KEYTAKEAWAYS

-

Market crashes affect both traditional and crypto markets, driven by economic bubbles and black swan events, with significant events like the LUNA crash and FTX bankruptcy underscoring crypto's volatility.

-

Effective preparation through diversification and careful research minimizes potential losses during market crashes, highlighting the importance of risk management.

-

Market crashes recur due to cycles of excessive optimism and rapid contraction, emphasizing the need for continuous vigilance and informed investment strategies to protect assets.

CONTENT

When talking about market crashes, what comes to your mind? Whether it’s the recent turmoil in the stock market caused by the COVID-19 pandemic or the financial crisis of 2008, market crashes always seem to occur without warning, leading to significant financial losses.

But did you know that crypto market crashes also exist for crypto assets?

This article will begin by discussing traditional financial market crashes before delving into the two most severe crypto market crashes to date.

Most importantly, we will offer guidance to readers on how to prepare for the possibility of another crypto market crash, aiming to minimize potential losses.

MARKET CRASH – EXPLANATION AND WHAT CAUSES IT

In the stock market, a market crash primarily refers to a significant and abrupt downturn in stock prices over a short period, often without warning. Several factors can trigger such crashes, including economic elements, rare but impactful events (known as “black swan” events, such as 911 or the COVID-19 pandemic), and the bursting of economic bubbles. Here, we delve into the main causes behind market crashes with a brief analysis and overview.

1. Economic Bubbles

An economic bubble occurs when the market prices of assets exceed their intrinsic value, encompassing stocks, commodities, real estate, and cryptocurrencies, among others. The formation of these bubbles is usually attributed to excessive money chasing limited financial assets. This scenario can arise from persistent low interest rates, eased lending restrictions, and governments’ stimulus or quantitative easing policies, leading to increased cash liquidity. This liquidity makes it easier for people to access or exchange cash, facilitating faster transactions. For instance, in a low-interest-rate environment, storing cash in banks becomes less profitable, prompting the circulation of money into other financial assets.

Overly optimistic investment sentiment is another cause, where future growth and profit prospects are viewed with excessive optimism.

Looking back at economic history, we’ve witnessed several instances:

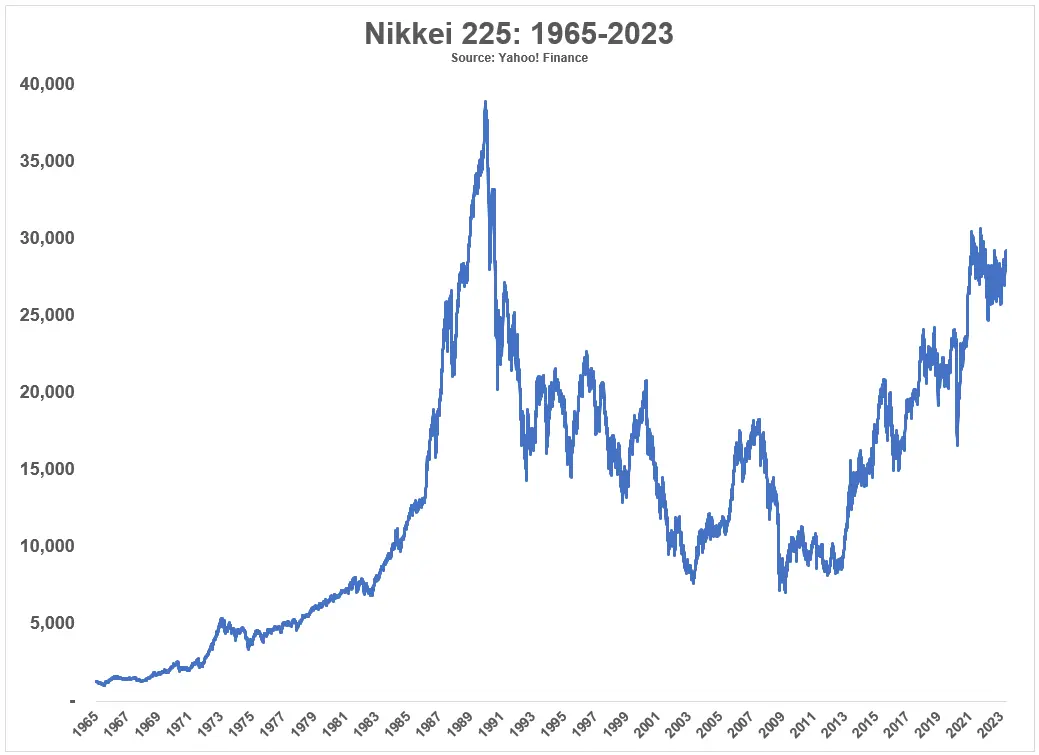

- The Japanese stock market bubble: The U.S. government, aiming to address a high exchange rate-induced trade deficit, signed the Plaza Accord in 1985, demanding a devaluation of the dollar against other major currencies. This led to a rapid appreciation of the Japanese yen, reducing exports. Japan responded with quantitative easing, flooding the market with capital. This capital found its way into the stock and real estate markets, causing rapid inflation. However, the Bank of Japan raised interest rates in 1989 to cool down the overheated market, triggering a stock market crash from its peak at 38,957.44 points, followed by a real estate market crash.

(Source: TradingView)

- The 1929 Wall Street crash: On October 29, 1929, the New York Stock Exchange experienced a sudden crash, with stock prices plummeting over four days (October 24-29), and the Dow Jones Industrial Average fell from 305.85 to 230.07 points, a 25% decrease. This crash was primarily due to prolonged speculative activities, with many investors using savings or loans to buy stocks, pushing prices beyond what the real economy justified. The Federal Reserve’s interest rate hike in August of the same year and a mild recession in the summer contributed to the fall in stock prices in September and October, exacerbating investor panic.

(Source: Federal Reserve Bank of St. Louis)

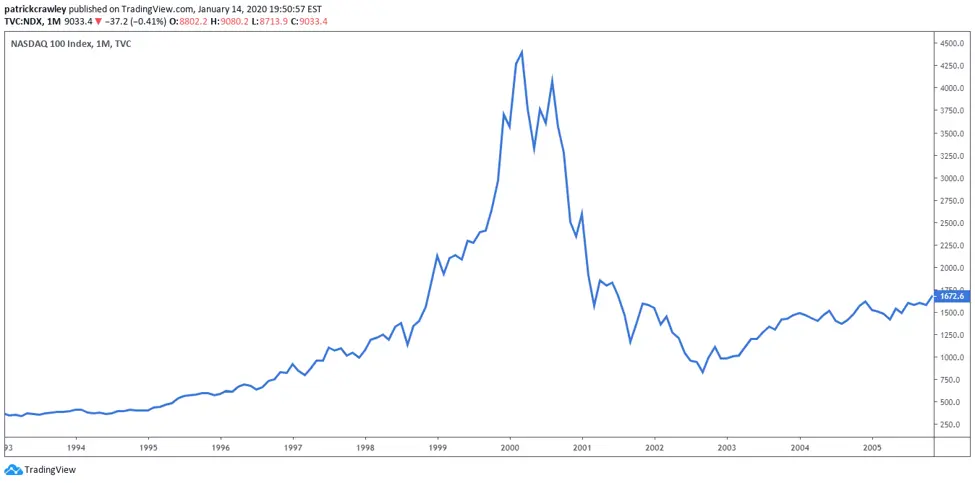

- The dot-com bubble: In the late 1990s, investors seeking investment opportunities coincided with the growth of the internet industry—with Yahoo founded in 1994, MSN in 1995, and Google in 1998. These internet-centric industries and companies needed funding, and investors had capital, leading to a perfect match. Consequently, a significant amount of investment flowed into internet companies, propelling the NASDAQ from around 1,000 points in 1996 to 5,000 points in 2000. However, these investments were not yet yielding tangible products or services. The Federal Reserve’s interest rate hike to 4.99% in July 1999, which soared to 6.54% by July 2000, increased investment costs, leading investors to withdraw funding and sell off internet company stocks. The NASDAQ plummeted from its peak of 5,000 points to around 1,000 points by 2002.

(Source: TradingView)

2. Black Swan Events

Black swan events refer to nearly unpredictable, significant disasters that cause market prices to collapse, including recent events like the COVID-19 pandemic, the 2008 financial crisis, and the 2001 9/11 attacks, among other sudden natural or human-made disasters.

- 2001 9/11 attacks:

Following the shocking terrorist attacks on September 11, 2001, the Dow Jones Industrial Average plummeted from approximately 9,600 points on September 10 to about 8,300, dropping around 1,300 points.

(Source: TradingView)

- 2008 financial crisis:

Triggered by the subprime mortgage crisis, the financial turmoil of 2008 led not only to the bankruptcy of Lehman Brothers but also had a profound impact on the stock market. From the outbreak of the crisis in September 2008, the Dow Jones Industrial Average fell from around 11,300 to about 8,500, a decline of approximately 25%.

(Source: TradingView)

- COVID-19 pandemic:

After the pandemic outbreak in the second half of 2019, global industries and economies were brought to a halt or significantly slowed. The Dow Jones Industrial Average, reflecting these disruptions, experienced a sharp decline from approximately 29,000 in February 2020 to 19,000 by March 2020, within just over a month. This substantial drop underscores the profound impact of the pandemic on the global economic landscape.

(Source: TradingView)

CRYPTO MARKET CRASH IN HISTORY – LUNA CRASH AND FTX BANKRUPTCY

Although the cryptocurrency market hasn’t been around as long as the stock market, it has experienced more than one crypto market crash already. Notably, the Luna coin crash and the FTX exchange bankruptcy are well-known incidents:

-

The Terra Luna crash

Luna, issued on the Terra blockchain, served purposes such as staking, governance, and collateral. Beyond these uses, Luna also backed the Terra blockchain’s stablecoin, UST. Unlike other stablecoins, which are backed by fiat currency deposits to ensure value, UST used a so-called ‘Terra algorithm’ to maintain price stability through arbitrage between Luna and UST. However, the lack of actual fiat currency backing required strong investor confidence, bolstered by Terra’s Anchor protocol promising up to 20% annual returns for UST savers, increasing UST’s popularity and, by extension, Luna’s value. Yet, a sell-off of $84 million in UST, combined with UST’s liquidity crisis due to excessive storage in Anchor, the Terra founder’s withdrawal of $150 million in UST, and a U.S. interest rate hike, sparked market panic, leading to UST’s de-pegging from the dollar. The collapse of Luna and UST coins occurred on May 9, 2022.

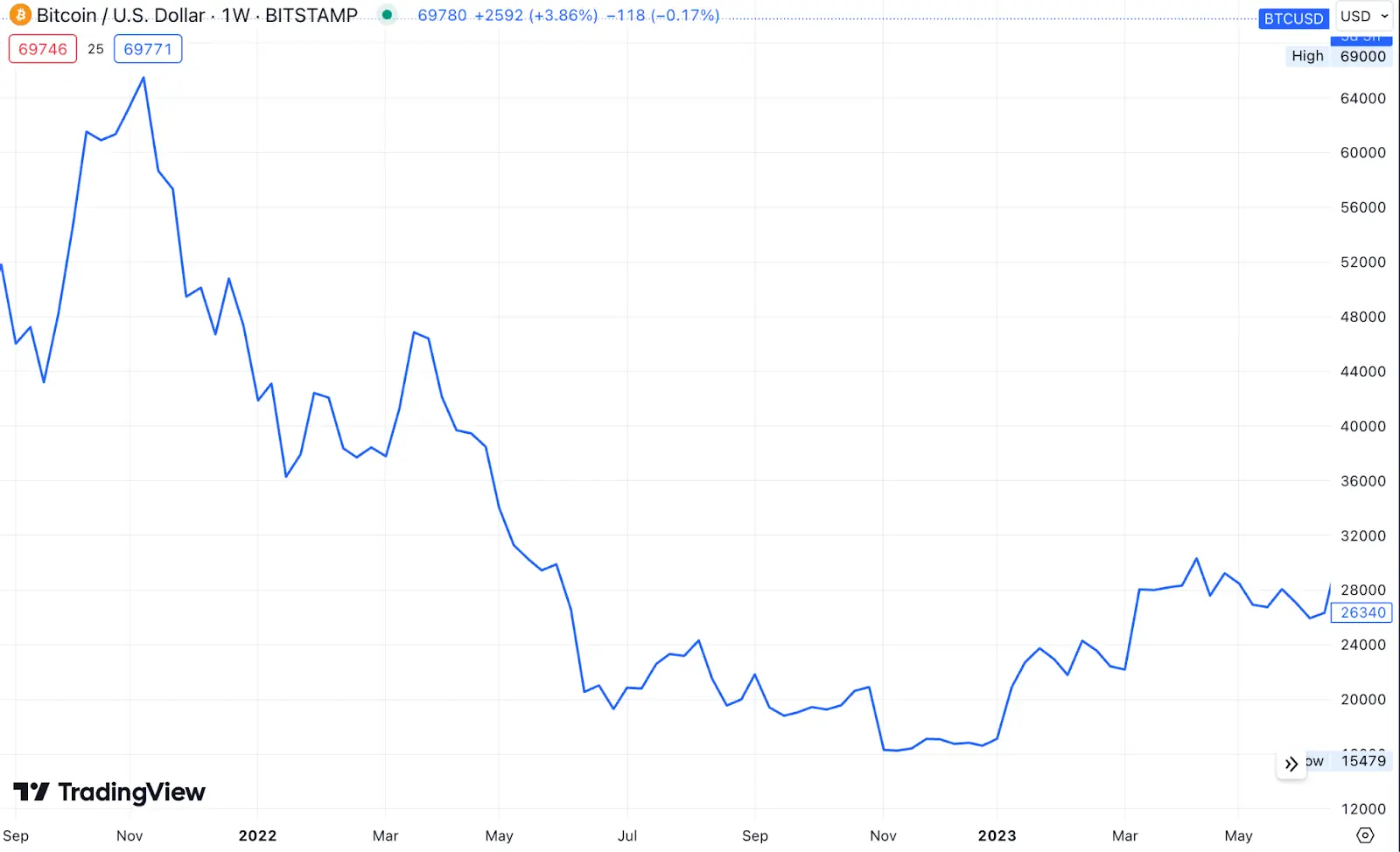

In the aftermath of the Luna and UST coins’ collapse, the price of Bitcoin took a steep dive, plummeting from $31,000 down to $19,300 by the end of June—a total loss of 40%. Bitcoin’s price hovered around the $20,000 mark for months, until November brought another unforeseen catastrophe to the cryptocurrency market: the bankruptcy of FTX. This event marked another significant moment of turbulence, highlighting the fragility and unpredictability of the crypto market.

-

The FTX bankruptcy

Once the world’s second-largest exchange, FTX fell after Coindesk revealed that a significant portion of the assets of FTX’s CEO Sam Bankman-Fried’s investment company, Alameda Research, consisted of FTX’s issued FTT tokens, raising concerns about FTX’s financial stability. The Wall Street Journal also questioned FTX’s use of customer funds for Alameda Research’s trading activities. The final blow came when Binance’s CEO announced the sale of FTT tokens held by Binance, leading to a panic that withdrew $6 billion in three days, an 85% plunge in FTT value, and FTX’s bankruptcy announcement on November 11, affecting over a million users and billions of dollars.

More to Read about Sam Bankman-Fried

Following the announcement of FTX’s bankruptcy in November 2022, the price of Bitcoin experienced a downturn similar to the mid-year Luna coin event, falling from $21,000 to approximately $16,800, a reduction of about 20%.

These two incidents represent the most significant crypto market crashes to date, both stemming from black swan events—unpredictable occurrences that, when they do happen, have a profound impact on the market. Just as these events have had a significant effect on Bitcoin, the primary asset in the cryptocurrency market, they mirror the kind of impacts previously seen in traditional financial markets, such as the Dow Jones Industrial Average in the United States or the stock market in Japan.

(Source: TradingView)

According to data from the Bank for International Settlements, the UST/LUNA crash led to over $450 billion in cryptocurrency market value being wiped out, while the bankruptcy of FTX resulted in approximately $200 billion in market losses.

If these figures seem abstract, consider comparing them to the current value of Tesla. With Tesla’s currency stock price at $177.67 (Mar 27) and a market capitalization of around $560 billion, the combined losses from these two crypto market crashes are equivalent to the market value of an entire Tesla company.

CRYPTO MARKET CRASH – HOW SHOULD INVESTORS PROTECT THEIR ASSETS FROM IT?

Whether it’s a stock market or crypto market crash, both represent a ticking time bomb for investors. This is especially tricky for those in the crypto market, given its faster pace and more volatile nature. Therefore, learning how to prepare for potential market crashes is crucial.

For both newcomers considering entering the crypto market and existing investors, two pieces of advice may prove helpful:

-

Prepare through asset allocation

The old adage “Don’t put all your eggs in one basket” rings true. Diversifying assets across different classes can effectively reduce losses during a crypto market crash. Imagine losing everything in a crypto crash versus mitigating losses by having investments in stocks or bonds.

The investor’s tolerance for risk and their personal financial planning for the future, whether short, mid, or long-term, are also accountable for a significant part of asset allocation. By adhering to these two fundamental principles and proactively arranging your own asset allocation, you can effectively minimize the potential losses that may arise from a crypto market crash.

More to Read about Asset Allocation

-

Avoid blind investment in hype

Looking back at past market crashes, it’s clear that excessive optimism and fervor for certain investments often precede crashes. While some investment opportunities may seem attractive, it’s essential to research potential risks, including whether an asset is overhyped or the reasons behind its promising returns. Remember, in the investment world, higher returns come with higher risks. Don’t impulsively invest in anything you are not familiar with just because you heard some positive news on the grapevine, even if your friends recommend it (take it from me, I made this mistake before). Approaching an expert‘s advice will always be suggested before you make any investment decisions.

WILL THE CRYPTO MARKET CRASH HAPPEN AGAIN?

Sadly, but yes, investors may witness the crypto market crash more than once in the future. Although the crypto market crash prediction is difficult to make, especially since the crypto regulations and technologies are still developing, one thing is certain: when humans are involved in economic or investment activities, it’s challenging to ensure that events like the crypto market crash 2022 mentioned earlier won’t recur.

As long as there’s a profit to be made, investors often overlook the potential consequences. This is especially true as the crypto market reached new heights in 2024, with Bitcoin’s price setting new records and fueling investor optimism. It’s crucial to remember that past market crashes often began with excessive optimism, leading to unsustainable expansions.

If a crypto market crash is inevitable, then the best we can do, as advised above, is to engage in thorough risk management to minimize potential losses as much as possible.

FAQS

- What is a market crash?

In the stock market, a market crash primarily refers to a significant and abrupt downturn in stock prices over a short period. Both economic bubbles and black swan events can cause a market crash.

- What are crypto market crashes in history?

Terra Luna crash and FTX bankruptcy are the two biggest crypto market crashes in history to date. It is estimated that these two events caused $650 billion in total market losses.

- How should investors protect their assets from the crypto market crash?

Readers can invest through the asset allocation that suits them the most to minimize the risks brought by the crypto market crash. Also, don’t impulsively invest in anything you are not familiar with before you seek experts’ advice.

- Will the crypto market crash happen again?

Yes, as long as humans are involved in economic or investment activities, it’s challenging to ensure that crypto market crashes won’t recur. What we can do is to engage in thorough risk management to minimize potential losses as much as possible.

More articles about the crypto market:

- Crypto Bull Market 2024: What It is and When to Buy – CoinRank

- Crypto Bear Market – What Causes It and Investment Advice During Recessions – CoinRank

- Crypto by Market Cap Ranking 2024 – Top 10 Cryptos You Should Know – CoinRank

- 4 Recommended Crypto Market Live Trackers for Staying on Trend

- Crypto 2024: Predicting When Crypto Market Will Go Up

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!