KEYTAKEAWAYS

- Preserve capital during market weakness by implementing structured risk management: 50% in major coins, proper leverage limits, and maintaining 60% stablecoin positions.

- Monitor macroeconomic indicators and on-chain data closely, as Fed policy now heavily influences crypto markets, with tools like exchange fund flows predicting movements.

- Adopt a long-term perspective with realistic goals: short-term capital preservation, mid-term asset accumulation at lows, and long-term positioning for the next bull cycle.

CONTENT

Practical strategies for crypto investors during high interest rates: Implementing risk management, strategic position sizing, security protocols, and psychological discipline while awaiting Federal Reserve policy shifts.

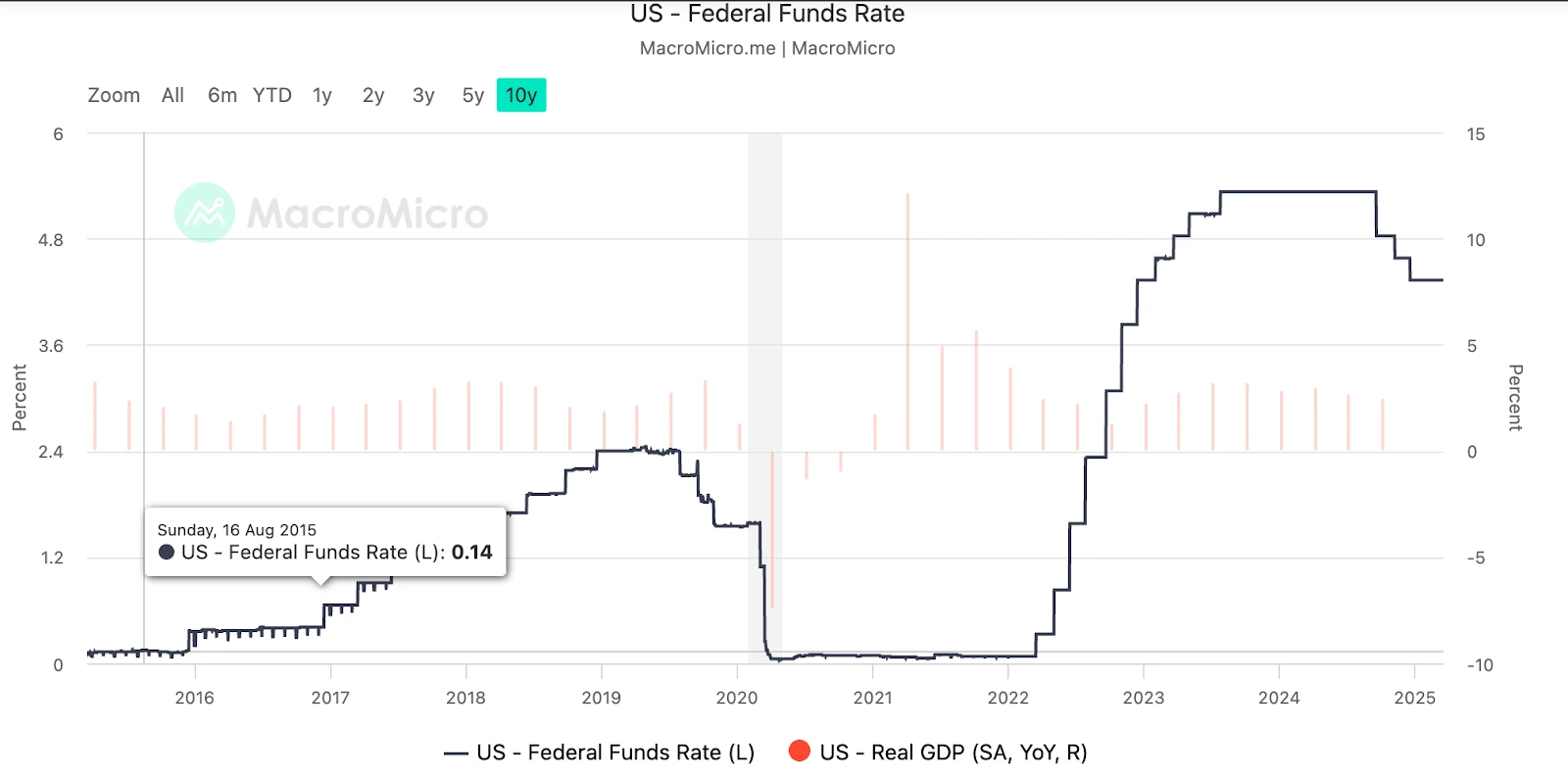

About two months ago, on March 19 at 2 PM Eastern time, the Federal Reserve announced its interest rate decision, keeping rates unchanged at 4.25-4.5%. Since raising rates to 4% in November 2022, the Fed has maintained rates above 4% for two years and five months now, something that hasn’t happened in the past decade.

Federal Reserve Interest Rate Changes Over the Last 10 Years

(Source: MacroMicro)

Looking at this round of Bitcoin halving (April 2024), the Fed’s interest rate was at its peak of 5.5% at the time of the halving, and this rate continued until September 2024, when the Fed finally cut rates by 50 basis points.

In hindsight, although Bitcoin completed its fourth halving on April 8, 2024, due to high interest rates, Bitcoin continued to decline until the September rate cut, when it began to rise again. However, when rate cuts were paused in January 2025, the market immediately plunged. Currently, rates remain at the high level of 4.25-4.5%, and the Fed does not plan to cut rates in the short term.

This makes it difficult for the market to make significant moves. Just as the market rebounds, it falls back due to lack of liquidity. This period can be considered a mini bear market in the middle of Bitcoin’s fourth halving cycle. Under these circumstances, what should retail investors do to get through this painful market downturn?

RISK MANAGEMENT CORE PRINCIPLES: SURVIVAL IS MOST IMPORTANT

During unfavorable market conditions, risk management is paramount. When the market is down, most people lose money—it’s just a matter of how much. Preserving capital and surviving until the market recovers is essential.

Specifically, the first rule of risk management is capital management.

This includes position control. Individual investments should not be too heavy. It’s advisable to adopt a phased position-building approach and diversification principles. For example, if you want to catch a rebound after a market crash, buy in batches. Divide your funds for buying the dip into four portions with a 3:2:3:2 ratio and buy one portion with each further decline.

Also, don’t invest all your funds in one coin, especially altcoins. Allocate funds according to the principle of 50% in mainstream coins like BTC, ETH, XRP, 30% in concept leader coins, and 20% in quality altcoins. This way, you can avoid severe losses due to market volatility, preventing a complete wipeout and leaving you only able to watch market fluctuations.

Next is leverage management. Use leverage reasonably and avoid high-leverage liquidations. Refrain from frequent contract trading. Leverage for mainstream coins like BTC can be around 10x, while altcoins are best kept below 10x, or even below 5x. If you get stopped out or liquidated with contracts, it’s best to pause for a while and only reopen positions when your emotions have stabilized. Most importantly, don’t go all-in with contracts. Contract funds should be controlled to below 20% of total funds—an amount you can sleep comfortably with and an expected loss you can tolerate.

The second rule is market risk management.

This primarily involves price volatility risk. The crypto market is extremely volatile, requiring set stop-loss and take-profit strategies. Without clear trading discipline, it’s easy to be influenced by emotions, chasing highs during FOMO and panic selling during market fear, ultimately resulting in losses.

You also need to be aware of potential black swan events, such as regulatory policies, hacker attacks, and project collapses, avoiding betting heavily on high-risk projects. This requires special attention to market intelligence and early warnings.

For example, monitor on-chain data (third-party data platforms: Nansen, Glassnode) to detect abnormal fund movements; track regulatory developments, such as SEC/FED meetings, to avoid policy risks. Black swan events cannot be predicted, but their impact can be reduced—diversified investments + security measures are core strategies.

Liquidity risk is also crucial. Even with paper profits, it may be impossible to cash out when liquidity is insufficient. Therefore, try to invest in high-liquidity assets and avoid assets with insufficient market depth that can lead to large slippage and difficulty in cashing out. If your investment amount is large, sell in batches to avoid market impact.

Markets are unpredictable, but reasonable risk management can ensure long-term survival and opportunities to wait for market recovery.

The third rule is learning to hedge risk.

You can hold stablecoins to avoid severe market fluctuations. Convert part of your positions to USDT, USDC, or other stablecoins to avoid price volatility during market instability. In a weak, directionless market, holding too many tokens may face the risk of huge drawdowns, especially for small-cap and new coins, which can suffer more severe drops, sometimes halving or going to zero in a single day. The specific ratio could be 40% tokens and 60% stablecoins.

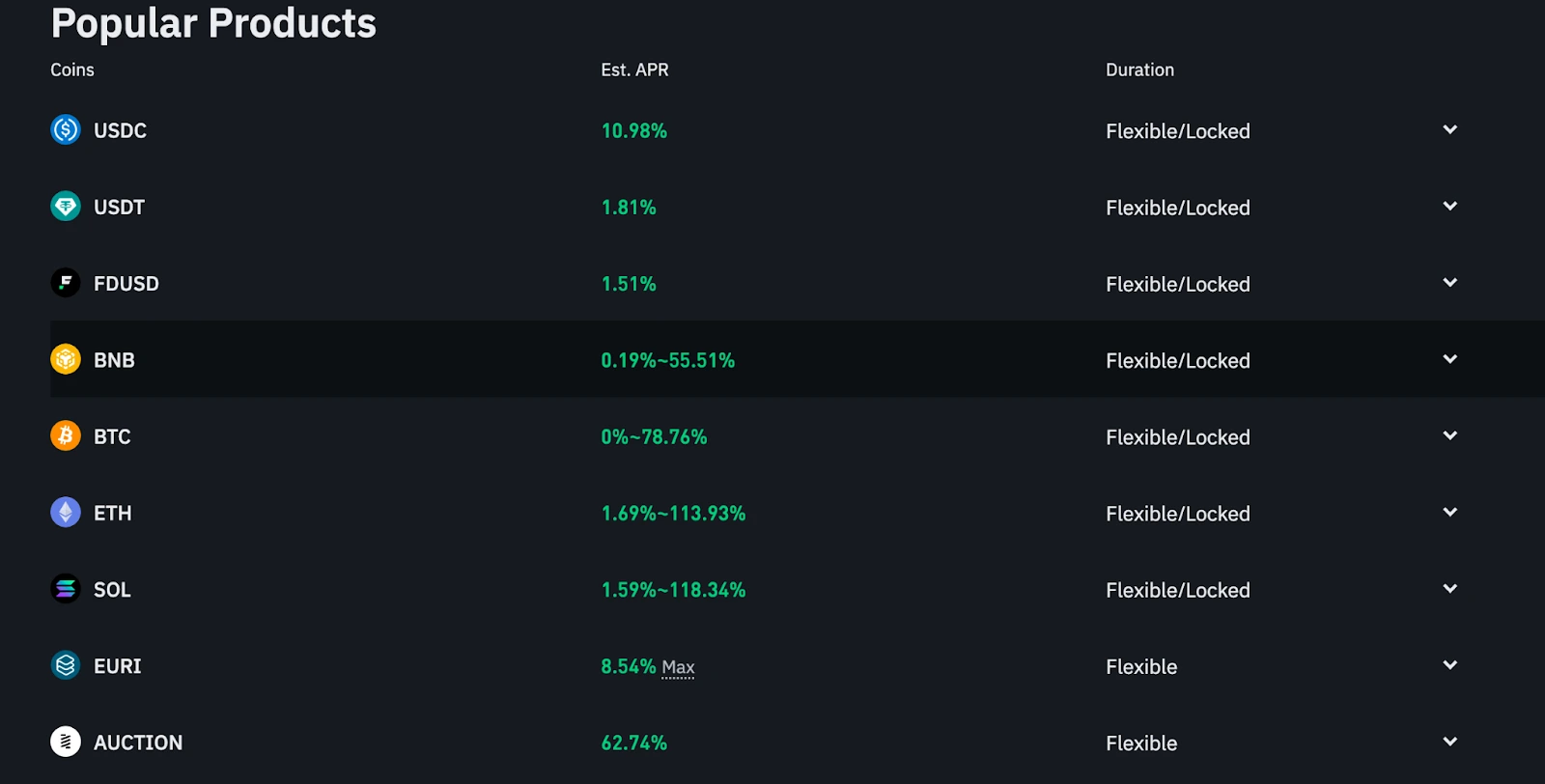

You can also utilize stablecoins for low-risk yield management, such as DeFi lending (like Aave, Compound) or CeFi platform financial products (like Binance Earn) to earn interest on stablecoins.

Binance Earn Related Products

Options or contract hedging is another approach. Hedge through options or perpetual contracts. For example, short BTC contracts to reduce losses from downward price movements when holding BTC spot. For instance, hold BTC spot while simultaneously shorting BTC perpetual contracts. This method is more suitable for uncertain short-term markets or when you have large funds and don’t want to sell BTC.

If BTC price drops: Spot loses, but contract short positions profit, reducing overall profit and loss. If BTC price rises: Spot profits, but contract short positions lose, yet some gains are still locked in.

If you have rich trading experience, you can also engage in cross-platform arbitrage, using price differences between different exchanges for risk-free arbitrage (such as triangular arbitrage, cross-exchange arbitrage). The more unstable the market, the greater the arbitrage opportunities, suitable for low-risk players to utilize.

Risk hedging is a strategy to reduce the impact of market volatility and optimize asset allocation, particularly important in the current context of high Federal Reserve interest rates and a weak crypto market.

The fourth rule is security risk management.

First, pay special attention to asset storage security. For example: Store large amounts of funds in cold wallets for long-term security, using hardware wallets (Ledger, Trezor); store cold wallet private keys offline where hackers cannot remotely steal them; distribute assets across multiple storage solutions to avoid losing all assets due to a single device failure.

For trading funds, use hot wallets and choose major exchanges such as Binance, OKX, Coinbase, Bitget, etc. These exchanges offer high liquidity and stable trading. Additionally, don’t put all your funds in a single exchange to protect against hacker attacks, exchange bankruptcies, and account freezes.

Then enhance protection to avoid hacker intrusions. Exchange and wallet accounts may be stolen due to password leaks, social engineering attacks, or phishing websites. Once hackers gain account access, funds can be transferred within seconds, making recovery impossible.

A comprehensive account security strategy is needed, such as enabling two-factor authentication (2FA) to prevent account theft. Use Google Authenticator/Authy and avoid SMS verification codes (risk of SIM swap attacks). Enable 2FA protection for transactions, withdrawals, and logins. Even if passwords are compromised, hackers will find it difficult to log in. Major exchanges provide anti-phishing codes to avoid fake email scams.

Finally, be especially careful not to click on unknown links, particularly on Telegram, to guard against phishing websites and scams. Use official channels to access exchanges and wallets to avoid fake websites. Don’t randomly click links in emails or social media to prevent malware attacks.

Carefully manage private keys and recovery phrases—don’t store them on computers or cloud drives where they can be stolen by trojans. Use paper backups or metal recovery phrase plates (like Cryptosteel). Refuse to share private keys with strangers or allow remote control of your devices to prevent social engineering attacks.

In the cryptocurrency market, security risk management is crucial. Whether it’s hacker attacks, exchange bankruptcies, private key loss, or phishing scams, all can lead to fund losses. Therefore, investors should establish a comprehensive system for asset storage security and account security management to ensure funds are not threatened by external factors.

TOOL AND INDICATOR APPLICATIONS: TAKE PROFITS AND AVOID GREED

During the current weak market conditions, it’s necessary to rely more on tools and indicators to judge market trends. If you notice signs of danger, don’t be greedy—take profits and secure gains.

First, pay attention to macroeconomic indicators to predict market trends in advance. The crypto space is increasingly integrated with the traditional world, so traditional factors increasingly influence crypto markets, sometimes decisively.

Key indicators include:

- Federal Reserve interest rate decisions (FOMC meetings): Watch for rate hike/cut expectations and pay attention to the dot plot (the Fed’s projection of future interest rates) and Powell’s speeches.

- US CPI, PCE (inflation data), e.g., high inflation → stronger rate hike expectations → risk assets fall.

- Non-farm payroll data (NFP): Strong data → economic resilience → continued high interest rates → negative for crypto.

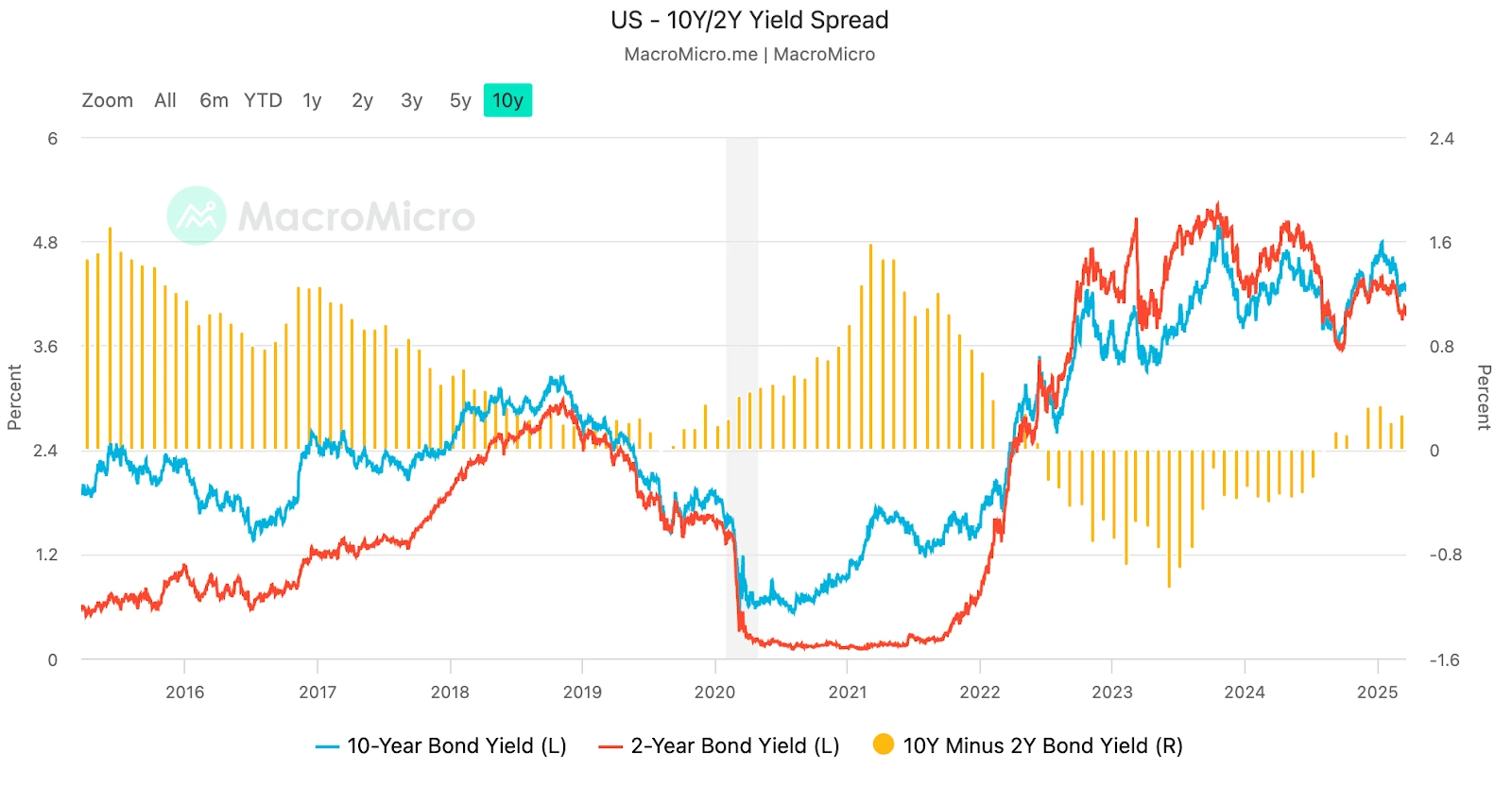

- US Treasury yields (10Y/2Y Treasury rates): High rates → funds flow back to bond markets → pressure on risk assets.

- US Dollar Index (DXY): Strong DXY → BTC likely to fall, Weak DXY → BTC may rebound.

- US stock market ups and downs: Basically, Bitcoin’s fluctuations have synchronized with US stocks, just with larger amplitude.

Third-party platforms to check related data include: FRED, TradingView, MacroMicro, etc.

US 10-Year Minus 2-Year Treasury Yield Spread

(Source: MacroMicro)

Second, pay attention to on-chain data and choose targets with active fund flows. Focus mainly on crypto exchange inflows and outflows: BTC, ETH flowing into exchanges → potential selling pressure; flowing out of exchanges → possibly long-term funds accumulating coins, positive for the market. Stablecoin inflows: Stablecoins flowing into exchanges → funds preparing to enter the market, possible rebound; stablecoins flowing out of exchanges → funds leaving the market, market may continue to weaken.

Holdings distribution: Observe whether large holders are increasing/decreasing positions, following smart money trends, etc. Third-party platforms to check related data include: Glassnode, Lookonchain, CryptoQuant, Nansen.

Third, grid or high-frequency trading strategies can be employed. During market downturns, it’s difficult to grasp major trend movements. You can use automated trading strategies to earn returns during sideways markets:

Grid trading is suitable for oscillating markets, automatically buying low and selling high for arbitrage. High-frequency arbitrage involves contract market-making arbitrage, using funding rate differences and spot-futures arbitrage to earn stable returns. Cross-exchange arbitrage exploits price differences between different exchanges, such as BTC/USDT vs. BTC/USD. Dollar-cost averaging into market dips can effectively capture rebounds during downtrends.

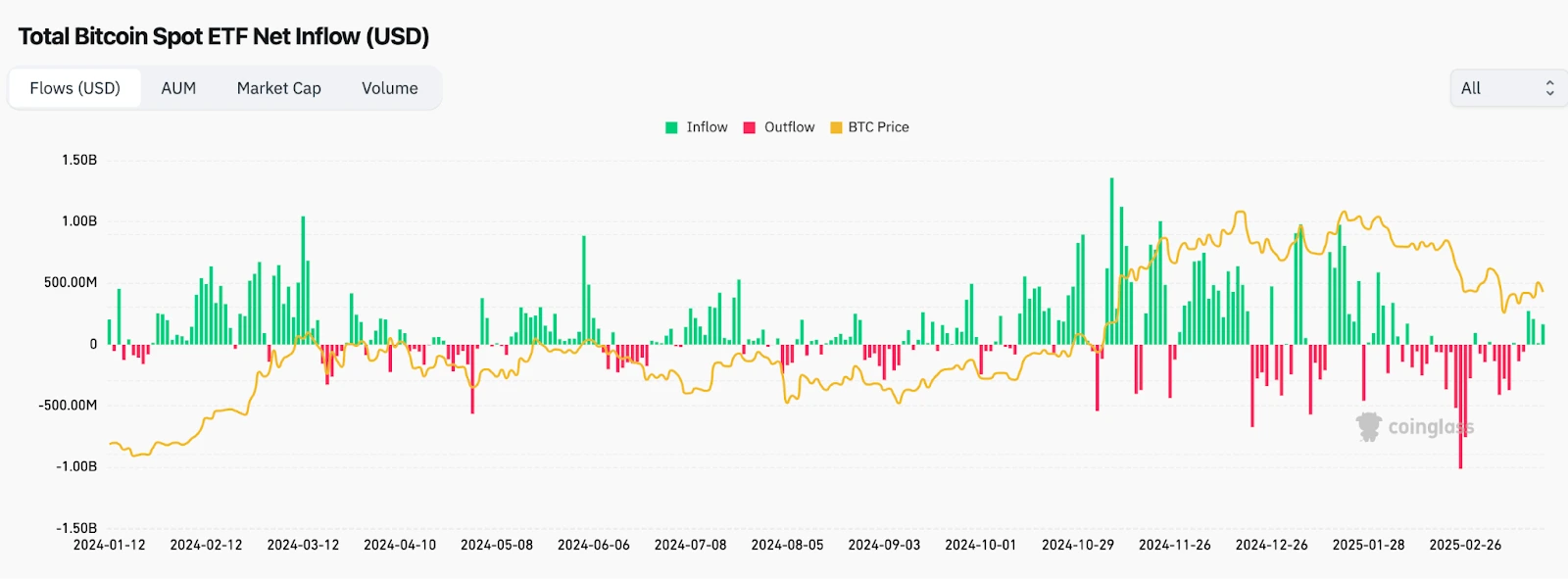

Fourth, pay attention to large fund holdings and reduce blind operations. Observe the movements of institutions and whales, follow market capital flows, and avoid trading against the trend. For example, Bitcoin miner selling: increased miner selling puts short-term pressure on the market; ETF fund flows: pay attention to BTC spot ETF holding changes, such as Grayscale (GBTC), BlackRock (IBIT), etc.

Third-party platforms to check related data include: Coinglass, Whale Alert, Fintel ETF data.

Bitcoin Spot ETF Net Inflows/Outflows

(Source: CoinGlass)

Fifth, set trading discipline and take profits when possible. The core of avoiding greed is setting trading rules in advance and strictly implementing them. Short-term trading especially requires setting stop-loss and take-profit levels, with a risk-reward ratio of at least 2:1 (e.g., 5% stop-loss, 10% take-profit). Place orders directly on exchanges before entering to avoid hesitation in the moment.

Facing the Fed’s high interest rates and a sluggish market, the core strategy is to control risk and use tools to improve win rates. The current market is not a good time for aggressive speculation but rather for maintaining rationality, gradually accumulating low-risk returns, and waiting for the next upward opportunity.

PSYCHOLOGICAL BUILDING AND LONG-TERM PERSPECTIVE: KNOW WHEN TO STEP BACK

During poor market conditions, investor mentality is most tested. It’s easy to chase rises and sell on dips, anxiously sitting at market peaks before panic selling. This is when psychological preparation and a long-term mindset are most needed—don’t exhaust your capital and energy during weak markets.

First, recognize market cycles from a broad perspective and accept that volatility is normal. After three halving cycles, the basic pattern has become similar: post-halving bull market → consolidation → bear market → recovery → bull market cycle, each cycle lasting about 3-4 years, usually highly correlated with Bitcoin halving cycles. In 2024-2025, with Bitcoin halving + ETF capital inflows, waiting for Fed rate cuts and balance sheet expansion, the market may fundamentally improve. Therefore, market downturns are opportunities to accumulate quality assets. Markets neither fall forever nor rise forever.

Then adopt a “long-term investment” mindset to avoid short-term volatility affecting decisions. Short-term speculation is characterized by emotional market fluctuations, easily influenced by sentiment, with frequent trading leading to losses. Long-term investment is based on industry trends and fundamentals, patiently holding core assets and avoiding the psychological pressure of frequent operations.

Focus on long-term validated core assets like Bitcoin, ETH, XRP, rather than short-term hot topics. Adopt a dollar-cost averaging strategy, such as buying BTC/ETH regularly weekly or monthly to avoid timing anxiety. Set long-term goals, such as “holding BTC until the end of 2025 or even until 2026 for profit.”

Also control FOMO and fear emotions to maintain rational investing. When market emotions are extreme, it’s easiest to make wrong decisions: Greed (FOMO)—when the market briefly rebounds, fear of missing opportunities leads to buying at high points; Fear (FUD)—during market declines, excessive pessimism leads to panic selling.

You can monitor market sentiment indicators like the Fear & Greed Index, being bold enough to establish positions during extreme fear and cautious about pullbacks during extreme greed. Avoid letting short-term news like regulatory negative news or hacker attacks influence long-term decisions—over the long term, the market continues to grow. Record the reasons for trading decisions and reflect on whether emotions influenced judgment.

Fear & Greed Index

(Source: CoinMarketCap)

Additionally, set realistic goals now and avoid “get-rich-quick fantasies.” During bear markets, many become pessimistic due to market weakness, but during bull markets, it’s easy to be overly optimistic, believing in overnight wealth. The reality is that most wealth growth comes from long-term persistence rather than short-term speculation.

Realistic goal setting could include:

- Short-term goals (6-12 months): Stabilize capital, avoid losses, accumulate knowledge.

- Medium-term goals (1-2 years): Accumulate quality assets at market lows, waiting for market recovery.

- Long-term goals (3-5 years): Capture the major trend of the next bull market, achieving financial growth.

Market declines are opportunities, not disasters. The key is whether you can persist until the market warms up. Set realistic and feasible goals, avoid fantasizing about getting rich quickly, and focus on long-term growth.

Finally, and most importantly: Maintain a healthy lifestyle and avoid “excessive obsession.” With the current weak market and small fluctuations, constantly watching price charts can increase anxiety. Therefore, reduce chart-watching frequency—don’t check prices every hour or even every minute.

Set up automatic alerts or check periodically. Maintain exercise, reading, and social activities to prevent market emotions from affecting your quality of life. Focus more on learning and accumulating knowledge, industry research, and technology trends rather than short-term price changes. The simple summary is: Work well to earn enough capital; sleep well, eat well, and maintain physical health—these are the most important foundations for capturing the next bull market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!