KEYTAKEAWAYS

- Bitcoin Mining Difficulty reached a record 136.29T, marking the fifth consecutive increase and reinforcing network strength.

- Difficulty adjustments keep block times steady at ~10 minutes, ensuring predictable issuance and stable security.

- Future challenges include energy costs, regulatory pressure, and quantum computing, balanced by renewable adoption and PoW resilience.

CONTENT

Bitcoin Mining Difficulty hit a new all-time high of 136.29T on Sept 5, 2025, reflecting growing network security, higher miner costs, and long-term industry challenges.

BITCOIN MINING DIFFICULTY REACHES A NEW ATH

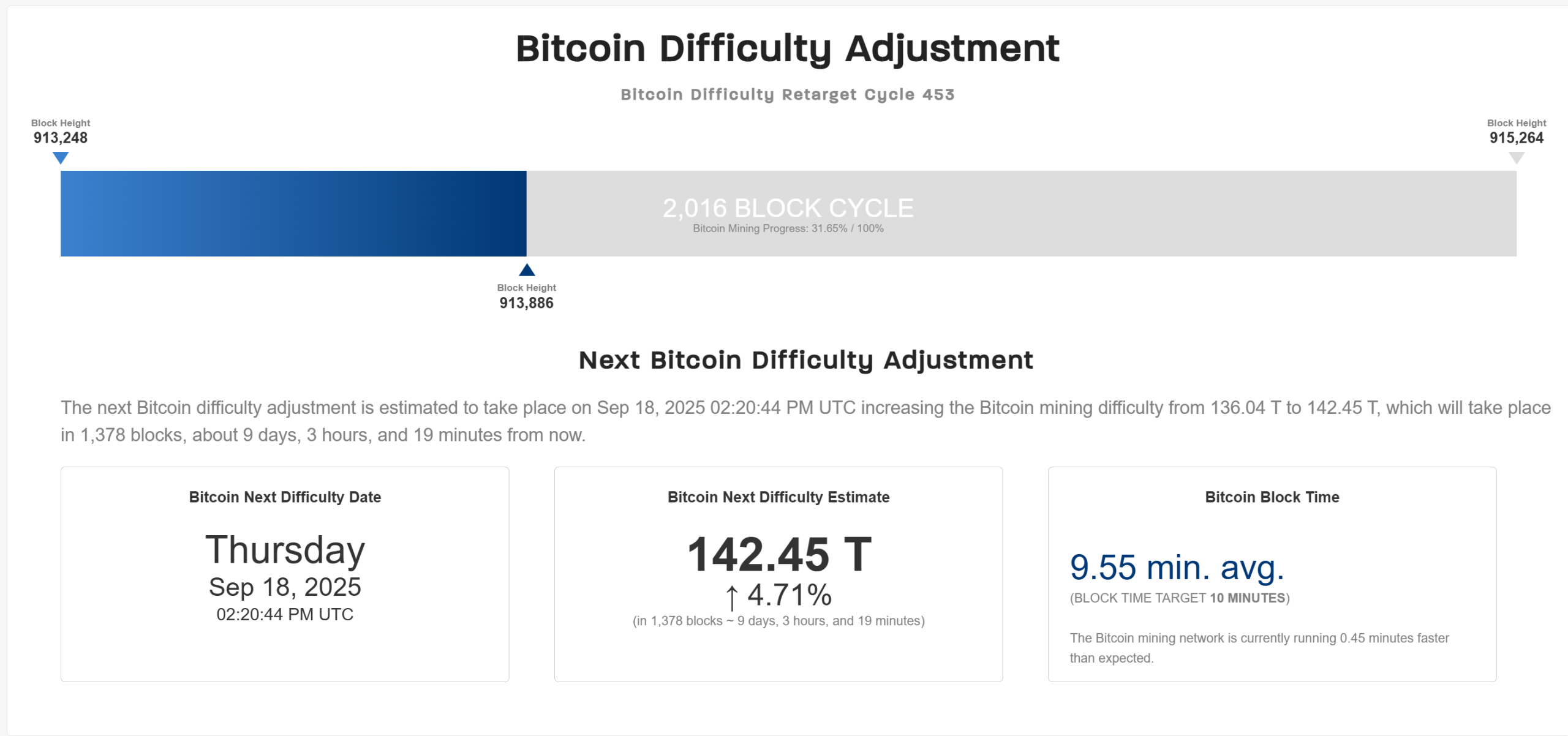

According to the latest data from CoinWarz, Bitcoin Mining Difficulty was officially adjusted on September 5, 2025, climbing to approximately 136.29 trillion (T) — marking a new all-time high (ATH). This was the fifth consecutive upward adjustment, highlighting the growing strength of the Bitcoin network’s hashrate and the increasing challenge for miners to secure new blocks.

(Source: CoinWarz)

The Bitcoin protocol is designed to ensure that, on average, one block is produced every 10 minutes. Recently, however, miners were finding blocks faster, with an average block time of just 9.52 minutes. To correct this imbalance, Bitcoin Mining Difficulty was automatically increased by about 5.1%.

This record-setting adjustment reflects not only the rising security of the BTC network but also the greater computational demands placed on miners. As difficulty reaches historic highs, the market will closely watch its impact on miner profitability, Bitcoin’s price dynamics, and the broader mining industry landscape.

>>> More to read: What is Cloud Mining in Crypto?

HOW DOES BITCOIN MINING WORK?

Before diving into what Bitcoin Mining Difficulty really means, it’s important to understand the fundamentals of Bitcoin mining itself.

Mining plays a critical role in the Bitcoin network and the creation of BTC. It is the backbone of Bitcoin’s consensus system — the protocol that ensures all participants reach agreement on new data added to the blockchain. In this process, miners compete to solve cryptographic puzzles using specialized hardware. Once successful, they earn the right to add a new block to the Bitcoin blockchain and receive block rewards.

To keep the system running smoothly, the network automatically adjusts Bitcoin Mining Difficulty on a regular basis. This ensures that blocks are added at a steady pace — roughly every 10 minutes — regardless of how much computational power (hashrate) is being contributed by miners.

In simple terms, the more miners that join the network, the harder it becomes to mine Bitcoin. This dynamic ensures that block production remains predictable, supply issuance stays on schedule, and the overall system remains secure.

>>> More to read: What is Crypto Mining?

WHAT IS BITCOIN MINING DIFFICULTY?

In simple terms, Bitcoin Mining Difficulty refers to how hard it is to discover and validate a new block on the Bitcoin blockchain through mining.

Because the Bitcoin network is fully decentralized and not controlled by any central authority, it relies on the algorithm designed by Bitcoin’s creator, Satoshi Nakamoto. This algorithm was embedded into the original Bitcoin protocol and is responsible for adjusting the difficulty of mining based on the total amount of computational power (hashrate) contributed by miners.

The system ensures that regardless of how many miners are participating, blocks continue to be discovered at a steady pace — roughly one every 10 minutes. In practice, this means Bitcoin Mining Difficulty constantly recalibrates itself to balance the network and maintain predictable issuance of BTC.

>>> More to read: What is Liquidity Mining in Crypto?

THE IMPORTANCE OF BITCOIN MINING DIFFICULTY

The algorithm behind Bitcoin Mining Difficulty is specifically designed to ensure that miners, on average, discover a new block roughly every 10 minutes. This mechanism is essential to maintaining the overall stability of the Bitcoin system. In practice, it means that miners collectively need about 10 minutes to solve the cryptographic puzzle, win the block reward, and add a new transaction block to the chain.

To preserve this pace, the protocol automatically adjusts Bitcoin Mining Difficulty upward or downward. When more miners or more powerful mining hardware enter the network, difficulty rises; when the opposite happens, the system lowers it. These adjustments are made by changing the number of leading zeros required in the block’s target hash.

Each miner competes to guess a valid hash, and the one whose hash matches or falls below the target is chosen as the winner. Without such a system, as more miners join with increasingly advanced hardware, new Bitcoin blocks would be discovered at unpredictable speeds, potentially destabilizing the network and even putting pressure on BTC’s long-term price stability.

>>> More to read: What is a Mining Pool in Crypto?

WHAT DETERMINES BITCOIN MINING DIFFICULTY?

The level of Bitcoin Mining Difficulty is mainly influenced by two key factors:

✅ Maintaining Network Integrity

The difficulty level of mining Bitcoin is adjusted based on how easy or hard it is for miners to find new blocks. On average, a new BTC block is added every 10 minutes. To preserve this consistency, the protocol raises the difficulty when blocks are found too quickly and lowers it when blocks are found too slowly.

The Bitcoin network enforces a universal block difficulty target, meaning that all valid hashes must be below a specific threshold. Mining pools can also define additional difficulty settings for their participants, but the network maintains a shared minimum to ensure fairness.

✅ The Relationship With Hashrate

Another critical factor is the hashrate, which measures the total computational power securing the network. A higher hashrate signals stronger security and faster processing. However, to keep block generation aligned with the 10-minute target, the protocol increases Bitcoin Mining Difficulty when the hashrate rises. Conversely, if the hashrate falls, mining becomes easier.

This mechanism ensures that no matter how much mining power is added or removed, the Bitcoin network remains stable, predictable, and resistant to manipulation.

>>> More to read: What is Hash? The Digital Fingerprint in Crypto

BITCOIN MINING DIFFICULTY FUTURE OUTLOOK

Although Bitcoin Mining Difficulty is already well-established, its long-term future faces uncertainties. Regulatory policies and rising energy costs are likely to impact miners, while global initiatives are pushing for cleaner, renewable energy sources to sustain mining operations.

Debates around Proof of Work (PoW) highlight the environmental cost of mining, especially compared to Proof of Stake (PoS), which dramatically reduces energy usage. Still, PoW remains Bitcoin’s security cornerstone, offering unmatched resilience against attacks.

To adapt, miners are turning to renewable energy like hydropower and solar, while researchers are preparing for new challenges such as quantum computing. The future of Bitcoin Mining Difficulty will ultimately depend on balancing sustainability with the need to maintain Bitcoin’s integrity and security.