KEYTAKEAWAYS

Just when the world's major stock markets are facing headwinds, the Indian stock market has repeatedly set new highs and has become the most outstanding market in recent times. Many investors are optimistic that this rising star in Asia will soon become the next China, and even challenge the "world factory."

CONTENT

INTRODUCTION TO DIFFERENT TYPES OF ETFS IN INDIA

Exchange-Traded Funds (ETFs) have gained immense popularity in India as a convenient and diversified investment option. Let’s take a closer look at the different types of ETFs available in the Indian market.

- Equity ETFs:

Equity ETFs in India track the performance of various equity indices like Nifty 50, Nifty Midcap 150, sectoral indices, or thematic indices. These ETFs offer investors exposure to a diversified portfolio of stocks, providing opportunities for long-term capital appreciation.

- Gold ETFs:

Gold ETFs allow investors to invest in gold without physically owning the metal. They track the price of gold and provide a convenient and cost-effective way to invest in this precious metal. Gold ETFs are popular among investors seeking to diversify their portfolios and hedge against inflation.

- Debt ETFs:

Debt ETFs track the performance of debt securities such as government bonds, corporate bonds, or money market instruments. These ETFs provide investors with an avenue to invest in fixed-income assets and generate regular income. Debt ETFs offer a lower risk investment option compared to equity-based ETFs.

- International ETFs:

International ETFs enable investors to gain exposure to foreign markets and global investment opportunities. These ETFs track the performance of indices from international markets and provide diversification beyond the Indian market. International ETFs can be an attractive option for investors looking to diversify their portfolios geographically.

TOP 5 INDIA ETFS

- Nippon India Index Fund S&P BSE Sensex

- HDFC Index S&P BSE Sensex

- Bandhan Nifty 50 Index Fund

- UTI Nifty 50 Index Fund

- Tata Nifty 50 Index Fund

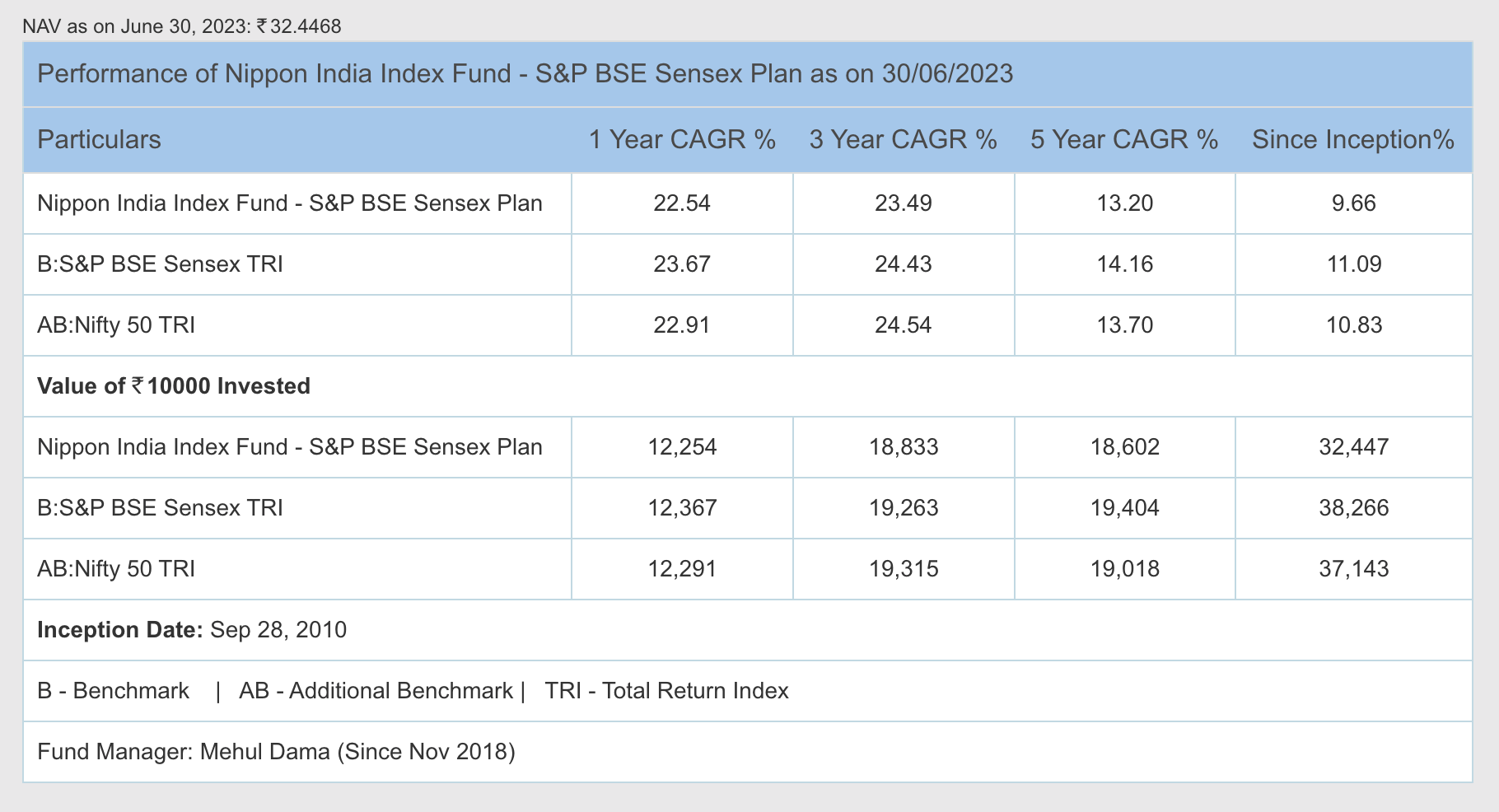

#1. Nippon India Index Fund S&P BSE Sensex

- 10-year-old medium-sized fund

- AUM of ₹477 Crores as of 17/07/2023

- Expense ratio of 0.15%

- 1-year returns of 24.99%

- Average annual returns of 13.19%

- Majority investments in Financial, Technology, Energy, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#2. HDFC Index S&P BSE Sensex

- 10-year-old medium-sized fund

- AUM of ₹5,071 Crores as of 17/07/2023

- Expense ratio of 0.2%

- 1-year returns of 24.99%

- Average annual returns of 13.45%

- Majority investments in Financial, Technology, Energy, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#3. Bandhan Nifty 50 Index Fund

- 10-year-old medium-sized fund

- AUM of ₹808 Crores as of 17/07/2023

- Expense ratio of 0.1%

- 1-year returns of 23.74%

- Average annual returns of 13.05%

- Majority investments in Financial, Energy, Technology, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#4. UTI Nifty 50 Index Fund

- 10-year-old medium-sized fund

- AUM of ₹11,586 Crores as of 17/07/2023

- Expense ratio of 0.2%

- 1-year returns of 23.68%

- Average annual returns of 12.91%

- Majority investments in Financial, Energy, Technology, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#5. Tata Nifty 50 Index Fund

- 10-year-old medium-sized fund

- AUM of ₹455 Crores as of 17/07/2023

- Expense ratio of 0.2%

- 1-year returns of 23.62%

- Average annual returns of 13.02%

- Majority investments in Financial, Energy, Technology, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

PROCESS OF BUYING ETFS

Investing in ETFs can be done through the following methods:

- New Fund Offering (NFO):

During the NFO period, investors can subscribe to the ETF by filling out the application form and investing a specified amount. Once the NFO closes, the ETF units are allotted to the investors.

- Secondary Market:

After the NFO period, ETF units are listed on stock exchanges, and investors can buy them from the secondary market through their stockbroker. ETF units are traded like regular stocks during market hours, and investors can place buy orders through their trading accounts.

The Requirement of Demat Account

To invest in ETFs, a demat account is necessary. Investors need to have a demat account to hold and trade ETF units. The buying and selling of ETF units occur in the demat account, and the transaction amount is debited or credited to the investor’s trading or bank account.

ADVANTAGES OF ETFS

- Low Expense Ratio:

ETFs generally have a lower expense ratio compared to actively managed mutual fund schemes. This means investors can benefit from cost-efficiency and potentially higher returns.

- Real-time Price Discovery:

Unlike traditional mutual fund schemes, ETFs provide real-time price discovery. Investors can buy or sell ETF units at prevailing market prices during trading hours, allowing for transparency and instant execution.

- Diversification:

ETFs, particularly those tracking broad indices, offer investors exposure to a diversified portfolio of stocks or assets. This diversification helps reduce risk by spreading investments across multiple securities or sectors.

- Low Minimum Investment:

ETFs have a low minimum investment requirement, making them accessible to a wide range of investors. Investors can start investing with a small amount and gradually increase their investment over time.

DISADVANTAGES OF ETFS

- Demat Account Requirement:

Investing in ETFs necessitates having a demat account, which comes with associated account opening and maintenance charges. Additionally, brokerage charges apply when executing ETF buying and selling orders.

- Low Liquidity:

Some ETFs may have low trading volumes, leading to lower liquidity. This can result in investors paying a premium to the Net Asset Value (NAV) while buying units or selling units at a discount to the NAV.

- No SIP Mode of Investment:

Unlike active mutual fund schemes, ETFs do not offer a systematic investment plan (SIP) mode of investment. Investors need to buy ETF units from the market by placing orders through their trading accounts.

FACTORS TO CONSIDER WHILE INVESTING IN ETFS

When investing in ETFs, consider the following factors:

- Expense Ratio:

Choose ETFs with lower expense ratios as they have a direct impact on the overall returns.

- Tracking Error:

Evaluate the tracking error of an ETF, which measures how closely the ETF’s performance tracks its underlying index. Lower tracking error indicates better replication of the index’s returns.

- Assets Under Management (AUM):

Consider the AUM of an ETF as larger schemes may have lower volatility. However, prioritize expense ratio and tracking error over AUM when making investment decisions.

CONCLUSION

ETFs offer investors a range of investment options in India, including equity, gold, debt, and international ETFs. These investment vehicles provide benefits such as cost-efficiency, real-time price discovery, diversification, and low minimum investment. However, investors should consider factors like expense ratio, tracking error, and their investment goals before making investment decisions. Conducting thorough research and understanding the unique characteristics of each ETF can help investors make informed choices and achieve their financial objectives.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!