KEYTAKEAWAYS

- Emergence of Fintech in Indonesia: Fueled by a large population, government support, and investor funding, Indonesian startups, especially in fintech, are gaining global prominence.

- Digital Ecosystem Integration: Indonesian fintech startups are embedding financial services in various sectors, enhancing user experience and expanding market reach.

- Growth and Challenges: While there are vast opportunities in Indonesia's fintech sector, startups face intense competition and must adapt to shifting market demands and investor expectations.

CONTENT

INDONESIA: SERVICE-BASED STARTUPS PROLIFERATE AND FOCUS ON FINTECH

In the past, Indonesia’s startup ecosystem received relatively little international attention. However, startups such as Gojek, GoPay, OVO, Dana, and others have propelled the country’s startup scene onto the global stage in recent years. Below are the five main factors that contribute to the emergence of Indonesia’s startups:

- An openness to new technologies

- The fourth-largest population in the world

- The provision of real-time and flexible services

- Investor funding

- Government support

In the realm of startups, vertical domains have emerged as the primary types, such as financial technology, educational technology, new retail, logistics, e-commerce, and Software-as-a-Service(SaaS). Technological applications predominantly drive these verticals, extensively leveraging AI and cloud computing. Due to their ability to swiftly integrate into the daily lives of the populace, businesses and enterprises in Indonesia are rapidly adopting these technologies. This development further catalyzes the overall digital transformation of the country’s industries.

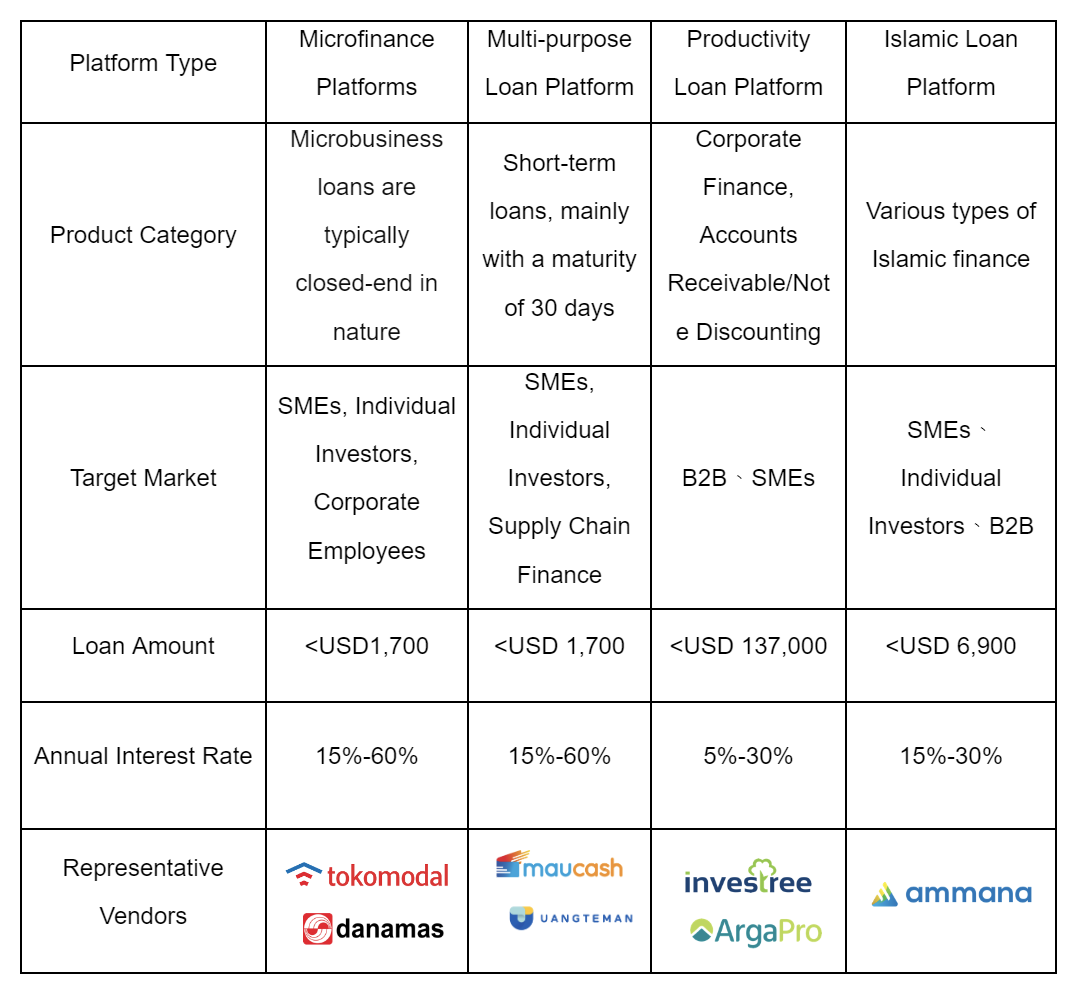

Table. Distribution of P2P Operators in Indonesia

(Source: Companies, Included VC, Crunchbase)

Regarding consumer profiles, individuals aged 18 to 30 exhibit the highest acceptance of financial technology. This figure presents new opportunities for fintech companies. However, it also indicates that these entities have room to increase market share among older consumers, especially in payments. Fintech services for older consumers are relatively lacking, with their target markets and extended value propositions primarily focused on the millennial and Generation Z demographics. Therefore, Fintech companies should consider developing tailored products to capture a share of the older consumer market.

FINTECH CAN BE FOUND IN ALL KINDS OF LIFESTYLE SERVICES

The financial technology market in Indonesia is an integral part of the country’s digital ecosystem. Companies continue to invest heavily in embedding financial products into existing product flows. For example, businesses in Business-to-Consumer(B2C) e-commerce, electronic ride-hailing, and food delivery, as well as Business-to-Business(B2B) commerce and financial technology SaaS solution providers, have integrated multiple fintech touchpoints in the areas of loans, payments, wealth, and insurance. These investments integrated the fintech model for several reasons.

Firstly, participants in the digital ecosystem can enhance customer retention and reduce transaction costs at points of sale through embedded financial products. Secondly, it expands the share of digital ecosystem users’ wallet spending. It assists participants in achieving diversification beyond core business products and services for higher profits and improved product monetization opportunities. Indonesia’s thriving digital ecosystem provides key examples to illustrate this point.

Case One: B2C E-commerce

B2C e-commerce platforms typically offer a range of financial products targeting different user groups, including B2B merchant loans (invoice financing), B2C loans (buy now, pay later), insurance (microtransaction insurance), wealth management (microtransaction insurance), mutual funds, and digital gold.

Case Two: Electronic car and car-sharing platform

The thriving electronic ride-hailing platforms in the country provide various auto financial products ( financial products available that allow people to acquire a car with any arrangement other than a full-cash single lump payment). Others include B2B loans (operational capital loans for drivers), B2C loans (buy now, pay later), and insurance (travel insurance) for those who want to buy a car.

Secondly, the emergence of digital banks in Indonesia is also harnessing the collaborative power of the overall innovation ecosystem. These digital players garner support from traditional banks, technology companies, and large holding corporations. Particularly for conventional banks, venturing into the digital realm offers opportunities to revitalize their core banking business or provide new solutions to enhance their value propositions. Digital banks enable well-established enterprises with substantial user bases to expand their product offerings and monetize through their exclusive ecosystems, presenting significant opportunities to enhance revenue sources.

The trend of traditional banks leveraging fintech partnerships is evident as these institutions seek to strengthen and broaden their existing business lines. Several banks with core capital exceeding 30 trillion Indonesian Rupiah have collaborated with e-commerce platforms and P2P lending institutions to acquire customers for loan products. Simultaneously, establishing new business lines is a strategic focus for traditional banks. Through collaborations with emerging enterprises like Ayoconnect, banks can develop open banking and Banking-as-a-Service(BaaS) business lines. Furthermore, fintech partnerships allow existing participants to build and reinforce internal capabilities, i.e., banks can leverage credit scoring and data analytics for Know Your Customer(KYC) processes to enhance risk management capabilities and customer experiences.

WHAT ARE CURRENT FINTECH OPPORTUNITIES AND RISKS IN INDONESIA?

While the vast market opportunities are undoubtedly attractive, associated risks come hand in hand. For new entrepreneurs, changes in the overall economy are leading to tightened market liquidity. Investors are now placing greater emphasis on the actual profitability of businesses, shifting away from the previous trend of prioritizing aggressive, rapid growth at any cost. This shift encompasses not only the financial profitability of companies but also factors such as customer lifetime value, acquisition costs, and retention rates.

Therefore, startups are reevaluating whether they need to adjust their operational strategies to meet the demands of investors. It causes significant implications for the growth trajectory of Indonesian fintech startups. One of the key points is that strategies must optimize distribution models and seek cost-effective, high-impact customer acquisition channels. At the same time, market competition is intensifying, stemming from other fintech players and extending into the fintech space from tech companies and traditional banks seeking to provide fintech solutions.

Major tech companies like Grab, Shopee, and GoTo possess mature ecosystems, established user bases, and more robust financial capabilities, allowing them to expand their influence in the fintech sector rapidly. Traditional banks are also becoming formidable competitors with substantial capital and advantages in lower funding costs (and higher profit margins) and offline business. Fintech companies must strengthen their unique value propositions in the face of growing competition. Partnerships within broader ecosystems are particularly valuable for enhancing distribution and bolstering defensive capabilities.

Certainly, beyond the risks, there are numerous opportunities. In addition to the mentioned market size and substantial growth rates, the gradual easing of government attitudes has also fueled the flourishing development of financial technology. The country’s regulatory authorities are increasingly accepting emerging ecosystems, and forward-looking regulations have positioned Indonesia as one of the most progressive nations in the region. The current regulatory framework will facilitate the growth and innovation of the fintech sub-industry.

In particular, Indonesia’s payment system blueprint, the ‘2025 Roadmap’, and the ‘SNAP National Standard’ have brought new opportunities to the open banking sector. These proposals have spurred the rise of numerous fintech startups, including Brick, Ayoconnect, Finantier, and Brankas, which collectively have raised over $70 million in funding. They facilitate collaboration with other industry players through API integration, enhancing usability—a critical factor in promoting collaboration between fintech companies and traditional financial institutions. One of the significant advantages of the SNAP standard is making collaboration between fintech companies and traditional financial institutions easier by standardizing API interactions within the payment system, which helps establish a fair, competitive environment for business model innovation and enables startups to compete more effectively with established enterprises in the market.

OPPORTUNITIES FOR FUNDING NEEDS IN INDONESIAN SMES ARE QUITE PROMISING

The adoption of financial technology by SME consumers is still in its early stages, especially beyond payment methods. It creates significant opportunities for lending, wealth management, and deposit institutions to target untapped markets. Cash remains the most widely used offline payment method for SMEs. The early stages of digital work, particularly in second and third-tier cities, have facilitated the continued use of cash. To transition into a cashless era, both the government and industry players must increase the adoption of digital payments.

For successful expansion into the SME sector, fintech players in Indonesia need to reconsider their value propositions. They should deploy customized products and distribution strategies that differ significantly from those targeting Business-to-Consumer(B2C) vertical industries. A more widespread approach may involve encouraging the broader adoption of digital payments and moving away from cash. In the lending aspect, suppliers must innovate to overcome the inherent risks of lending to SMEs, especially in less developed economic regions. In the fintech SaaS field, suppliers must educate SMEs on the potential benefits of fintech solutions. Simultaneously, industry players should adopt innovative approaches and alternative credit scoring technologies to provide loans to SMEs, thereby reducing potential lending risks.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!