KEYTAKEAWAYS

- Saylor's Strategic Shift to Bitcoin

Michael Saylor transformed MicroStrategy’s treasury strategy by allocating billions into Bitcoin, redefining corporate asset management. - Bitcoin as Ideological and Financial Hedge

Saylor views Bitcoin not only as a superior store of value over gold but also as a hedge against inflation and centralized monetary policy. - MicroStrategy's Debt-Financed BTC Accumulation

Uniquely, MicroStrategy leverages convertible debt to finance its BTC purchases—an aggressive strategy reflecting Saylor’s long-term conviction.

CONTENT

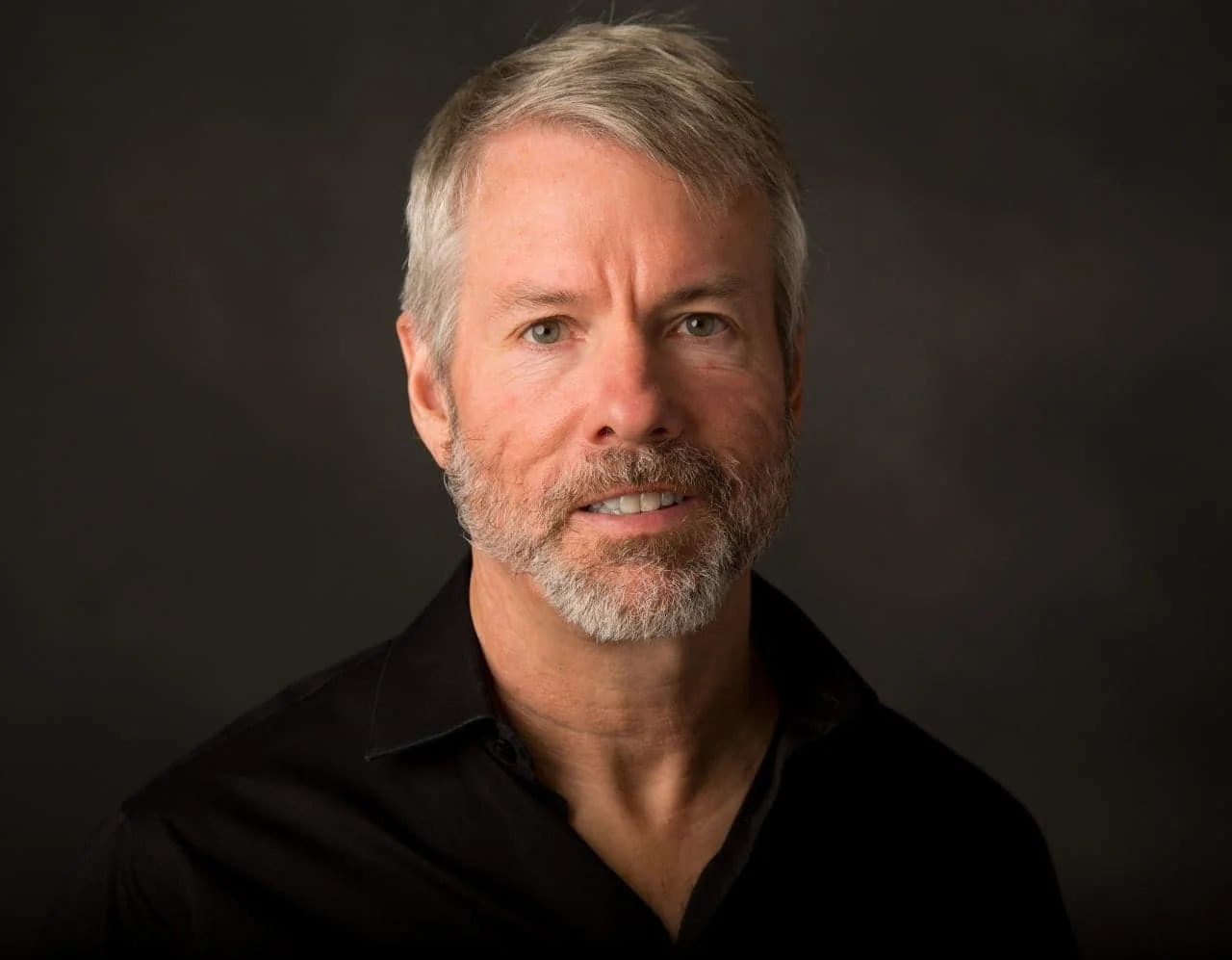

Michael Saylor, Executive Chairman of MicroStrategy, leads the firm’s bold Bitcoin strategy, positioning both as central figures in institutional crypto adoption.

WHO IS MICHAEL SAYLOR?

Michael Saylor is an American entrepreneur, tech executive, author, and philanthropist. He is best known as the co-founder and Executive Chairman of MicroStrategy, a business intelligence company that has become globally recognized for its large-scale Bitcoin holdings. Over the years, Saylor has played a pivotal role in advancing both the company’s growth and the enterprise adoption of Bitcoin and blockchain technology.

📘 Background & Founding Journey

Born in 1965 in Lincoln, Nebraska, Michael Saylor grew up in a U.S. Air Force family, spending much of his childhood on various military bases. He received a scholarship through the ROTC program and attended MIT, earning dual degrees in Aeronautics and Astronautics, and Science, Technology, and Society. In 1989, he co-founded MicroStrategy with his MIT fraternity brother Sanju Bansal, focusing on business analytics software. The company went public in 1998 and weathered major volatility during the 2000 dot-com crash.

₿ Bitcoin Advocacy & Investment Strategy

In 2020, Michael Saylor led MicroStrategy to adopt a Bitcoin-centric asset strategy, making its first purchase of 21,454 BTC and continuing to accumulate ever since. As of early 2025, MicroStrategy holds over 500,000 BTC, making it the largest publicly traded holder of Bitcoin. Saylor views Bitcoin as “digital gold” and a hedge against inflation and currency devaluation. His bold corporate strategy has reshaped institutional perspectives on digital assets.

🧑🏫 Other Roles & Contributions

- Author: In 2012, Saylor published The Mobile Wave, a book exploring how mobile technology is reshaping global society.

- Philanthropist: He founded Saylor Academy, a nonprofit offering free online college-level courses to promote educational access.

📈 Net Worth & Influence

As of 2025, Michael Saylor‘s estimated net worth exceeds $10 billion, largely driven by his holdings in MicroStrategy stock and Bitcoin assets. He is widely regarded as one of the most influential voices in the push toward Bitcoin institutional adoption.

🔍 Saylor’s View on Bitcoin

Michael Saylor often refers to Bitcoin as “the apex property of humanity,” superior to gold or any other traditional store of value. According to him, Bitcoin is the most secure and portable asset one can own, thanks to its resistance to inflation and government interference.

>>> More to read: What is Bitcoin: A Comprehensive Overview

WHAT IS MICROSTRATEGY?

MicroStrategy was founded in 1989 by Michael Saylor and Sanju Bansal. It is a software company that provides business intelligence (BI), mobile software, and cloud-based analytics solutions. The company went public in 1998 through an IPO on the NASDAQ under the ticker symbol MSTR.

📌 MicroStrategy and Bitcoin

Although MicroStrategy had long focused on developing data analytics and BI solutions, it gained widespread attention when it began purchasing Bitcoin as a treasury reserve asset.

In 2020, Michael Saylor made headlines by steering MicroStrategy into the crypto space. Amid economic uncertainty caused by the COVID-19 pandemic, Saylor grew concerned that inflation would erode the company’s cash reserves.

In August 2020, MicroStrategy made its first Bitcoin purchase, acquiring $250 million worth of BTC. Saylor defended the move by arguing that Bitcoin wasn’t just a passing digital trend, but rather a form of “digital gold” capable of preserving wealth and delivering long-term value. Since then, the company has continued to accumulate Bitcoin and currently holds over 300,000 BTC—more than 1.4% of Bitcoin’s total supply.

📌 Buying Bitcoin with Debt

What sets MicroStrategy apart from other Bitcoin-holding companies is its bold strategy of buying BTC through debt financing. The company has raised billions of dollars by issuing convertible notes—debt instruments that can be redeemed later for cash, MicroStrategy stock (MSTR), or a combination of both.

✅ For example:

- In late 2020, MicroStrategy raised $650 million and used all of it to buy Bitcoin.

- More rounds followed, including a $500 million secured note issuance in 2021.

- In October 2024, the company announced plans to raise $4.2 billion over the next three years for further Bitcoin purchases.

- In November 2024, it priced a new convertible senior note offering, targeting $2.6 billion. The final raise totaled $3 billion, with maturity in 2029.

As of November 2024, the company had conducted six convertible bond issuances, with maturities ranging from 2027 to 2032.

While many consider this strategy risky, Michael Saylor believes it’s worth it—calling Bitcoin “the scarcest asset in the world.” He likens Bitcoin to “digital real estate,” emphasizing its ability to withstand inflation.

🔍 How Much Bitcoin Does MicroStrategy Hold?

As of April 20, 2025, MicroStrategy holds 538,200 BTC.

On April 21, 2025, Michael Saylor posted on X (formerly Twitter) that the company had acquired an additional 6,556 BTC for approximately $555.8 million—at an average price of $84,785 per Bitcoin. He also noted that as of 2025 year-to-date, the company had achieved a 1% return on its Bitcoin holdings.

$MSTR has acquired 15,355 BTC for ~$1.42 billion at ~$92,737 per bitcoin and has achieved BTC Yield of 13.7% YTD 2025. As of 4/27/2025, we hodl 553,555 $BTC acquired for ~$37.90 billion at ~$68,459 per bitcoin. https://t.co/5OOs3UdWLg

— Michael Saylor (@saylor) April 28, 2025

SUMMARY

As cryptocurrencies continue to integrate with mainstream finance, Michael Saylor is likely to remain a dominant force in the digital asset landscape. MicroStrategy has made its mission clear: to relentlessly accumulate Bitcoin and champion its role as the future of money.

For Saylor, Bitcoin isn’t just a business strategy—it’s a philosophical commitment to a decentralized financial system that empowers individuals across the globe. Whether you see Michael Saylor as a visionary or a risk-taker, his impact on finance and crypto is undeniable.

From an observer’s perspective, what sets Saylor apart is not just the size of his bets, but his unwavering conviction. In a world of short-term profit cycles and corporate hedging, he has taken a long-term stance that aligns ideology with investment—a rare combination. His moves have pressured traditional CFOs to rethink corporate treasury management, and have sparked institutional conversations about Bitcoin’s role as a reserve asset. Love him or criticize him, Saylor has redefined what it means to lead in a financial revolution.

📌 Key Bitcoin Beliefs from Michael Saylor

✅ Bitcoin is the ultimate store of value

Saylor believes Bitcoin surpasses gold as the most effective asset in history for preserving wealth across time and space.

✅ Backing Bitcoin doesn’t mean rejecting fiat

He emphasizes that supporting Bitcoin is not an anti-government or anti-fiat stance—it’s about protecting capital in a world of monetary debasement.

✅ Never sell your Bitcoin

According to Saylor, Bitcoin is not a trading asset but a multi-generational treasury reserve. True conviction means holding it forever.

▶ Buy Crypto at Bitget

ꚰ CoinRank x Bitget – Sign up & Trade!