KEYTAKEAWAYS

-

AMMs use liquidity pools and algorithms to enable decentralized, efficient token trading without order books or intermediaries.

-

Integrated with tokenomics, AMMs incentivize liquidity, enable fair price discovery, and support ecosystem growth through decentralized participation.

-

Despite risks like impermanent loss and slippage, AMMs evolve with innovations such as dynamic liquidity, cross-chain support, and Layer 2 integration.

- KEY TAKEAWAYS

- HOW AMMS WORK: AN ALGORITHM-DRIVEN NEW PARADIGM OF TRADING

- DEEP INTEGRATION OF AMMS WITH TOKENOMICS

- THE UNIQUE ADVANTAGES OF AMMS: DECENTRALIZATION, OPENNESS, AND OUTPERFORMING CEXS

- CHALLENGES FACING AMMS: RISKS AND LIMITATIONS

- THE FUTURE OF AMMS: INNOVATION AND INTEGRATION

- CONCLUSION: THE REVOLUTIONARY SIGNIFICANCE OF AMMS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Amid the wave of blockchain and decentralized finance (DeFi), Automated Market Makers (AMMs) have become the core technology behind Decentralized Exchanges (DEXs), fundamentally transforming how tokens are traded.

Unlike centralized exchanges (CEXs) in traditional finance that rely on order matching between buyers and sellers, AMMs use smart contracts and algorithm-driven liquidity pools to provide users with instant, decentralized trading experiences.

This mechanism not only lowers the barrier for new tokens to enter the market but, through deep integration with tokenomics, drives the sustainable development of blockchain ecosystems.

This article will delve into how AMMs work, their role in token economics, their advantages and challenges, and future trends, offering a comprehensive understanding of this revolutionary technology in the blockchain space.

HOW AMMS WORK: AN ALGORITHM-DRIVEN NEW PARADIGM OF TRADING

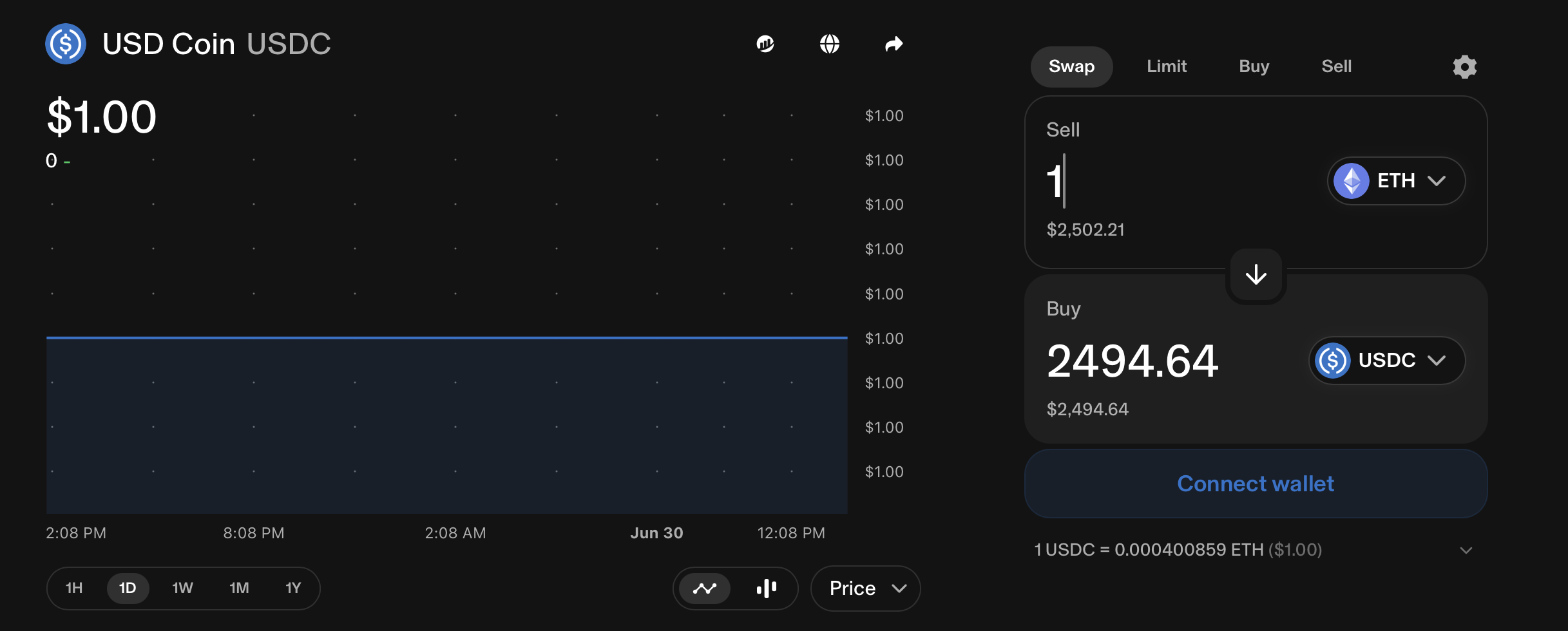

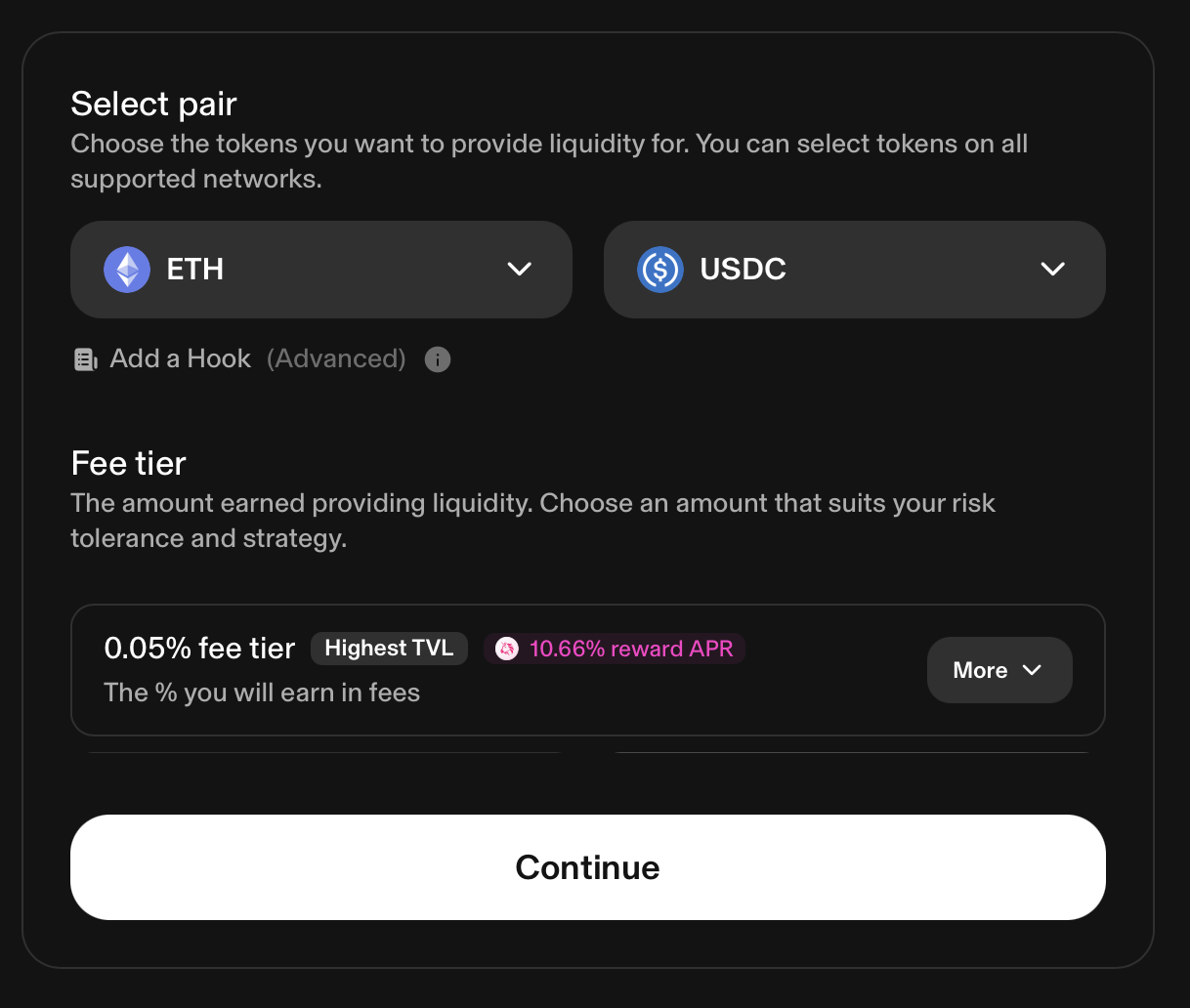

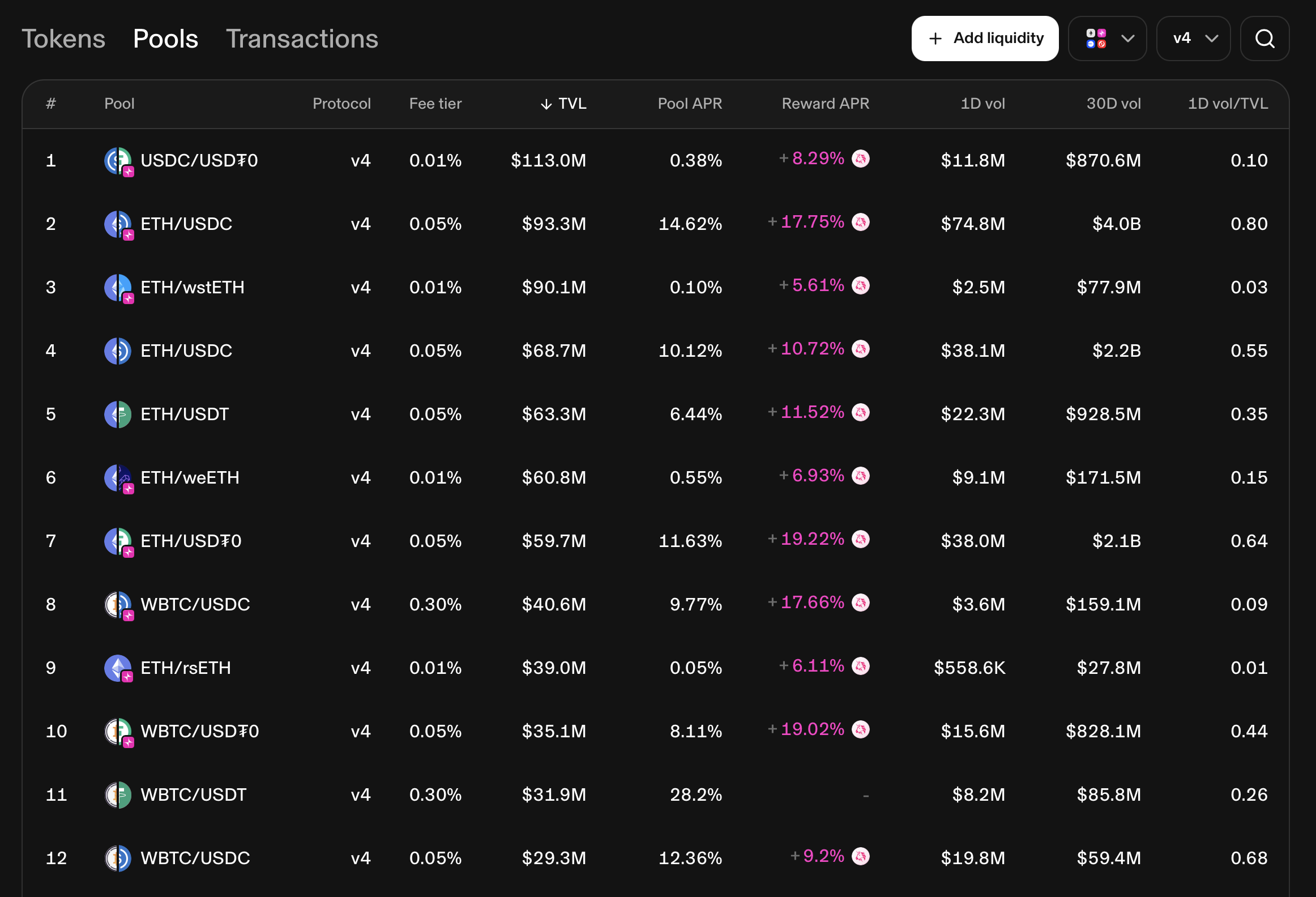

At the heart of an AMM is the synergy between liquidity pools and pricing algorithms. Liquidity pools are comprised of two tokens (e.g., ETH and USDT) deposited by users, known as liquidity providers (LPs).

These tokens must be provided at equivalent value ratios to ensure pool balance. LPs receive LP tokens representing their share of the pool and earn returns from the trading fees (typically 0.3%) collected on each swap.

The pricing mechanism of AMMs generally relies on simple mathematical formulas. The most common is the constant product formula used by Uniswap: x * y = k, where x and y are the quantities of the two tokens in the pool, and k is a constant.

When a user purchases one token, its quantity in the pool decreases while the other increases, maintaining the constant k and dynamically adjusting the price. This ensures immediate execution—users don’t need to wait for a counterparty to complete a trade.

However, when trading volume is high or pool depth is insufficient, significant price slippage may occur.

This algorithm-driven trading method is not only efficient but also provides liquidity support for niche tokens, drastically reducing the barrier for new projects entering the market.

DEEP INTEGRATION OF AMMS WITH TOKENOMICS

AMMs are not just trading tools; they are a fundamental pillar of tokenomics.

Tokenomics studies token supply, distribution, incentives, and utility—areas directly influenced by AMM mechanisms. Firstly, AMMs incentivize liquidity provision through trading fees and governance token rewards.

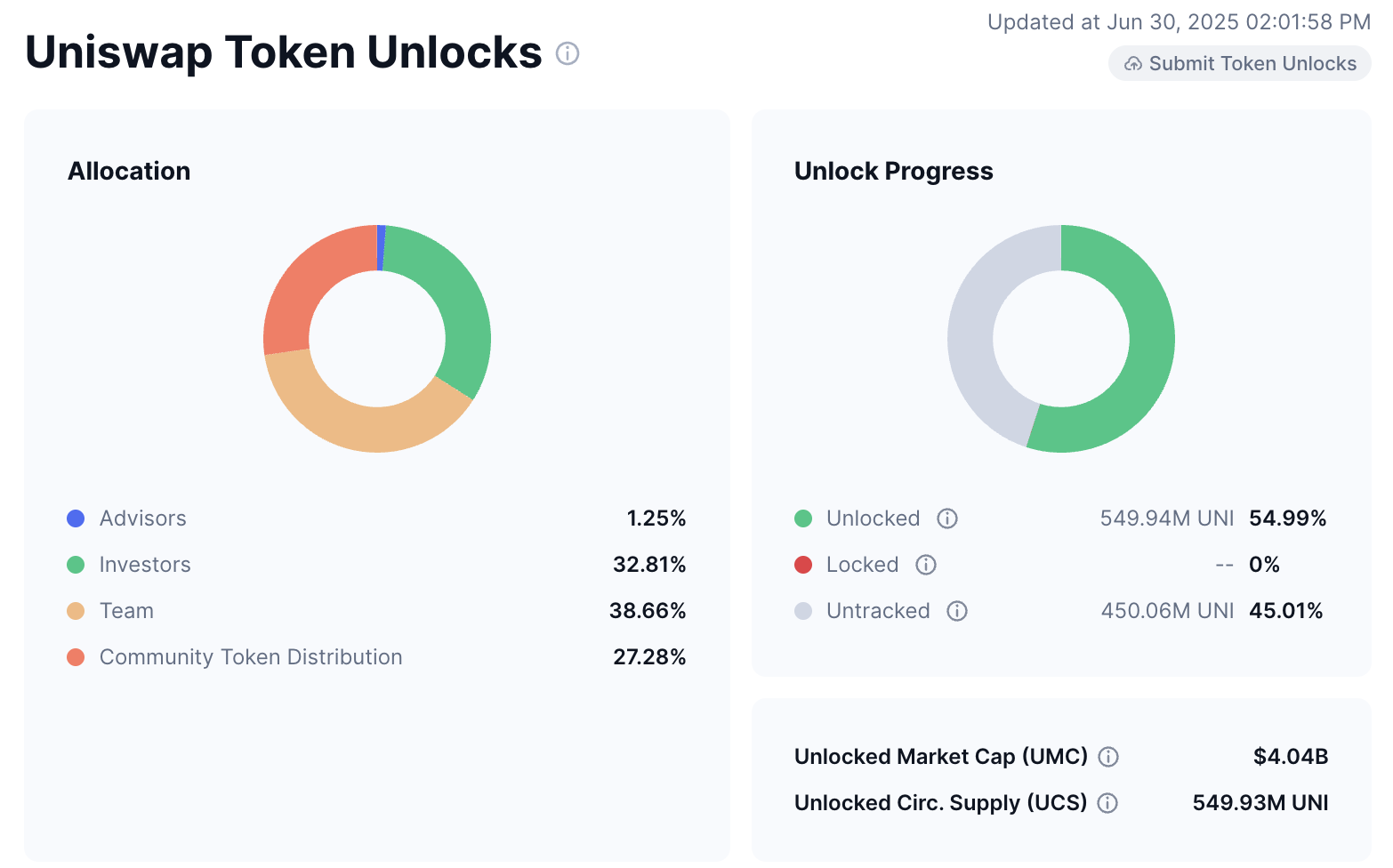

For instance, Uniswap’s UNI token not only grants holders governance rights but also attracts users to lock capital via liquidity mining, enhancing pool depth and boosting token demand.

Secondly, AMMs give tokens practical utility—whether for paying trade fees (like ETH on Ethereum), participating in protocol governance, or forming part of a trading pair—enhancing token value capture.

Additionally, AMMs provide fair price discovery via supply-demand interactions, enabling new projects to access equitable markets. Deep liquidity pools also help reduce price volatility and improve user experience.

However, integrating tokenomics with AMMs requires careful design. Excessive token rewards can cause inflation, while unfair distribution can undermine community trust.

Thus, a successful AMM must balance token issuance, distribution, and incentive mechanisms to ensure long-term ecosystem sustainability.

THE UNIQUE ADVANTAGES OF AMMS: DECENTRALIZATION, OPENNESS, AND OUTPERFORMING CEXS

AMMs offer significant benefits to blockchain trading, particularly in decentralization and openness, addressing many shortcomings of centralized exchanges (CEXs). First, AMMs enable truly decentralized trading.

CEXs rely on centralized entities to manage user funds and match trades, exposing users to risks like theft, platform collapse, or regulatory intervention.

In contrast, AMMs operate entirely via smart contracts; users’ tokens remain on-chain, and trades execute without trusting third parties, aligning with blockchain’s decentralization ethos.

Second, AMMs offer instant liquidity for new tokens. CEXs generally impose strict listing criteria and high fees, excluding many niche projects from markets.

AMMs allow anyone to create a liquidity pool, supporting new token trading and significantly lowering market entry barriers, thereby fueling DeFi innovation.

Third, AMMs are automated, removing the need for manual intervention and reducing operating costs. Users only pay gas fees to trade, while CEXs typically charge high transaction and withdrawal fees. Lastly, AMM’s openness invites broad community participation.

Anyone can become a liquidity provider or create a new pool. In contrast, CEX ecosystems often restrict participation and may manipulate markets via hidden order books.

AMMs use transparent smart contracts and publicly accessible pool data, addressing issues of opacity, central control, and excessive cost, thereby providing users with a fairer and freer trading environment.

CHALLENGES FACING AMMS: RISKS AND LIMITATIONS

Despite their revolutionary nature, AMMs come with inherent risks. First, impermanent loss is a primary concern for liquidity providers.

When the token prices in a pool fluctuate significantly, the value of LPs’ assets may fall below simply holding the tokens—a particularly acute issue in volatile markets. Second, slippage can increase trading costs, especially with large transactions in shallow pools.

Additionally, high gas fees on networks like Ethereum add to trading costs, though Layer 2 solutions like Optimism and Arbitrum are easing this issue. Finally, front-running—where miners or bots profit from transaction ordering—can degrade user experience.

These challenges require AMM projects to continuously optimize technical designs and economic models to improve efficiency and user satisfaction.

THE FUTURE OF AMMS: INNOVATION AND INTEGRATION

As DeFi rapidly evolves, AMMs continue to innovate, showing promising potential.

Innovations such as dynamic AMMs—including Uniswap v3’s concentrated liquidity model—allow LPs to allocate capital within specific price ranges, significantly improving capital efficiency and reducing impermanent loss.

Cross-chain AMMs (e.g., THORChain) facilitate token swaps across different blockchains, driving interoperability across ecosystems.

Additionally, AMMs optimized for stablecoins and low-volatility assets (e.g., Curve) attract large-volume traders through low-slippage algorithms.

In the future, AMMs may integrate with traditional order-book models to create hybrid exchanges that balance liquidity provision and precise order matching.

Moreover, with the adoption of Layer 2 networks and sidechains like Polygon, gas costs are expected to decline further, making AMMs more accessible to all.

CONCLUSION: THE REVOLUTIONARY SIGNIFICANCE OF AMMS

As the cornerstone of DeFi, Automated Market Makers have reshaped blockchain trading through liquidity pools and algorithmic pricing.

They not only provide instant liquidity but, by deeply aligning with tokenomics, drive rapid development of blockchain projects and community engagement.

Compared to centralized exchanges, AMMs offer a fairer trading environment—free from fund security risks, high fees, and market manipulation—thanks to their decentralization, openness, and transparency.

Despite challenges such as impermanent loss, slippage, and high gas fees, AMM’s innovative and flexible nature makes it foundational to decentralized finance.

With ongoing advancements like dynamic AMMs, cross-chain integration, and cost-effective solutions, AMMs are set to play an even more critical role in the blockchain economy, delivering efficient, transparent, and decentralized trading experiences to users around the world.

Whether for emerging DeFi projects or mature blockchain ecosystems, AMMs will continue to lead the wave toward a decentralized financial future.