KEYTAKEAWAYS

- When choosing a crypto trading platform, prioritize security, user interface, coin variety, transaction fees, and customer service for optimal trading.

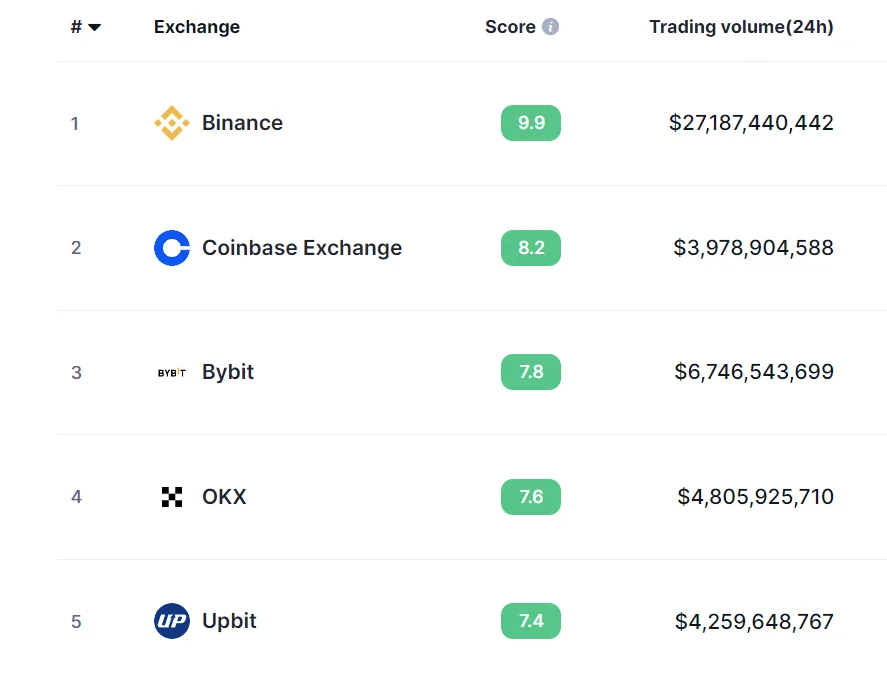

- Binance, Coinbase, Bybit, OKX, and Upbit lead in 2024, offering robust security, diverse trading options, and extensive user support.

- Learn from the FTX collapse: diversify assets, avoid long-term storage on exchanges, and be cautious with high-risk investments on centralized platforms.

CONTENT

Find the best crypto trading platforms for you! Explore our top 5 picks for April 2024, offering security, efficiency, and tools for both beginners and experienced traders.

WHAT ARE CRYPTO TRADING PLATFORMS?

In everyday life, the currencies we use, such as the U.S. Dollar, are called fiat currencies and are issued by governments or central banks. In contrast, cryptocurrencies are not issued by any specific country or region and can be used globally without the need for exchange.

Cryptocurrencies allow for global transactions without high transaction fees and eliminate the need to exchange between multiple banks and different national currencies, promoting the free movement of assets.

Currencies must be liquid, and crypto trading platforms (exchanges) exist to enhance the liquidity of digital currencies. These platforms provide a centralized market for cryptocurrencies, increasing liquidity, reducing transaction costs, and offering a more secure environment for buying and selling.

Cryptocurrency exchanges (also known as virtual currency exchanges) are trading platforms for cryptocurrencies, acting much like “online brokers.” They provide online services for trading cryptocurrencies (such as Bitcoin, Ethereum, or Dogecoin) and crypto trading tools, among other investment activities.

Although cryptocurrency exchanges are not regulated or controlled by any central bank or government agency, they can be categorized into two types:

- Centralized Exchange (CEX):These are exchanges controlled and regulated by a centralized entity.

- Decentralized Exchange (DEX): These are exchanges that operate without centralized control or regulation.

Today’s discussion will primarily focus on Centralized Exchanges (CEX).

TOP 5 CRYPTO TRADING PLATFORMS

(source: CoinMarketCap)

1 . Binance

Binance is currently the most well-known and widely used crypto trading platform. The user interface of Binance is user-friendly and supports multiple languages. It provides a variety of products and crypto trading tools designed to suit the various needs of its users, offering multiple ways to interact with the cryptocurrency market.

The founder of Binance is Changpeng Zhao, a Canadian-Chinese engineer. In 2014, he invested all his funds into Bitcoin and later became the co-founder and Chief Technology Officer (CTO) of OK Coin, which was the largest Bitcoin trading platform in China at that time. In July 2017, he established the Binance exchange and issued its native cryptocurrency, Binance Coin (BNB).

2. Coinbase Exchange

In 2021, Coinbase Exchange went public on NASDAQ, becoming the second largest crypto trading platform in the United States and a pioneer in the cryptocurrency exchange sector. The platform’s intuitive design makes it easy for anyone, anywhere, to participate in the cryptocurrency market, thus pushing for groundbreaking developments in the financial sector.

Coinbase is particularly suitable for beginners in cryptocurrency trading. It offers a wealth of educational content for novices and a simple trading interface that minimizes the use of candlestick charts, instead presenting clear numerical changes to show cryptocurrency trends. The focus of the exchange is primarily on the buying, selling, sending, and receiving of cryptocurrencies, with fewer complex trading products.

3. BYBIT

Bybit, established in 2018 by Ben Zhou and headquartered in Singapore, has become a major force in the crypto market with a daily trading volume close to 10 billion US dollars.

As the third-largest spot trading platform globally, just behind Binance and Coinbase, Bybit offers 100x leverage on BTCUSD perpetual contracts and integrates traditional financial practices with digital features to ensure a safe, professional, and transparent trading environment. It caters to a diverse clientele, including retail and institutional investors.

Bybit prioritizes security with advanced measures like multi-signature wallets, SSL encryption, and DDoS protection, demonstrating its commitment to safeguarding user funds and maintaining a robust trading platform.

4. OKX

OKX, a cryptocurrency exchange and Web3 platform headquartered in Seychelles was founded in 2017 by Star Xu. Originally known as OKEx and one of the top three cryptocurrency exchanges in China, it shifted its focus globally in October 2021 following China’s stringent cryptocurrency regulations, ceasing its operations within the mainland.

Renamed OKX in 2022, the platform now offers trading in over 300 cryptocurrencies, including Bitcoin and Ethereum, along with crypto trading tools, derivatives and financial products. The OKX Web3 Wallet, a part of the platform, connects with 50 public blockchains, allowing users to buy and sell NFTs, trade DeFi contracts, and perform cross-chain operations conveniently.

5. Upbit

Upbit, launched in October 2017 by Dunamu, the parent company of Kakao Pay, quickly established itself as South Korea’s largest cryptocurrency exchange. Renowned for robust security, rapid transactions, and excellent customer service, Upbit offers a highly secure and user-friendly trading environment. The platform is particularly noted for its fast trade execution and professional support, along with a real-time market tracking system for Bitcoin prices.

As one of South Korea’s premier crypto trading platforms, Upbit supports a wide array of cryptocurrencies and advanced crypto trading tools while maintaining comprehensive security measures such as two-factor authentication and multi-tiered security systems. Upbit’s diverse trading options, extensive customer support, and structured fee system make it an optimal choice for secure and efficient cryptocurrency trading.

(Because Upbit only supports Korean Won and doesn’t serve U.S. users, we recommend CoinW instead. You can learn more about CoinW in point six.)

6. CoinW

With a daily trading volume exceeding $15 billion and an equivalent liquidity pool, CoinW is a significant player in the crypto market. The exchange supports over 1000 cryptocurrencies and a wide range of trading options, establishing itself as more than just a trading platform. Launched in 2017, CoinW features spot and futures markets, copy-trading, and direct cryptocurrency purchases, providing a comprehensive suite of services. Users can also contribute liquidity to pools and participate in the earnings program.

CoinW leverages state-of-the-art technology, substantial liquidity, and an extensive range of supported cryptocurrencies to proudly serve over 9 million users globally.

HOW TO CHOOSE CRYPTO TRADING PLATFORMS

When selecting crypto trading platforms, consider these five factors: security, transaction fees, variety of available coins, user interface and experience, and customer service. Here’s a simplified explanation of each:

- Security

Evaluate the safety of a cryptocurrency exchange by its reputation, transparency, and reviews. Reliable crypto trading platforms ensure the security of your funds during transactions, which is crucial.

- Transaction Fees

Even small fees can accumulate to a considerable sum. Most exchanges clearly list their fee structures on their websites. If you trade frequently, consider these costs when choosing a platform.

- Variety of Coins

While almost all cryptocurrency exchanges support Bitcoin (BTC) and Ethereum (ETH), there are thousands of other cryptos in circulation. If you’re interested in diversifying your investments, check how many different types of coins an exchange supports.

- User Interface and Experience

Crypto trading platforms that offer an interface in your native language can provide a more comfortable and seamless experience. User experience is subjective, so exploring various exchanges is advisable to see which feels best to you.

- Customer Service

Customer support is typically available at centralized exchanges. If you opt for a decentralized exchange like Uniswap or PancakeSwap, you won’t have access to customer service. Beginners should consider highly secure, well-known, and highly rated centralized exchanges and assess the effectiveness of their customer support based on online reviews and firsthand experiences.

THINGS TO KNOW WHEN USING CRYPTO TRADING PLATFORMS

Here are some essential points to understand before trading cryptocurrencies:

- High Risk: Cryptocurrency trading is currently considered high-risk due to its novelty and the inherently decentralized nature of digital currencies, which are not centrally regulated. Thus, not all countries provide comprehensive regulations and protections.

- Exchange Security: Major crypto trading platforms have experienced hacks and losses. The ability to safeguard client assets depends on the exchange’s size and technological capability.

- Security Over Time: The security of the cryptocurrency sector still needs to be proven over time. It is often advised on international forums not to keep large sums of money in accounts for long periods. Regularly withdrawing profits and leaving only a minimal amount in the account is a recommended strategy.

CASE STUDY: FTX COLLAPSE AND WHAT CAN WE LEARN FROM IT?

FTX, founded in 2019, offered over 70 types of futures pairs, 6 types of index contracts, as well as unique offerings like leveraged tokens that don’t liquidate, volatility contracts, U.S. 2020 presidential election contracts, options, and oil contracts.

Before its downfall, FTX was highly rated at 8.4 out of 10 on the CoinMarketCap website. However, from November 8, 2022, when withdrawals were halted, to the announcement of its bankruptcy on November 11, 2022, the world witnessed the rapid collapse of the second-largest global exchange. Millions worldwide were unable to withdraw their funds, and bankruptcy reorganization and compensation processes are still ongoing.

This case teaches us that while crypto trading platforms provide convenience for trading and participating in various activities, they should not be blindly trusted. They should merely be seen as intermediaries for transactions.

Key Lessons from the FTX Incident:

- Diversification of Assets: If you are involved in the cryptocurrency market, you should not keep a high proportion of your assets in any single exchange. Instead, spread them across multiple hot wallets, cold wallets, and wallets from other exchanges.

- Avoid Long-term Storage in Exchange Wallets: Do not keep a high proportion of your cryptocurrency in a single exchange wallet for long periods. Apart from the portion that needs to be liquid, the rest should be transferred back to your own cold wallet.

- Centralized Management of Exchanges: The advantage of using exchanges is their convenience, lower transaction costs, and accessible customer service. However, the disadvantages include a lack of regulation, potential for human error, risk of hacks, etc. Even if you predominantly hold stablecoins, trading on centralized crypto trading platforms should still be considered a high-risk investment strategy.

FAQS

- What are crypto trading platforms?

Crypto trading platforms allow trading and investing in cryptocurrencies like Bitcoin and Ethereum globally without central regulation.

- What are the top 5 crypto trading platforms in 2024?

Binance, Coinbase, Bybit, OKX, and Upbit lead, with CoinW as a noteworthy honorable mention for robust trading options.

- How should one choose crypto trading platforms?

Consider security, transaction fees, coin variety, user interface, and customer service when selecting crypto trading platforms.

- What are the risks associated with cryptocurrency trading?

Cryptocurrency trading is high-risk due to its novelty, decentralization, and lack of comprehensive regulation in many countries.

- What lesson did the FTX collapse teach investors?

Diversify assets, avoid long-term storage on exchanges, and exercise caution due to risks like lack of regulation and potential hacks.

More articles about the crypto trading:

-

Crypto Futures Trading: A Way to Multiply Your Crypto Returns

-

Understanding Automated Crypto Trading at a Glance and How to Optimize Your Investment by It

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!