KEYTAKEAWAYS

- Ethereum remains the dominant smart contract platform with the largest DeFi and DApp ecosystem, driven by strong network effects and liquidity.

- Solana stands out for high throughput and low fees, attracting performance-focused applications, NFTs, and memecoin activity.

- Choosing between Solana and Ethereum depends on use cases, as both networks serve different technical and ecosystem needs.

CONTENT

Solana vs Ethereum: a deep comparison of performance, fees, scalability, and ecosystems, exploring whether SOL can challenge ETH as blockchain competition intensifies after 2025.

Solana (SOL) and Ethereum (ETH) are among the most widely recognized blockchain technologies in the crypto industry, playing central roles in decentralized applications (DApps) and the broader digital asset ecosystem. For years, Ethereum has been regarded as the foundation of smart contracts and DApp development, benefiting from strong network effects and a deeply established ecosystem.

At the same time, Solana has emerged as a prominent alternative, positioning itself around scalability and high-performance execution. While Ethereum prioritizes security, decentralization, and ecosystem maturity, Solana focuses on high throughput and low latency, making it particularly attractive for performance-sensitive use cases.

✏️ After 2025, this competition has intensified even further.

In 2023, Solana recorded notable growth across several technical metrics, including active addresses and daily transaction volume. Its native token, SOL, also experienced significant price volatility, drawing renewed market attention. Combined with the rapid expansion of the Solana ecosystem in areas such as memecoins and NFTs, these developments reignited community debate over whether Solana could challenge Ethereum’s long-standing dominance.

As a result, discussions around Solana as a potential “Ethereum killer” resurfaced, although such narratives remain highly controversial and far from settled.

🔍Does this mean Solana is fundamentally better than Ethereum?

Or do these two networks simply follow different technical paths and ecosystem strategies, each serving distinct market needs? Understanding the core differences between Solana and Ethereum remains essential to evaluating their respective roles in the evolving blockchain landscape.

>>> More to read: Bitcoin vs. Gold: Which is the Better Investment?

WHAT IS SOLANA (SOL)?

Solana is a high-speed, low-cost blockchain platform designed for decentralized applications. It was founded in 2017 by Solana Labs and supported by the Solana Foundation. The network is commonly recognized as a high-performance blockchain, built with a multi-layered consensus structure to reduce bottlenecks and limit reliance on centralized intermediaries.

Because Solana shares several similarities with Ethereum while introducing improvements focused on scalability, it is often referred to as an “Ethereum killer.” This label mainly reflects Solana’s emphasis on throughput and execution efficiency rather than a direct replacement of Ethereum’s ecosystem.

A key innovation behind Solana is Proof of History (PoH), a mechanism designed to verify the ordering and integrity of historical data. By using cryptographic hashing to create unique fingerprints for data—such as past transactions—Solana can process transactions more efficiently. This approach contrasts with early Proof of Work (PoW) systems used by networks like Bitcoin (BTC) and Litecoin (LTC), which rely on energy-intensive mining.

Solana is also fully open-source, allowing third-party developers to build applications directly on its infrastructure.

>>> More to read: What is Solana? The Ethereum Killer

WHAT IS ETHEREUM (ETH)?

Ethereum is an open-source, decentralized blockchain launched in 2015 by Vitalik Buterin and other co-founders. It uses its native cryptocurrency, ETH, for transactions, fees, and interactions with applications on the network.

Unlike Bitcoin, Ethereum introduced a decentralized computing platform that enables smart contracts and decentralized applications (DApps). These smart contracts are written in Solidity and support a wide range of use cases, including decentralized finance (DeFi) and non-fungible tokens (NFTs). Many Ethereum DApps use ETH or other tokens for lending, borrowing, and yield generation.

Ethereum hosts the world’s largest DApp and DeFi ecosystem. While it was originally a Proof of Work (PoW) network, Ethereum transitioned to Proof of Stake (PoS) in 2022 to improve security, energy efficiency, and long-term scalability.

It is worth noting that Ethereum refers to the blockchain network itself, while ETH is the native token used to pay for transactions and execute smart contracts. At its core, Ethereum operates as a programmable blockchain powered by the Ethereum Virtual Machine (EVM).

>>> More to read: What Is Ethereum & How Does It Work?

SOLANA VS ETHEREUM

Solana (SOL) and Ethereum (ETH) both host a large number of active applications running on their blockchains. However, it is widely acknowledged that Ethereum remains the more popular platform overall, largely due to its more mature, transparent, and complex DApp ecosystem.

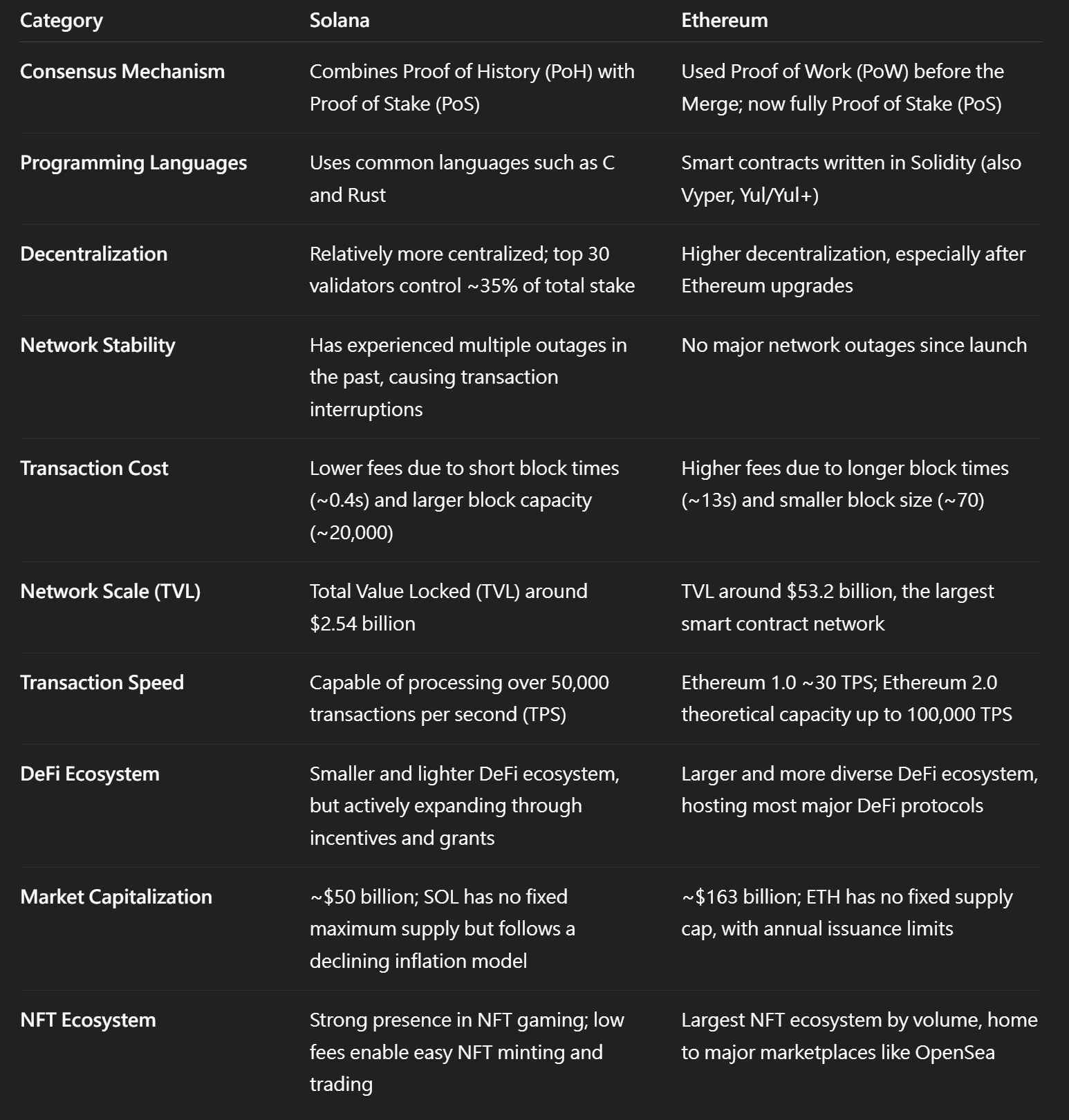

Although Solana is often described as an “Ethereum killer,” the two networks differ in several important ways. These differences span consensus design, developer experience, decentralization, performance, and ecosystem scale.

📌 Key Differences Between Solana & Ethereum

✅ Consensus Mechanism

Ethereum (ETH) originally relied on the Proof of Work (PoW) consensus mechanism, similar to Bitcoin. Under PoW, miners validate transactions and create new blocks using computational power, which enhances security but limits transaction throughput. After upgrading to Ethereum 2.0, Ethereum transitioned to Proof of Stake (PoS), a change expected to significantly improve network efficiency and performance.

Solana (SOL) differs by introducing Proof of History (PoH), a mechanism that cryptographically verifies the order of events by attaching timestamps to transactions. This allows transactions to be processed in a more predictable sequence, unlike Ethereum and Bitcoin, where transactions are not finalized in real time.

In addition, a key architectural distinction lies in execution design. Solana follows a more stateless and parallel execution model, reducing memory overhead and allowing transactions to be processed simultaneously. This design choice is one of the main reasons behind Solana’s high scalability.

✅ Transaction Costs

Transaction fees represent one of the most noticeable differences between Solana and Ethereum, and are a major reason some users favor SOL.

Solana is widely known for its low transaction fees, while Ethereum fees are typically much higher. As of July 2022, the average gas cost on Ethereum was around 3 Gwei (approximately $0.09), whereas Solana transactions cost about 0.0000053 SOL (roughly $0.000014).

This gap is largely driven by block design. Ethereum produces blocks every 13 seconds with limited capacity, while Solana produces blocks every 0.4 seconds and can include up to 20,000 transactions per block.

✅ Transaction Speed

In terms of raw throughput, Solana is among the fastest blockchains currently in operation. This is primarily due to its network architecture, which prioritizes throughput, while Ethereum historically prioritized decentralization.

Ethereum 1.0 processes roughly 30 transactions per second (TPS), whereas Solana (SOL) can process over 50,000 TPS. After upgrades, Ethereum is expected to theoretically support up to 100,000 TPS.

For context, Visa’s global payment network is estimated to handle around 65,000 TPS, often used as a benchmark for comparison.

✅ Network Scale

Ethereum remains the largest smart contract network by a wide margin. According to DeFiLlama data, Ethereum (ETH) has a Total Value Locked (TVL) of approximately $53.2 billion, while Solana (SOL) has a TVL of about $2.54 billion—a difference of more than 95%.

This scale advantage explains why most financial and DeFi applications continue to prioritize Ethereum. While Solana has begun attracting institutional interest, it may take time for its ecosystem to approach Ethereum’s network depth and liquidity.

✅ Market Capitalization

Both Ethereum and Solana use native tokens to pay for transaction fees and secure their networks, making them two of the most important assets in the crypto market.

Ethereum is currently the second-largest cryptocurrency by market capitalization, behind Bitcoin, with a market value of approximately $305 billion. Solana ranks around fifth, with a market capitalization of roughly $43 billion.

Solana does not have a fixed maximum supply of SOL. However, its inflation rate decreases over time and is expected to converge toward approximately 1.5% in the long term.

✅ DeFi Ecosystem

Due to its longer history, Ethereum hosts a larger and more diverse DeFi ecosystem than Solana. Major protocols such as MakerDAO, Lido, Uniswap, and Aave are all built on Ethereum. The network also played a central role in the 2021 NFT boom, with most major NFT marketplaces launching on Ethereum.

By comparison, Solana’s DeFi ecosystem is still in an earlier stage. However, some Solana DApps have begun attracting users, supported in part by ecosystem incentives and hackathon-driven growth. Protocols such as Solend and Raydium currently account for a large share of DeFi activity on Solana (SOL).

While blockchain technology continues to evolve, an observable pattern has emerged: when Ethereum gas fees rise, Solana user activity often increases. Although future outcomes remain uncertain, Ethereum currently maintains a broader and more mature DeFi ecosystem with wider application coverage.

>>> More to read: Banks x Blockchain|Faster. Safer. Smarter.

WHICH IS BETTER: SOLANA OR ETHEREUM?

From a data-driven perspective, Solana is still trailing behind Ethereum, and whether it can eventually surpass Ethereum will depend on continued functional improvements and ecosystem support.

That said, for individual users and investors, deciding which blockchain is “better” ultimately comes down to specific needs and use cases.

If you are a developer, underlying technology and network architecture are likely to be key considerations when comparing Ethereum (ETH) and Solana (SOL). Each blockchain follows a distinct design philosophy, with different consensus mechanisms and scalability trade-offs. Solana (SOL) is currently one of the fastest blockchains in terms of transaction throughput, while Ethereum (ETH) handles significantly higher overall transaction volume and remains more deeply integrated into the broader crypto market.

Regardless of which project you favor, maintaining an open mindset and actively exploring different blockchain networks and DeFi experiences is essential.

As the world continues to move toward greater decentralization, both Solana and Ethereum are likely to play important roles in the future. What ultimately deserves closer attention is not only their technological direction, but also their long-term growth potential and the evolving role of SOL and ETH within the crypto ecosystem.