KEYTAKEAWAYS

- Vietnam's fintech market is projected to grow from $34.5 billion in 2023 to $63.8 billion in 2028, driven by diverse startups and supportive government policies.

- Digital lending is revolutionizing SME financing in Vietnam, with local and international fintech firms facilitating unsecured loans and aiding digital transformation.

- The Vietnamese government's regulatory sandbox and international collaborations are catalyzing fintech innovation, attracting global investments and fostering startup growth.

- KEY TAKEAWAYS

- OVERVIEW OF THE CURRENT STATE OF THE FINANCIAL TECHNOLOGY MARKET IN VIETNAM

- LENDING MARKET EMERGES AS THE FRONTLINE OF FINTECH IN VIETNAM

- REGULATORY SANDBOX: A CATALYST FOR ENCOURAGING FINTECH INNOVATION IN VIETNAM

- FOSTERING FINTECH DEVELOPMENT THROUGH THE CONTINUOUS ESTABLISHMENT OF STARTUP-FRIENDLY ENVIRONMENT

- DISCLAIMER

- WRITER’S INTRO

CONTENT

OVERVIEW OF THE CURRENT STATE OF THE FINANCIAL TECHNOLOGY MARKET IN VIETNAM

According to the analysis by market research firm Mordor Intelligence, the size of the financial technology market in Vietnam is expected to grow from $34.5 billion in 2023 to $63.8 billion in 2028, with a projected compound annual growth rate(CAGR) of 13% from 2023 to 2028. The rapidly developing fintech market presents substantial market potential. In actual numbers, Vietnam currently boasts over 130 fintech startups providing services to a diverse range of customers, covering various sectors such as digital payments, wealth management, and blockchain. Vietnam’s fintech sector is on a growth trajectory, supported by regulatory frameworks and government policies, increasing its attractiveness year by year.

In recent years, financial technology, or fintech, has been reshaping the financial industry’s landscape, enabling widespread adoption of innovative financial services and attracting billions of dollars in global investments. For example, in 2021, Vietnamese fintech startup Infina secured $2 million in seed funding from five international venture capital firms, including Japan’s Saison Capital, Indonesia’s Venturra Discovery, Singapore’s 1982 Ventures, the United States’ 500 Startups, and South Korea’s Nextrans. Infina has developed an application called “Infina,” allowing users to make regular deposits, invest in certificates of deposit, and trade exchange-traded funds. The target audience comprises consumers aged between 25 and 40 seeking alternative options for long-term asset classes like real estate investment.

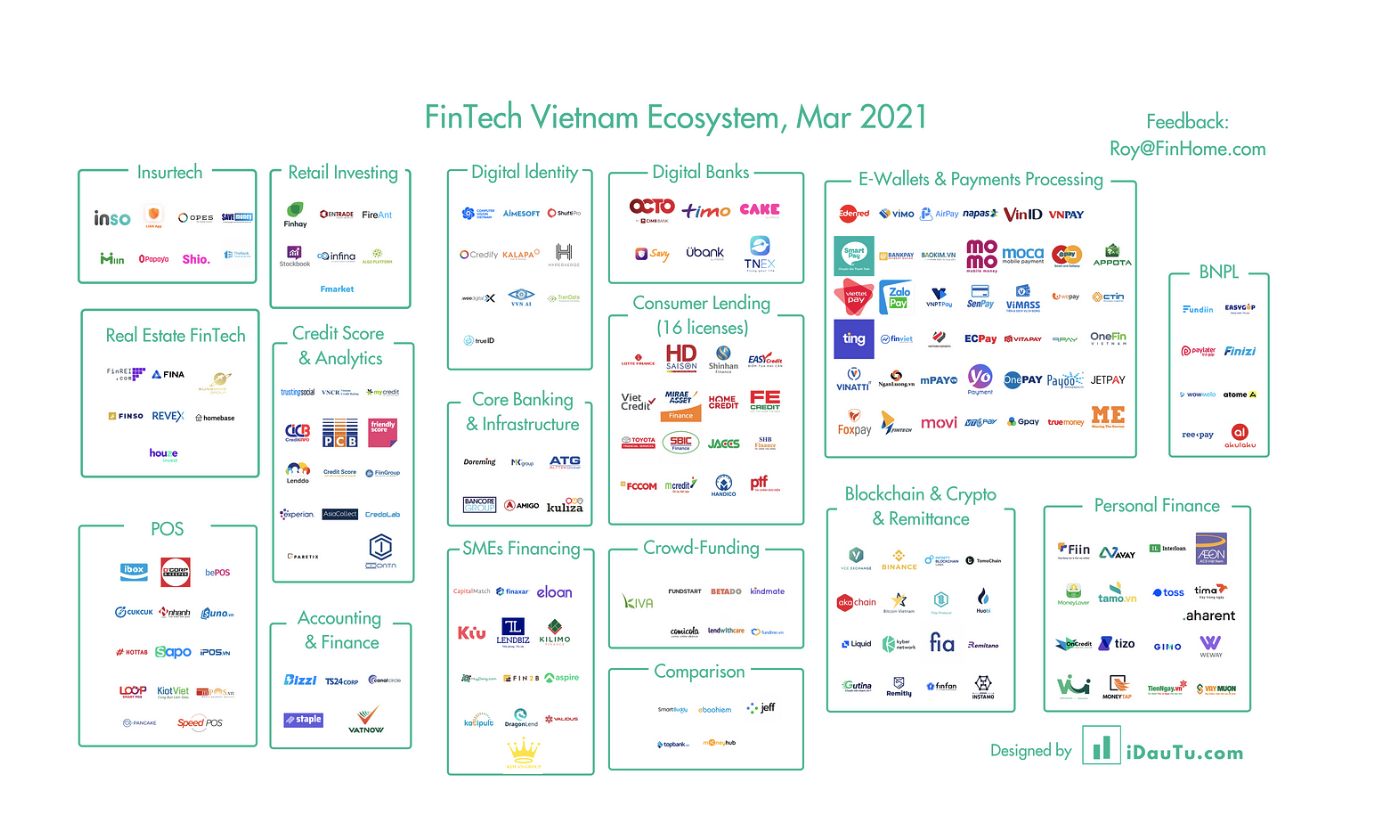

Figure. Vietnam’s Fintech Startup Ecosystem Is Thriving

(Source: FinTech Vietnam)

(Source: FinTech Vietnam)

While financial technology is an emerging industry, it is currently riding the wave of digital transformation. Various fintech sectors such as P2P lending, equity crowdfunding, digital payments, cryptocurrency, and Insurtech are experiencing positive growth. Given the high proportion of the population without bank accounts or sufficient bank accounts, coupled with increasing mobile connectivity (150%), internet penetration (70%), and the rising adoption of 3G and 4G (45%), Vietnam remains largely an untapped market. This development, of course, has become a focal point for investments in the financial industry.

Recognizing the importance of digital transformation, Vietnamese banks have actively researched and experimented with applying new technologies through fintech to enhance their operational processes. This action aims to serve customers better and improve the overall banking experience. Over the past years (since 2017), the banking sector in Vietnam has been adapting and applying fintech to various banking services, including mobile and QR code payments, e-wallets, consumer identification tags, and credit card payments. This rapid transformation has helped Vietnamese banks enhance competitiveness, reaching a broader user base, particularly enabling consumers in rural and remote areas to access banking services. The current trend is that nearly all banks in Vietnam are investing in digital transformation.

LENDING MARKET EMERGES AS THE FRONTLINE OF FINTECH IN VIETNAM

1. The Rise of F88, a Digital Lending Startup in Vietnam

Riding the wave of digital payments, approximately 40 fintech companies in Vietnam are attempting to replicate the success of Alipay or WeChat Pay in China. While local companies like MoMo and ZaloPay continue to lead in the digital payments sector, they have yet to reach the widespread adoption achieved by Alipay or WeChat Pay in their respective markets. Local fintech players such as ZaloPay and MoMo have introduced features like Buy Now Pay Later(BNPL) over the past two years to expand beyond payment functionalities. These diversified approaches reflect a broader trend in the region: the fintech battleground is shifting to another domain—digital lending.

For instance, F88 is an emerging local non-bank lending provider established in 2013. Initially operating on a pawnshop model, requiring customers to provide collateral for loans, F88 recognized the trend of technological development sensitively. Consequently, it diversified its services, introducing offerings such as automobile collateral loans, life and property insurance, bill payments, mobile currency, and e-wallet top-ups. One of F88’s strengths is its ability to process loans within 15 minutes. However, it faces competition from rivals such as Trust Social, Home Credit, and FE Credit.

2. Digital Lending Facilitating the Digital Transformation of Vietnamese SMEs

Like other Southeast Asian countries, small and medium-sized enterprises(SMEs) play a crucial role in Vietnam’s local economy, constituting over 90% of all businesses. This prevalence is particularly notable in textiles, manufacturing, construction, services, wholesale, and retail industries. SMEs in Vietnam have traditionally excelled in operating through flexible and cost-effective approaches. However, sustainable funding is required to achieve higher productivity in the future, such as upgrading under the catalysis of Industry 4.0.

Many SMEs face challenges as they lack sufficient funds for innovation in products and processes, with limited research and development expenditures.

Additionally, with numerous multinational corporations entering and establishing their presence in Vietnam, SMEs must compete globally. Therefore, the adequacy of funding significantly impacts the survival and competitiveness of these enterprises. Fortunately, digital lending serves as a remedy for the financial constraints of thousands of SMEs. Fintech startups are forging connections with commercial banks in the country to offer unsecured loans to SMEs. For instance, Validus Vietnam, a subsidiary of Validus Capital headquartered in Singapore, collaborates with TTC Group/VC Do Ventures to expand its digital lending operations in Vietnam. They aim to increase the market share of loans in retail, food, healthcare, clothing, pharmaceuticals, and logistics industries.

Simultaneously, in collaboration with its partners, Validus introduces the ‘eBIZ Rapid Loan platform’ capital solutions for international supply chain operators to support SMEs. The eBIZ Rapid Loan platform can approve unsecured loans of up to 500 million Vietnamese Dong (approximately USD 21,322) within 48 hours, with a repayment period of 12 months. To date, Validus has provided over $1 billion in loans to small and medium-sized enterprises(SMEs) operating in Vietnam, Singapore, Indonesia, and Thailand through this platform. The company also collaborates with the Vietnam Young Entrepreneurs Association, offering digital microloans to its 9,000 members.

Another example is Funding Societies, a Singapore-based payment platform, which invested $22.5 million in VNG Corporation to develop a network of 150,000 agents and retail points. This network aims to provide unsecured loans valued at $2 billion to potential SMEs. Besides the local player F88 mentioned earlier, the entry of foreign players into the local lending market is evident. Many international fintech companies are establishing relationships with local banks and financial institutions. This international collaboration helps consolidate Vietnam’s competitiveness in digital lending, enabling SMEs in Vietnam to access better financial resources, enhance production capacity, and embark on digital transformation. These loans assist SMEs in adapting to the changes occurring in the Vietnamese industry, shifting from exporting raw materials to seeking opportunities for higher value-added processing products in the global market, further solidifying the country’s position in the worldwide supply chain.

REGULATORY SANDBOX: A CATALYST FOR ENCOURAGING FINTECH INNOVATION IN VIETNAM

In addition to the lending demand arising from industrial transformation and upgrading, the regulatory sandbox mechanism provided by the government is also a critical factor in promoting the widespread adoption of digital lending. In 2021, the Vietnamese government introduced a regulatory sandbox mechanism, allowing startups and other fintech initiatives to experiment under regulatory supervision. With authorities aiming to encourage innovation and competition in financial services, the sandbox mechanism has gained popularity in Vietnam’s financial industry.

According to Resolution No. 100/NQ-CP(develop a Decree on a mechanism for controlled testing of financial technology (Fintech) activities in the banking sector.), governments of Southeast Asian countries launching the digital transformation plan in 2022 have formally entrusted the State Bank of Vietnam(SBV) to develop the sandbox, assigning the central bank the primary responsibility for overseeing sandbox management. For businesses, six fintech solutions will be piloted in the banking sector, including granting loans on a technological platform, credit scoring, application programming interface(API) data sharing, peer-to-peer(P2P) lending, blockchain, and the application of distributed ledger technology(DLT) in banking operations. Other technologies within the sandbox’s objectives for collaboration between banking and innovative businesses will also be explored.

FOSTERING FINTECH DEVELOPMENT THROUGH THE CONTINUOUS ESTABLISHMENT OF STARTUP-FRIENDLY ENVIRONMENT

From the perspective of the entire startup ecosystem, Vietnam has become a more attractive choice for international companies setting up factories in Asia, benefiting from international relations and resilience in supply chain establishment. There are two main reasons for this shift: first, Western countries imposing tariffs on goods manufactured in China, and second, Vietnam signing free trade agreements with the European Union, the United Kingdom, and several countries in the Asia-Pacific region over the past few years. As China’s manufacturing costs continue to rise, businesses must diversify their strategies with a “China +1” approach, and Vietnam’s ecosystem stands to benefit from these trends, becoming a genuine regional and global hub.

The Vietnamese government has initiated various funds and measures at different levels to seize this investment boom in response to this trend, which include the SpeedUP Fund initiated by the Ho Chi Minh City Department of Science and Technology, the Startupcity.vn online platform, the Vietnam-Finland Innovation Partnership Program, the Saigon Silicon City Center, and the National Technology Innovation Fund (NATIF) under the Ministry of Science and Technology. Moreover, international organizations such as the United States Agency for International Development(USAID) are gradually providing more diverse development opportunities for Vietnam’s ecosystem through various collaborative programs.

Simultaneously, Vietnam’s venture capital sector is growing, with major investors including Singapore’s Antler and the United States’ 500 Startups. The scale of venture capital funds is expected to reach $5 billion between 2023 and 2025. The government also provides tax incentives to attract foreign investors or companies to Vietnam. In 2016, Vietnam launched the “2025 Vietnam Startup Ecosystem Initiative,” also known as “National Plan 844,” to further promote the flourishing entrepreneurial ecosystem. Since the implementation of this plan, the number and revenue of startups have shown significant growth. This positive funding cycle will drive industry transformation and benefit digital lending in the long run.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!