KEYTAKEAWAYS

- Polygon (Matic) enhances Ethereum by offering scalable, secure, and faster blockchain transactions.

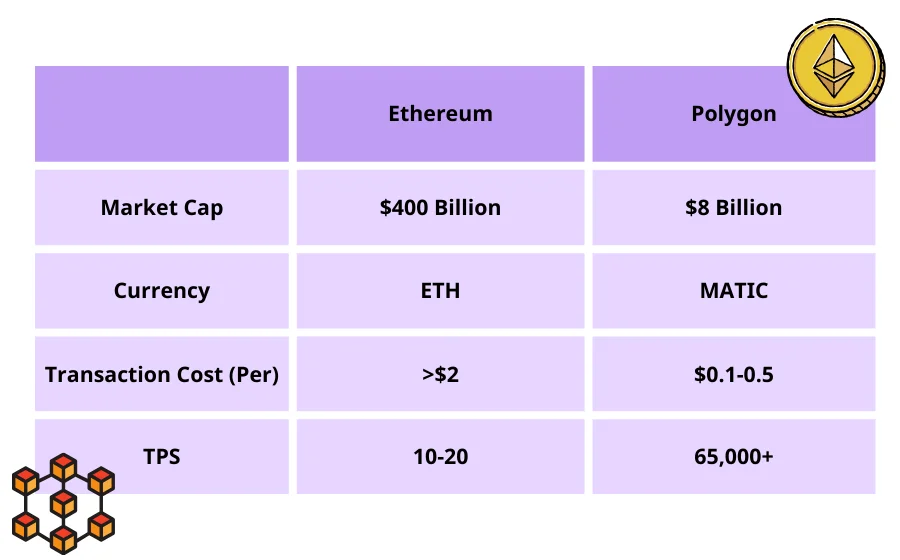

- With up to 7,000 TPS, Polygon significantly surpasses Ethereum's capacity, reducing congestion and fees.

- Polygon's diverse scaling solutions, including Plasma and Rollups, offer high compatibility and flexibility for Ethereum DApps.

CONTENT

Discover Polygon ($Matic), a solution to Ethereum‘s pressure from 70% of DeFi projects on its platform. Learn about its advantages and future prospects.

WHAT IS POLYGON ($MATIC)?

To understand Polygon, it’s essential to know what is the Matic first. Polygon is originally called Matic Network which was founded by an Indian team in 2017 using the Tendermint SDK to create an Ethereum sidechain to address Ethereum’s network congestion and low throughput issues. Polygon is an upgraded version aimed at becoming a multi-chain framework, supporting various sidechains and Layer 2 solutions. Despite the name change, Polygon and Matic Network refer to the same project. Matic coin is the native token used on the Polygon blockchain, similar to Ether (ETH) on the Ethereum chain.

In February 2021, Matic Network was renamed Polygon to expand its mission and technology scope, including a suite of developer solutions with various functionalities. Polygon is not just a simple scaling solution like its predecessor, Matic Network- it uses a technology called Plasma to process transactions off-chain before finalizing them on the Ethereum mainnet. The main features of Matic include:

- Scalability: Fast, low-cost, and secure transactions on the Matic sidechain, with determinism achieved on the main chain and Ethereum as the first compatible Layer 1 base chain.

- High Throughput: Achieved up to 7,000 TPS on a single sidechain in internal testnets, with horizontal scaling through adding multiple chains.

- Security: A PoS system.

Meanwhile, Polygon is a modular, flexible framework that supports building and connecting two main types of solutions:

- Stand-alone Chains: These chains rely on their own security, have their own validator nodes, and their own consensus models, such as Proof of Stake (PoS) and Delegated Proof of Stake (DPoS). Stand-alone chains offer the highest level of independence and flexibility, they provide a secure and flexible environment for handling vast data and transactions, maintaining data security and privacy, and offering many conveniences. Stand-alone chains are valuable development platforms for organizations and businesses to design their own consensus mechanisms and apply them in various fields such as digital asset trading, IoT, and community governance.

- Secured Chains: In addition to supporting existing Plasma chains, Polygon will support other major Layer 2 solutions such as Optimistic Rollups, zkRollups, and Validium, essentially becoming a unique “Layer 2 aggregator.” Secured chains do not build their own validator pools but rely on Ethereum’s security.

Polygon’s core technology helps users securely and quickly manage their assets without directly facing the large number of transactions and inefficiencies of Ethereum. This Layer 2 solution provides a more efficient, secure, and fast transaction environment for Ethereum. Polygon has a complete development ecosystem that helps developers quickly develop Ethereum smart contracts and easily integrate with multiple Layer 2 solutions. Utilizing stand-alone and secured chains, Polygon is compatible with almost all Ethereum scaling solutions, acting like the internet for Ethereum, where all existing scaling solutions can easily connect to Ethereum through Polygon.

MATIC COIN [POLYGON]

Matic coin is the token on the Polygon blockchain, in the ERC20 format. Every transaction on the Polygon blockchain, including sending tokens, using smart contracts, and staking in PoS, requires MATIC coins.

The main uses of Matic coin are:

- As Polygon’s Transaction Fees: As the native token, Matic coin is used for transaction fees on all operations on the chain, with each transaction fee being only about $0.01-0.02 worth of MATIC, much cheaper than on the main chain.

- Staking for Security on Polygon: Validators and delegators stake their MATIC coins in smart contracts to protect the smooth operation of the network, achieving consensus and ensuring network security.

HOW POLYGON (MATIC) ADDRESSES ETHEREUM’S CHALLENGES

Currently, Ethereum processes 14 transactions per second (TPS), while Polygon can handle up to 7,000 TPS. This makes everything built on the blockchain cheaper and faster, like a high-speed lane on the highway. Thus, Polygon’s initial development intent was to help solve existing problems with Ethereum. As Ethereum’s user numbers and transaction volume have surged in recent years, the system has shown signs of being overwhelmed, such as:

- System latency

- High transaction fees

- Insufficient throughput

- Overcrowding

No other platform has introduced as many scaling solutions as Polygon. Here are their primary scaling solutions:

- Plasma Technology: Polygon employs Plasma technology for scaling, a second-layer solution that transfers transaction volume to Polygon’s sidechain, reducing pressure on the Ethereum mainnet.

- Rollups Support: Polygon provides support for Rollups(second-layer scaling solution), which processes transactions in batches on the sidechain, thereby increasing the system’s overall throughput.

- zkRollups Technology: Polygon also supports zkRollups, a Zero-Knowledge Rollups technology that uses zero-knowledge proofs to ensure transaction security and privacy, speeding up transaction processing.

- Optimistic Rollups Implementation: Additionally, Polygon has implemented Optimistic Rollups, an optimistic rollups technology that achieves efficient and low-cost transaction processing through positive assumptions and effective collateral strategies.

- Polygon SDK Release: Polygon has released the Polygon SDK, a development toolkit designed to assist developers in creating customized sidechain solutions, enhancing the system’s scaling capabilities and functionality.

According to Polygon’s official website, there are even more scaling solutions in the pipeline. The ones listed above are currently the most significant. These scaling solutions and technologies provide high compatibility with Ethereum, supporting most Ethereum applications (DApps) and smart contracts, offering developers and users more choices and flexibility.

ADVANTAGES AND DISADVANTAGES OF POLYGON (MATIC)

Advantages:

- Low transaction fees:Matic coin transaction fees usually range between 0.1 to 0.5 MATIC (about $0.077 to $0.38), compared to Ethereum’s fees of approximately $2.5 to $20, especially during network congestion when Ethereum’s gas fees significantly rise.

- Faster transaction speeds: Ethereum’s TPS is about 20-40, while Polygon’s test network TPS can reach 6,000-10,000, significantly faster than Ethereum.

- High compatibility: Polygon is compatible with almost all Ethereum scaling solutions, such as Layer 2, Rollups, and zkRollups, allowing it to support applications of these technologies.

Disadvantages:

- Dependence on Ethereum’s security: As a non-proprietary blockchain, Polygon’s security and infrastructure rely on Ethereum. A major security vulnerability or attack on the Ethereum mainnet could potentially impact Polygon’s sidechain.

- Not suitable for everyday transactions: Matic coin is primarily used for payments, settlements, and participating in ecosystem activities on the Polygon blockchain, making it unsuitable for daily consumption.

IS POLYGON (MATIC) WORTH INVESTING IN?

Currently, around 70% of DeFi projects operate on the Ethereum platform, which faces scaling challenges due to its single-chain structure. Against this backdrop, Polygon (Matic)has shown promising prospects. In recent years, the number of projects collaborating with Polygon has surged, with partners including Stripe, Reddit, Adidas, Starbucks, and the NFL, among others, expanding the application areas. In the blockchain community, Polygon is recognized as a leader in solving Ethereum’s congestion issues. However, future competitors could surpass Polygon, so investors need to stay informed about market trends. At present, Matic coin, as Polygon’s native token, holds significant investment potential.

Since its development in 2017, the price of Matic coin has been on the rise, even surviving the crypto market crash in 2021, when it soared from $0.8 to a new high of $2.45, becoming one of the top 20 cryptos. It’s mainly due toEthereum’s high transaction costs, which attracted many investors to Polygon’s lower fees.

However, in 2022, the overall economy, Fed rate hikes, and energy crises, among other negative factors, led to a downturn in the crypto market, led by Bitcoin (BTC) and Ethereum (ETH), with Matic coin’s price falling to a low of $0.38. Entering 2023, despite the increasing adoption rate of cryptos, regulatory changes have affected market demand and prices, adding uncertainty. Experts believe that Matic coin may not see a significant increase in the short term.

Nevertheless, as Polygon’s projects continue to grow and its brand influence expands into different areas, Matic coin has risen to the 13th position in market value rankings, showing its long-term development potential. DigitalCoinPrice predicts that the highest price of Matic coin this year could be $1.87. If Polygon fully leverages its strength and influence in the coming years, its price performance is expected to continue growing, potentially reaching a high of $4.09 within two years.

However, kindly keep in mind that conducting thorough market research and due diligence before investing in Matic coin is essential, along with devising a clear investment strategy based on one’s risk tolerance.

>>> More to read : Optimism (OP): Ethereum’s Layer-2 Scaling Solution

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!