KEYTAKEAWAYS

- Crypto futures trading provides a way to profit from cryptocurrency price movements without needing to own the underlying assets.

- Traders can generate profits in both bullish (rising) and bearish (falling) markets by accurately predicting price direction.

- Leverage can significantly magnify potential gains in crypto futures trading but also dramatically increases the risk of losses.

CONTENT

Learn how crypto futures trading can multiply your crypto returns. Understand the difference between futures and perpetuals, leverage concepts, and strategies for success.

WHAT IS CRYPTO FUTURES TRADING?

Crypto futures trading offers an exciting opportunity for traders to predict where the prices of digital assets will go in the future, without the need to actually hold those assets in their digital wallets.

Based on the settlement terms, the common types of contracts include perpetual and futures. This article will focus specifically on futures.

Perpetual vs. Futures: What’s the Difference?

- Perpetual: Think of these as ongoing bets on cryptocurrency prices. There’s no set time to finish, so you can decide when to end it based on your strategy. They’re great for staying flexible and moving with the market prices.

- Futures: These are like promises to buy or sell cryptocurrencies at a specific price on a certain date. Once that date arrives, the deal must happen at the agreed price, making it a way to plan against or hope for future price changes.

Essentially, it enables traders to place a “wager” on whether the value of popular cryptocurrencies such as Bitcoin and Ethereum will rise or fall, using leverage to increase the amount of money they can trade beyond what they actually own.

This way, traders have the potential to boost their investment returns significantly by predicting market movements accurately.

>>> Learn More : CRYPTO TRADING STRATEGIES

HOW DOES CRYPTO FUTURES TRADING WORK?

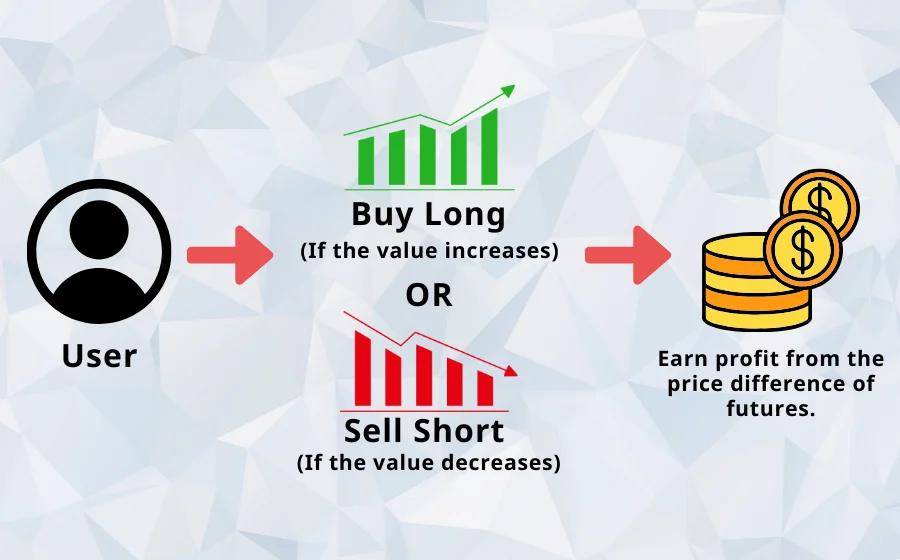

There are two main ways to profit from crypto futures trading:

1. Going Long: When you go long, you are essentially betting that the price of the underlying asset will go up.

2. Going Short: When you go short, you are essentially betting that the price of the underlying asset will go down.

Or, multiply your investment by using leverage.

Leverage Explained with Examples

Leverage allows you to control a larger position in the market than what your initial capital would permit. It’s like borrowing money to increase your investment size, aiming for higher returns. However, leverage also increases the risk of higher losses, which makes it one of the more advanced crypto futures trading strategies.

Profit Scenario:

- Susan has $10.

- She wants to invest in a cryptocurrency.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market moves up by 10%.

Calculations for Profit:

- Market increase: 10% of $100 = $10 profit.

- Susan’s initial $10 investment is now worth $20 ($10 initial + $10 profit).

Loss Scenario:

- Susan starts again with $10.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market drops by 10%.

Calculations for Loss:

- Market decrease: 10% of $100 = $10 loss.

- Susan’s initial $10 investment is now worth $0 ($10 initial – $10 loss).

- Susan has $0 left from her leveraged investment.

CRYPTO FUTURES TRADING TIPS: BOOSTING YOUR PROFITABILITY

- Develop a Trading Strategy: It’s crucial to establish a plan that clearly outlines when you’ll enter and exit trades and how you’ll handle risks.

Here are a few common crypto futures trading strategies to consider:

- Trend Trading: Identify trends based on trend indicators (such as moving averages, trend lines) and trade in the direction of the trend.

- Reversal Trading: Look for reversal opportunities when the price reaches key resistance or support levels.

- Range Trading: Take advantage of price volatility by selling at highs and buying at lows.

- Risk Management: Spread your investments across various trading accounts to reduce risk, and use stop-loss and take-profit orders to manage your trades effectively.

- Stop-Loss Orders: Automatically close losing trades when the price reaches a level to limit losses.

- Take-Profit Orders: Automatically close profitable trades when the price reaches a certain level to lock in profits.

A cautionary tale: Daniel, a friend of mine, once opened a 100x leverage position on a crypto futures contract without setting a stop-loss order. On a mere train ride home, he watched in horror as he lost over 500 USDT. Remember, folks, always set a stop-loss to avoid a train wreck in your trades!

3. Continuous Learning: Given the intricacies of crypto futures trading, it’s essential to continually educate yourself to improve your trading abilities. This can include reading up-to-date books and articles on trading or enrolling in courses designed to enhance your trading knowledge and skills.

FAQS

- What is crypto futures trading?

Crypto futures contracts let traders bet on future cryptocurrency prices using leverage to amplify potential returns.

- How does crypto futures trading work?

Crypto futures trading profits by going long or short, using leverage to control larger market positions and magnify returns or losses.

- What are some crypto future trading tips?

Boost crypto futures trading profitability with strategic planning, risk management, and continuous learning to navigate trends, reversals, and market volatility.

More articles about the crypto trading:

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!