KEYTAKEAWAYS

- CoinMarketCap is a comprehensive resource for tracking cryptocurrency prices and market data.

- It provides information on market capitalization, trading volume, circulating supply, and other essential metrics.

- CoinMarketCap also ranks exchanges, both centralized and decentralized, to help users choose the most secure platforms.

CONTENT

Learn how CoinMarketCap can be your go-to resource for navigating the crypto market place. Discover insights into cryptocurrency prices, market capitalization, trading volume, and more.

CRYPTO MARKET PLACE: AN INTRODUCTION

Crypto market places, or exchanges, have exploded in popularity since the advent of Bitcoin. These decentralized platforms are where digital assets are bought and sold at market prices, and they’ve grown to encompass a vast array of blockchain-based instruments.

However, with so much information flying around, it’s easy to feel overwhelmed. That’s where tools like CoinMarketCap come in. They provide a much-needed overview of the entire crypto market place, helping investors make sense of it all.

In this article, we’ll dive deep into CoinMarketCap, exploring its features, benefits, and how it can be a game-changer for your crypto journey.

CRYPTO MARKET PLACE: WHAT IS COINMARKETCAP?

CoinMarketCap (CMC) is a comprehensive resource for tracking cryptocurrency prices and data of crypto market places. The platform offers real-time data on crypto assets and markets, including price tracking, market capitalization, trading volume data, and news related to the cryptocurrency world.

Founded by Brandon Chez in May 2013, CoinMarketCap quickly grew to become a crucial information source in the cryptocurrency industry, trusted and cited by users, institutions, and media. The website is frequently used to compare thousands of crypto assets and is often referenced by major news outlets like CNBC and Bloomberg. Even the US government utilizes CoinMarketCap’s data for research and reporting purposes.

In April 2020, CoinMarketCap was acquired by Binance, the world’s largest cryptocurrency exchange. Despite the acquisition, CoinMarketCap continues to operate independently, providing reliable crypto data and information to users worldwide.

CRYPTO MARKET PLACE: COINMARKETCAP’S MAIN FUNCTIONS

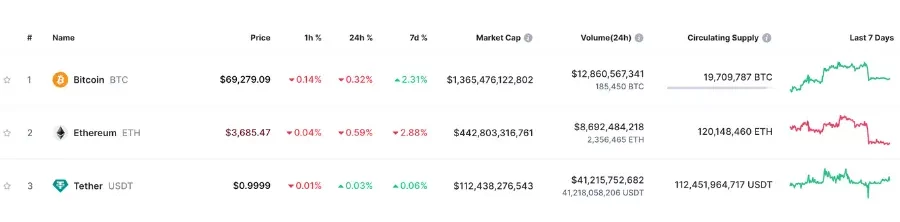

1. Cryptocurrency Prices, Period Gains, Market Cap, Trading Volume, and Circulating Supply

- Market Cap

Market cap is a measure of the value of an asset, including cryptocurrencies, stocks, or other financial products. In a crypto market place, market cap is used to assess the overall value and significance of a particular coin. It is calculated by multiplying the price of a single unit of the coin by the circulating supply, giving an idea of the coin’s market size and influence.

- Trading Volume

Trading volume refers to the total amount of a specific crypto traded within a given period. It is a key indicator of a coin’s liquidity and activity level. Changes in trading volume can reflect market sentiment, such as significant news events like token airdrops, partnerships, hacks, or black swan events, which typically lead to a surge in trading volume.

High trading volume generally indicates that a coin can be easily bought or sold. In contrast, low trading volume means that trades might take longer to match on a crypto market place and could lead to price slippage, especially on decentralized exchanges.

- Circulating Supply

Circulating supply refers to the number of coins of a particular crypto that are in circulation and available to the public. Some cryptocurrencies have mechanisms like mining or staking that gradually release coins, so the circulating supply is often less than the total supply until all coins are mined or released. For example, Bitcoin has a total supply of 21 million coins, but only 19.47 million are currently in circulation, with over 90% already mined.

Interestingly, there have been instances where individuals lost their private keys or seed phrases, making it impossible to access their cryptocurrency assets. This effectively reduces the circulating supply of a coin.

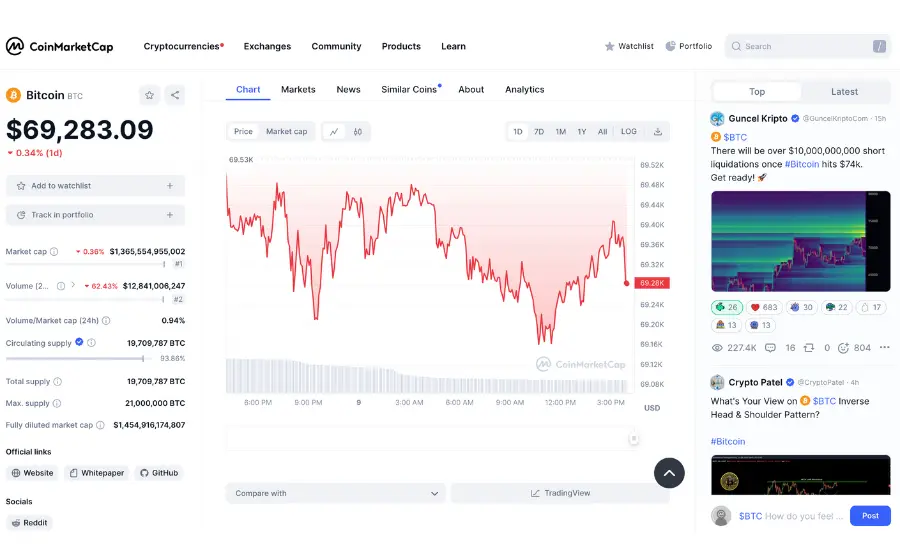

2. Viewing Coin Details from the Ranking List

When you select a coin name from the ranking list, you can access the coin’s page to see more detailed information and data about that coin. Here are a few commonly used pieces of information:

- Official Links

This may seem like an insignificant section, and many people might think they can find these links through Google search. However, many hackers or scam groups in the crypto space use fake links to trick users into depositing funds or buying fake cryptocurrencies. They even buy ads to push these fake links to the top of search results, causing many people to lose money.

If you are a beginner, it’s relatively safer to visit the project’s official website or social media platforms through a trusted source like CoinMarketCap.

>>> Read more: 5 Tips To Recognize Crypto Investment Scams for New Investors

- Network Information

The network information here refers to the blockchain on which the coin operates, such as Ethereum, BNB Chain, or Solana. Blockchain explorers are tools that allow you to query all wallet addresses on that chain, view asset balances, transaction behaviors, and token holdings. Supported wallets are listed to show which blockchain wallets are compatible with this network. Since assets on different chains may not be compatible, using cross-chain tools is necessary to avoid losing funds due to incorrect chain transfers.

If you are a beginner, always check whether your destination wallet supports the blockchain token before transferring coins from a crypto market place or another wallet, and ensure the address is correct.

- Coin Markets

The coin markets section is a straightforward list showing which centralized exchanges (CEX) or decentralized exchanges (DEX) offer this token, along with the available trading pairs, related derivatives such as contracts, and their trading volumes and liquidity. It is usually recommended to trade on exchanges with better liquidity and deeper trading depth.

>>> Read more: How Do We Choose a Qualified Crypto Exchange?

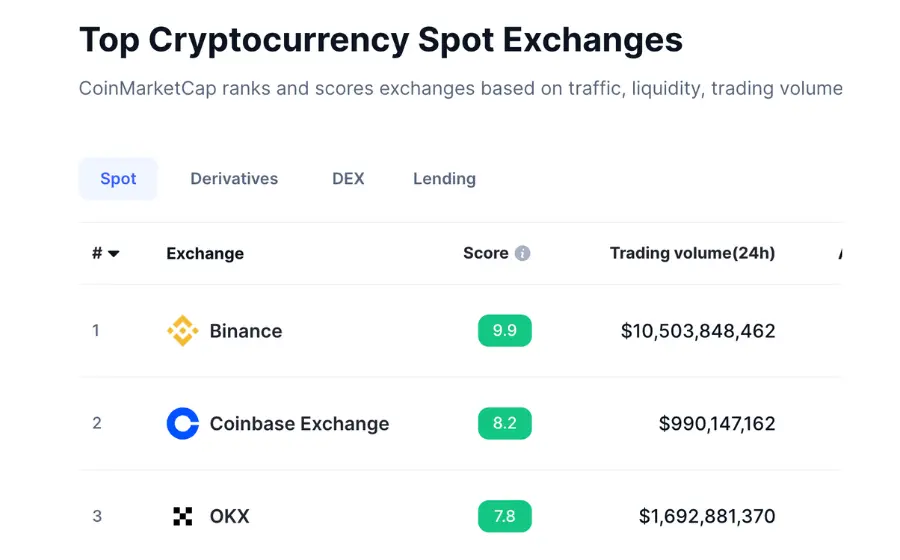

3. Exchange Rankings and Decentralized Exchange (DEX) Rankings

In the highly volatile cryptocurrency industry, where bull and bear cycles are short and regulatory conditions vary across countries, it’s not uncommon to hear about exchanges collapsing or absconding with users’ funds. Some of these incidents are due to poor fund management or liquidity issues, while others are outright scams set up to defraud investors. Therefore, selecting a secure crypto market place is crucial before investing.

- Exchange Rankings

The exchange ranking page on CoinMarketCap (CMC) provides a ranking of exchanges based on various metrics such as liquidity, number of visitors, and the number of available coins. Generally, the higher an exchange ranks, the more credible it is considered. If you plan to buy cryptocurrencies on a centralized exchange, it is advisable to use one of the higher-ranked exchanges for greater security.

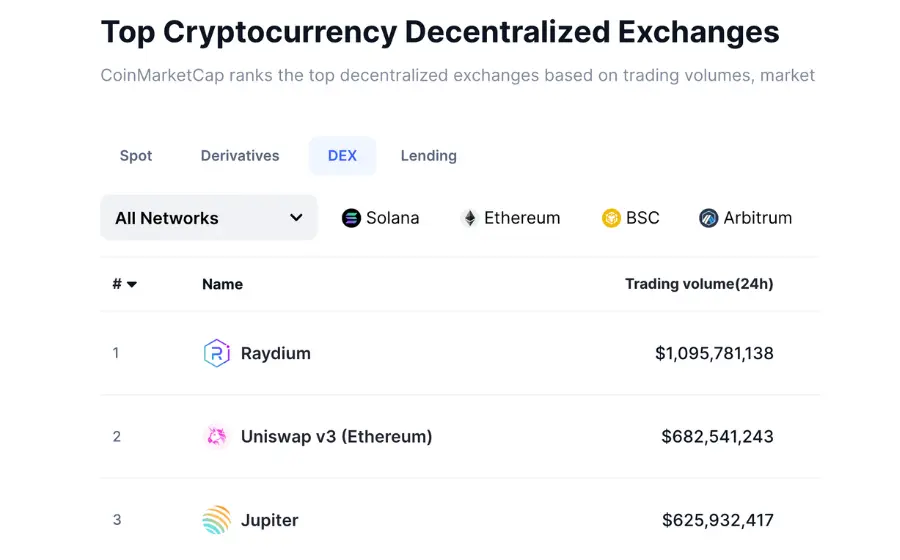

- Decentralized Exchange (DEX) Rankings

Decentralized exchanges are ideal for on-chain transactions or coin swaps, typically using an automated market maker (AMM) liquidity pool mechanism, which eliminates the need for order matching and allows for immediate transactions.

CMC also provides rankings for decentralized exchanges based on trading volume and market share, categorized by different blockchain networks. If you are new to a particular blockchain and want to trade or swap for stablecoins, you can check this page to find out which DEX has the best liquidity on that network.

Although DEXs are generally governed by smart contracts, they still carry security risks similar to centralized exchanges, such as hacking or asset theft. Therefore, it is also recommended to use higher-ranked DEXs for safer trading.

>>> Read more: TOP 5 Crypto Trading Platforms April 2024

SUMMARY

Blockchain technology and cryptocurrencies are still in their developmental stages. The cryptocurrency market is chaotic, extremely fast-paced, and full of opportunities. Mastering project information and market trends is key to gaining an advantage. Rather than buying and selling based on gut feeling or randomly investing in projects, it’s better to learn how to use tools to find investment opportunities with good returns.

Most countries’ regulations and oversight of exchanges are not yet comprehensive. Even if a certain crypto market place or cryptocurrency can be found on CoinMarketCap, it doesn’t necessarily mean it is completely safe.

Large data aggregation platforms like CoinMarketCap are indispensable tools on your cryptocurrency journey.

At the very least, after today’s introduction, we hope you can avoid most of the scams in the cryptocurrency market. If someone asks you to invest in a cryptocurrency or use a particular exchange that cannot be found on CoinMarketCap, be extremely cautious. Cryptocurrencies, as a new form of asset, are worth the time to study and invest in.

>>> Learn more:

-

Crypto 2024: Identifying Signals for When Crypto Market Will Go Up

-

Binance Boosts Notcoin: 30 Million Users Propel Market Cap to $820 Million in One Hour

-

Crypto Quiz: Answer These 6 Questions and We’ll Tell You Which Crypto You Are

FAQS

- What is a crypto market place?

A crypto market place is a platform for buying, selling, and trading digital assets.

- What is CoinMarketCap?

CoinMarketCap is a platform for tracking cryptocurrency prices and market data.

- What data does CoinMarketCap provide?

Price tracking, market capitalization, trading volumes, and more.

- How does CoinMarketCap help avoid scams?

It provides official links and reliable project information.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!