthermore, according to the dot plot, the United States aims to reduce its FFR to 3 by 2030.

Therefore, inThe policy transition has been completed.—Whether interest rates will fall is not speculation in the United States; it’s a fact.

It could even be said that the biggest driving force and essence of the bull market before October 2025 originated from this.

The market’s advance pricing of whether the path of interest rate cuts is certain.

2. FINANCIAL INTERMEDIARIES: NOT FULLY “CONNECTED” YET, BUT CRUCIAL.

This layer is for viewing:Has the money truly expanded through the banking/credit system to the “underlying financing” of the real economy and broad risk assets?。

Let’s start with the traditional capital context: the question is whether banks/financial systems are willing to lend money.

This is the real “faucet”.

The key indicators are bank lending, lending standards (SLOOS), commercial bank balance sheets, and credit spreads (HY/IG).

The reality is that in the early stages of an interest rate cut cycle, banks remain cautious, businesses are still hesitant to borrow, and money remains tied up in short-term debt.

This is why, when interest rate cuts actually begin, risky assets often fall instead of rising.

(The expectation of an interest rate cut has already been priced in; now the market is waiting for actual monetary easing.)

Let’s take a look at the professional report released by the Federal Reserve—(those who are not interested can skip to the crypto market section below).

- Second QuarterWith tightening lending standards, demand for commercial and industrial (C&I) loans is weak across businesses of all sizes.Banks generally report that commercial real estate (CRE) lending standards are tightening and demand is weak.

- Monthly Balance of Commercial and Industrial Loans (C&I)2025-11: 2,698.7 billion US dollarsIt is almost at the same level as in October and September, which is a “sideways and slow change”.

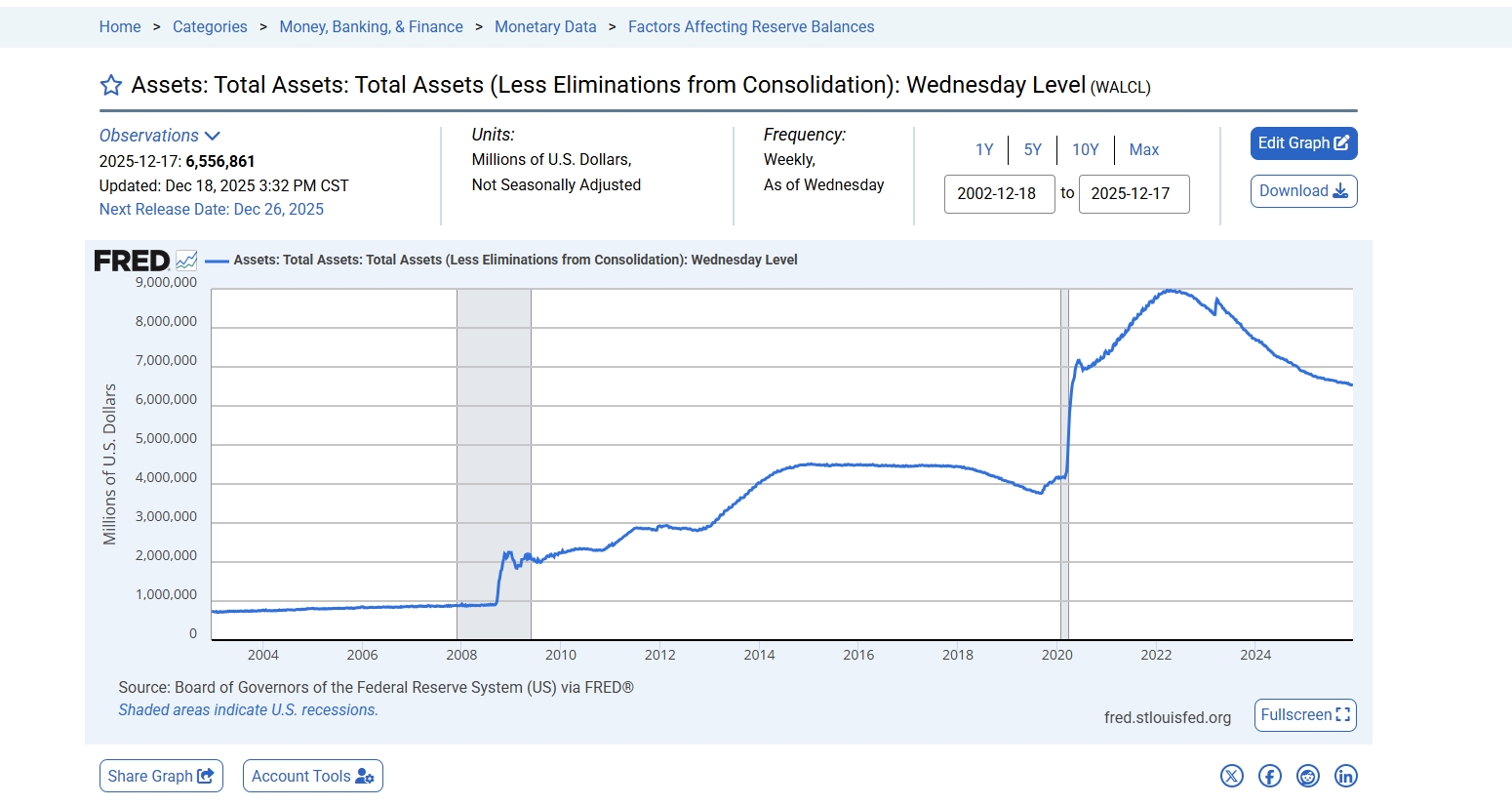

- The central bank’s balance sheet does not show a “flood-like expansion,” and its balance sheet as of December 17, 2025, was $6.5569 trillion.

The above three points show that although interest rates are generally decreasing for the middle class, banks have not relaxed their risk control measures accordingly.

The water pipe didn’t burst; it was just slowly seeping through.

The above is the logic of traditional assets, mainly stocks and credit markets. So what is the situation like in the crypto market?

The encryption logic is actually the same as the mid-term indicator I wrote before, and the conclusion is still that the intermediary layer is blocked.

In cryptography, the intermediary layer is not a bank lending platform, but rather:

- Is the supply of stablecoins expanding in a trend (adding purchasing power)?

- Is there a net inflow (marginal increase) into ETFs/institutional channels?

Those who follow me should know that the current situation is that stablecoins are hardly rising, while ETFs are experiencing outflows.

You can find the data in my previous posts.

So, although the data metrics used by middle-level managers in crypto and traditional assets differ, the underlying situation is the same.

It’s all blocked, it hasn’t exploded yet.

3.MARKET BEHAVIOR LAYER – THE REAL DETERMINANT OF PRICES

The next issue is whether institutions are willing to invest; this is a crucial point.

Even if institutions have the funds, for them, encryption is merely an option, not a necessity.

This is a crucial point, which is why I’ve consistently advocated for looking beyond the cryptocurrency space and researching global assets.

Including a radical viewpoint I expressed in my previous post, among crypto capital’s investment options, crypto is only slightly better than leftovers.

I’ll discuss this in the next article.

4. SUMMARY

Therefore, connecting these three points reveals a very practical order.

Interest rate cuts → (not necessarily) lending → (even less certain) risk-taking

This explains the question I raised at the beginning, why…An easing cycle is not a straight-line bull market.

The above viewpoints are referenced from @Web3___Ace